by Don Vialoux, Timing the Market

Interesting Charts

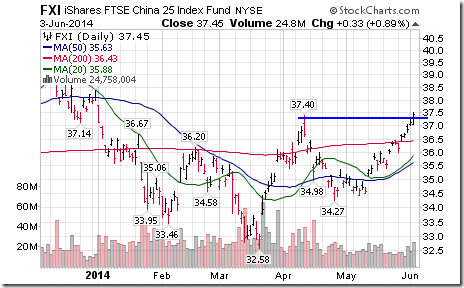

Chinese related ETFs continue to surprise on the upside.

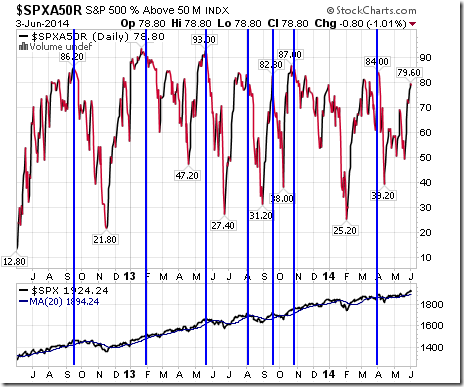

Percent of S&P 500 stocks trading above their 50 day moving average has reached an important “warning sign” level. When Percent reaches 80% and turns lower, an intermediate correction normally occurs.

MarketWatch.com Headline

Headline reads, “A June swoon? Well, it’s been the worst month over the last decade”. Following is a link:

Yesterday’s StockTweet

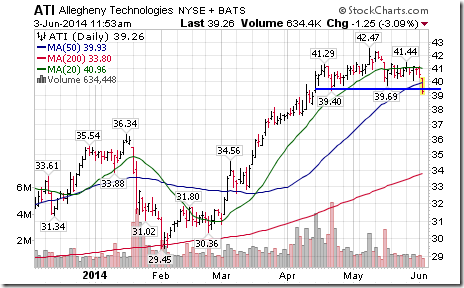

More signs of technical weakness in the steel sector. ATI completed a classic head and shoulders

Technical action by individual equities yesterday

Technical action by S&P 500 stocks remained quietly bullish yesterday. Twelve stocks broke resistance (AEP, AMAT, BDX, CI, ESV, FDO, FE, HRL, KEY, MET, PRU, TMK) and three stocks broke support (ATI, DO, SPLS).

Among TSX 60 stocks, TransAlta broke support.

Updates on previously recommended seasonal trades

Many have just reached the end of their period of seasonal strength. Most, but not all were profitable. All except the Biotech trade were highlighted in reports published at GlobeInvestor.com Now is the time to liquidate positions if not done so already.

· Memorial Day Holiday Trades

The one-day trade in the Canadian equity market on May 26th recorded a small profit. The U.S. trade from May 21st to June 4th has been profitable and ended today. Since May 21st, the S&P 500 Index is up 1.9%.

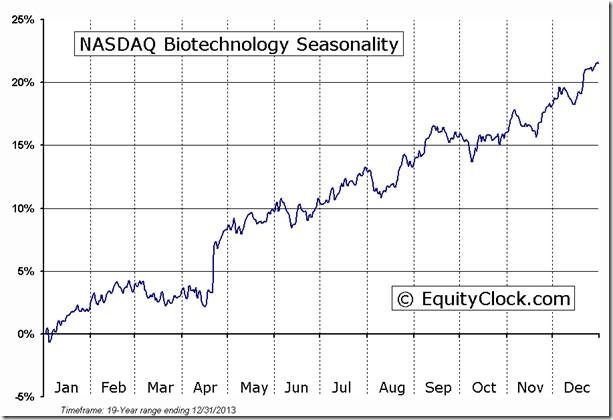

· Biotech Trade

The trade from mid- April to June 3rd is now over. Nice profit (approximately 10%)

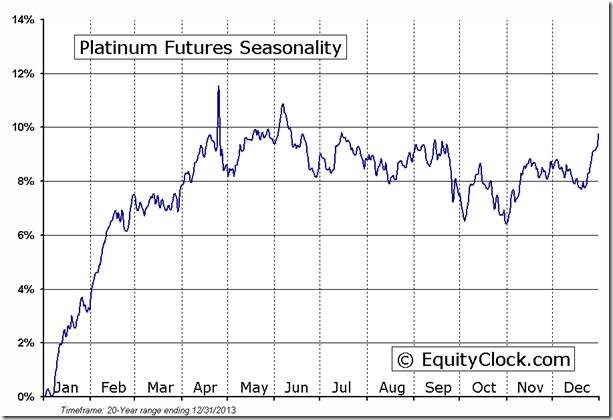

· Platinum Trade

The trade from mid-January to current was not successful this year. Platinum at $1438 is unchanged from mid-January

Platinum Futures (PL) Seasonal Chart

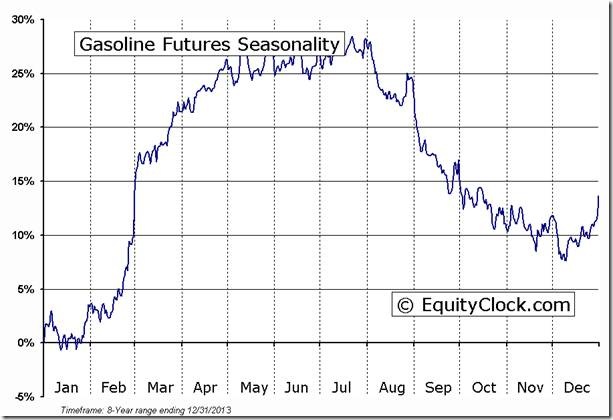

· The Gasoline Trade

Another trade that was not successful this year! UGA (The ETF tracking gasoline prices) recommended in mid- February is unchanged. Gasoline prices frequently peak near the Memorial Day holiday weekend.

