by Don Vialoux, EquityClock.com

(Mr. Vialoux is scheduled to appear on BNN’s Market Call Tonight on Wednesday at 6:00 PM)

Pre-opening Comments for Tuesday September 30th

U.S. equity index futures were higher this morning. S&P 500 futures were up 5 points in pre-opening trade.

The Canadian Dollar moved lower following release of Canada’s July GDP report. Consensus was an increase of 0.3% versus a gain of 0.3% in June. Actual was unchanged.

eBay added $4.29 to $56.95 after announcing plans to spin off PayPal.

Alcoa added $0.28 to $16.21 after Bank of America/Merrill upgraded the stock from Neutral to Buy. Target is $12.00.

Computer Sciences gained $0.48 to $60.10 after Raymond James upgraded the stock from Market Perform to Outperform. Target is $75.

Kellogg (K $61.81) is expected to open lower after Morgan Stanley downgraded the stock from Equal Weight to Underperform.

Lockheed Martin is expected to open higher after Stifel Nicloaus upgraded the stock from Hold to Buy. Target is $220.

Ford slipped $0.07 to $15.04 after Craig Hallum downgraded the stock from Buy to Hold. Target is $17.

EquityClock.com’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2014/09/29/stock-market-outlook-for-september-30-2014/

Note the study showing impact on the S&P 500 Index during periods of strength in the U.S. Dollar.

Also note comment on Ford. Yesterday, Ford lowered third quarter revenue and earnings guidance due to a lower than expected contribution from operations outside of the U.S. (i.e. impact of strength by the U.S. Dollar). Look for more international companies to lower guidance before third quarter results are released.

Interesting Charts

Weakness in the Hang Seng and its related ETFs triggered weakness in world equity markets yesterday.

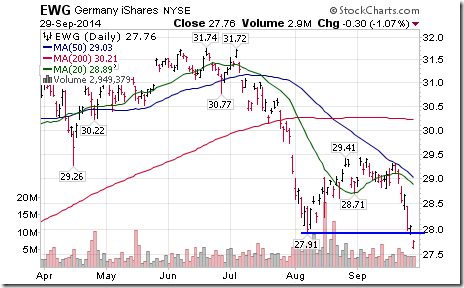

Weakness in Hong Kong quickly spread to European equity markets and related ETFs

In the U.S. the VIX Index continued to spike.

StockTwits released yesterday@equityclock

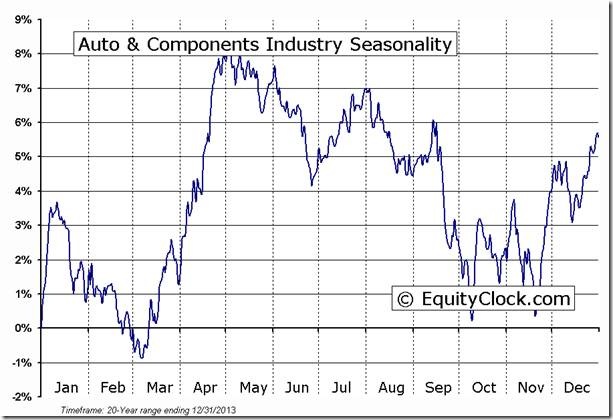

$CARZ broke support at $38.35. ‘Tis the season for weakness in autos!

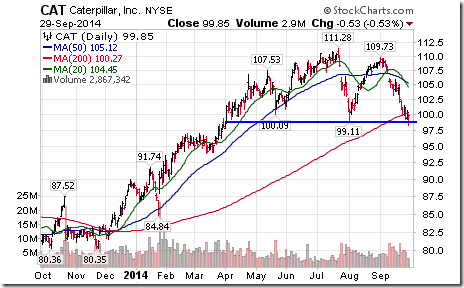

$CAT broke support at $99.11 to complete a head & shoulders pattern. ‘Tis the season for weakness!

$IEV broke support at $45.13. Big Cap Eurostocks are leading equity markets on the downside.

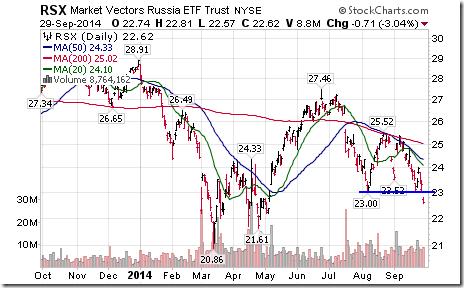

$RSX broke support at $23.00, down over 3%. Bad news for equity markets!

Technicals for S&P stocks to 10:30 AM: Bearish. 1 stock broke resistance: $CINF. 8 stocks broke support: $WAG,$OXY,$LH,$CAT,$CA,$TDC,$VMC,$GLW

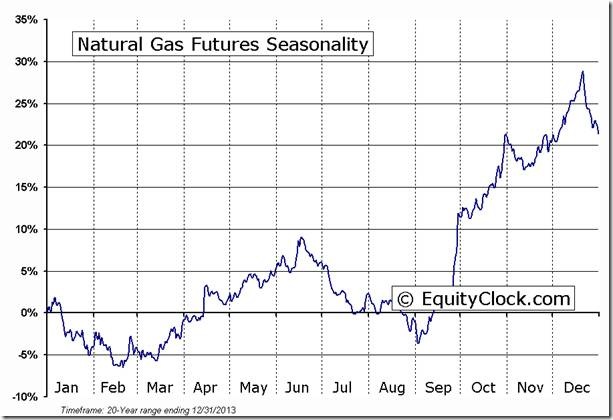

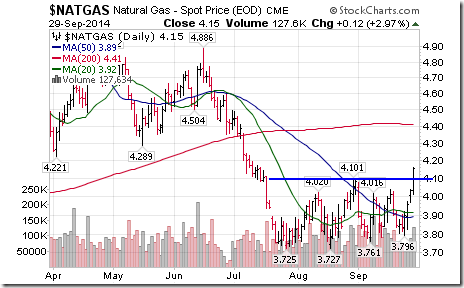

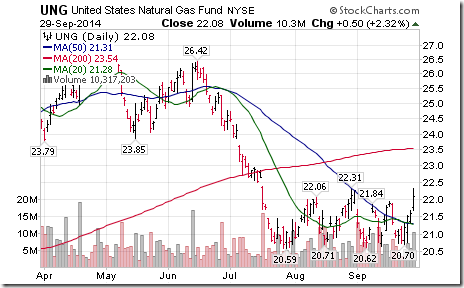

Nice breakout above a base pattern by natural gas above $4.10. ‘Tis the season! $UNG is the ETF.

Horizons/Tech Talk Weekly Seasonal/Technical Sector Report

Following is a link:

http://www.horizonsetfs.com/campaigns/TechnicalReport/index.html

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

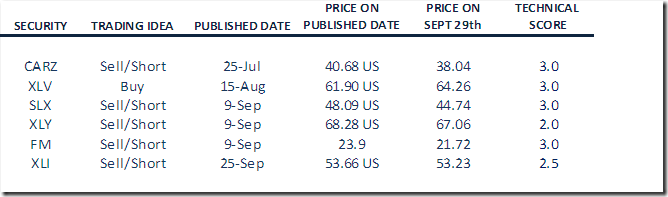

Monitored Technical/Seasonal Trade Ideas

A security must have a Technical Score of 1.5 – 3.0 to be on this list.

Green: Increased Technical Score

Red: Reduced Technical Score

= = = = = = = = = = = = = = = = = = = = = = = =

Tuesday, September 30, 2014

TOP ASSET 5 CLASSES, SECTORS AND COUNTRY HEAT MAPPING

|

Comment

On the short term, the strength of the US dollar has impacted global currencies, emerging market fixed income and commodities. Bonds have re-emerged in the top rankings of both the weekly (short term) and monthly (intermediate term) rankings despite the on-going headlines and financial speak that says inflation is coming and/or higher employment. Many readers will be familiar with the adage that bonds are where the smart money lives and the data bears it out now.

Other persistent themes include CDN staples and info. tech (the later solely on a re-invigorated Blackberry), US biotech (a long term secular theme in my opinion and the next macro fundamental global game-changer) as well as India and Thailand on the country level.

CHARTS of the WEEK

Interest Rates Long Term

This long term look of US 10 year interest rates (a good proxy for CDN rates) shows a long term trend intact. The end of 2013/beginning of 2014 represented a good buying opportunity for investors with the risk-to-reward favourable as a “stop” was near at hand just overhead above 3%.

Intermediate Term

This shorter, intermediate term, look at the same security shows a push down toward the recent lows in August around 2.30%. A break below this level finds support at 2.00% then 1.60%. Bonds at the best of times are an unloved asset class that deserves more attention

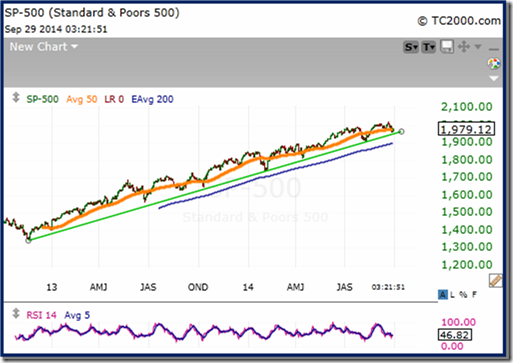

S&P 500 Index

On this intermediate term look the S&P shows little signs of weakness as a break of the 50d MA has been a buying opportunity in July and November 2013 and in January and August 2014. The one systemic difference today is the parabolic rise of the USD and how it will impact corporate earnings in Q3. Long contract on the USD are at record levels.

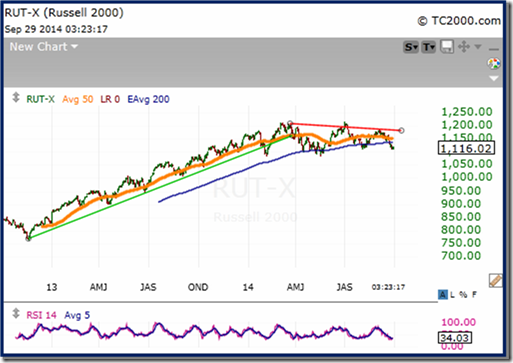

Russell 2000 Index

The Russell 2000 on the other hand has been showing some noticeable weakness and volatility. A move above 1205 would confirm that the rolling top we see is just a consolidation period. It should be noted that the Russell is important in that it was a leader off the bottom in 2008. Falling leaders get attention but its too early to extrapolate further.

Gold Bullion

Gold (and gold producer’s) fall is directly related to the rise of the USD. Gold, after all, is not the inflation hedge most think, but a currency. It moves during times of fiat currency flux – which eventually can lead to inflation or deflation, as the case may be. The upside resistance in the USD is seen inversely in the near-term support of gold. Gold producers, which lead gold bullion have clearly made a higher low which is positive for both.

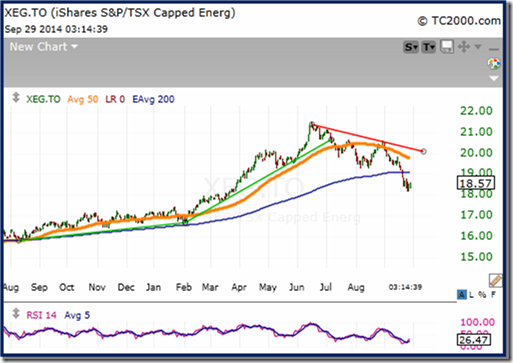

TSX Capped Energy Index

The Canadian energy sector, represented here by the ETF (XEG), has a distorted period of seasonality this year. The first period of strength runs from February to May, then the second from July to October. This year the first period ran much longer; the second never showed. CastleMoore sold its energy stocks in its Canadian equity portfolio (40% allocation) in late June/early July

If you would like to receive our recently published bi-monthly newsletter with articles from Ben Hunt, Hap Sneddon, Mukul Pal and others or know more about our model portfolios click on the link.

http://www.castlemoore.com/investorcentre/signup.php.

CastleMoore Inc. uses a proprietary Risk/Reward Matrix that places clients with minimum portfolios of $500,000 within one of 12 discretionary portfolios based on risk tolerance, investment objectives, income, net worth and investing experience. For more information on our methodology please contact us.

Buy, Hold…and Know When to Sell

This commentary is not to be considered as offering investment advice on any particular security or market. Please consult a professional or if you invest on your own do your homework and get a good plan, before risking any of your hard earned money. The information provided in CastleMoore Investment Commentary or News, a publication for clients and friends of CastleMoore Inc., is intended to provide a broad look at investing wisdom, and in particular, investment methodologies or techniques. We avoid recommending specific securities due to the inherent risk any one security poses to ones’ overall investment success. Our advice to our clients is based on their risk tolerance, investment objectives, previous market experience, net worth and current income. Please contact CastleMoore Inc. if you require further clarification on this disclaimer.

= = = = = = = = = = = = = = = = = = = = = = = =

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

Horizons Seasonal Rotation ETF HAC September 29th 2014

Copyright © EquityClock.com