· The Auto Sector Trade

Another trade that was not successful! CARZ is up only 1% since recommended in the third week in February despite stronger than expected gains in car sales this spring.

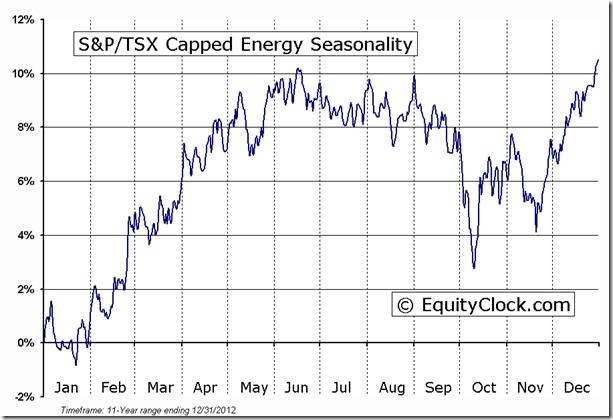

· The Canadian Energy Trade

One of the more successful seasonal trades! Since recommended in the third week in January, the TSX Energy Index has gained 15%.

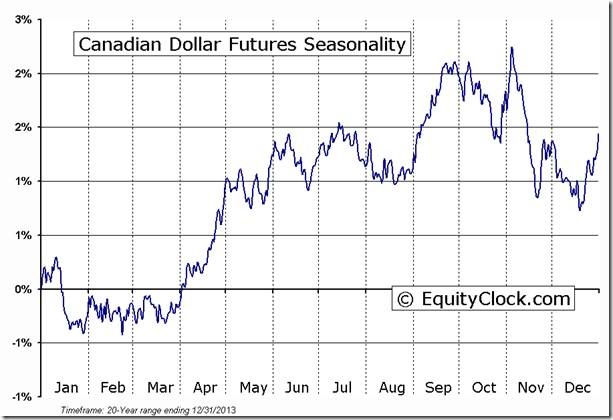

· The Canadian Dollar Trade

Another successful trade! Since recommended in mid-March the Canuck Buck has advanced from 89.93 to 91.62

Canadian Dollar Futures (CD) Seasonal Chart

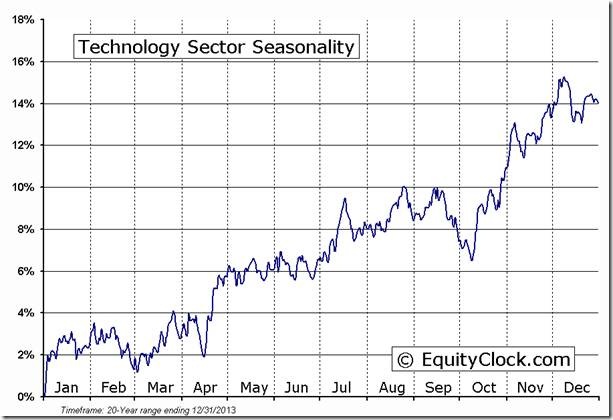

· U.S. Technology Trade

Another success trade! The S&P Technology Index has gained 5.9% since recommended in mid-April. This is the one trade that potentially “could have legs” into mid-July

FP Trading Desk Headline

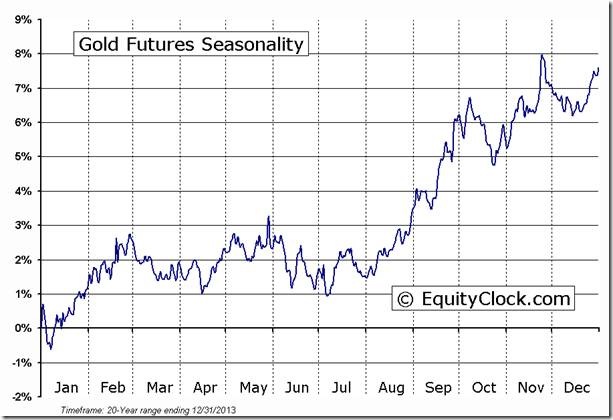

FP Trading Desk headline reads, “Why have gold prices been so volatile this year? Following is a link:

http://business.financialpost.com/2014/06/03/why-have-gold-prices-been-so-volatile-this-year/

Editor’s Note: Seasonal influences currently are negative. Watch for the next seasonal upside trade starting in July.

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

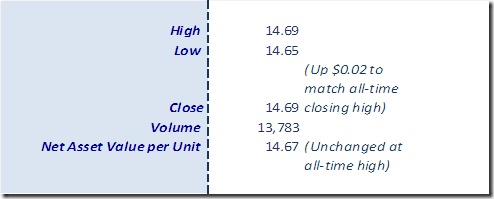

Horizons Seasonal Rotation ETF HAC June 3rd 2014

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray