by Don Vialoux, Timing the Market

Apr 22

(Editor’s Note: Jon Vialoux is scheduled to appear on BNN’s Market Call Tonight at 6:00 PM EDT this evening)

Interesting Charts

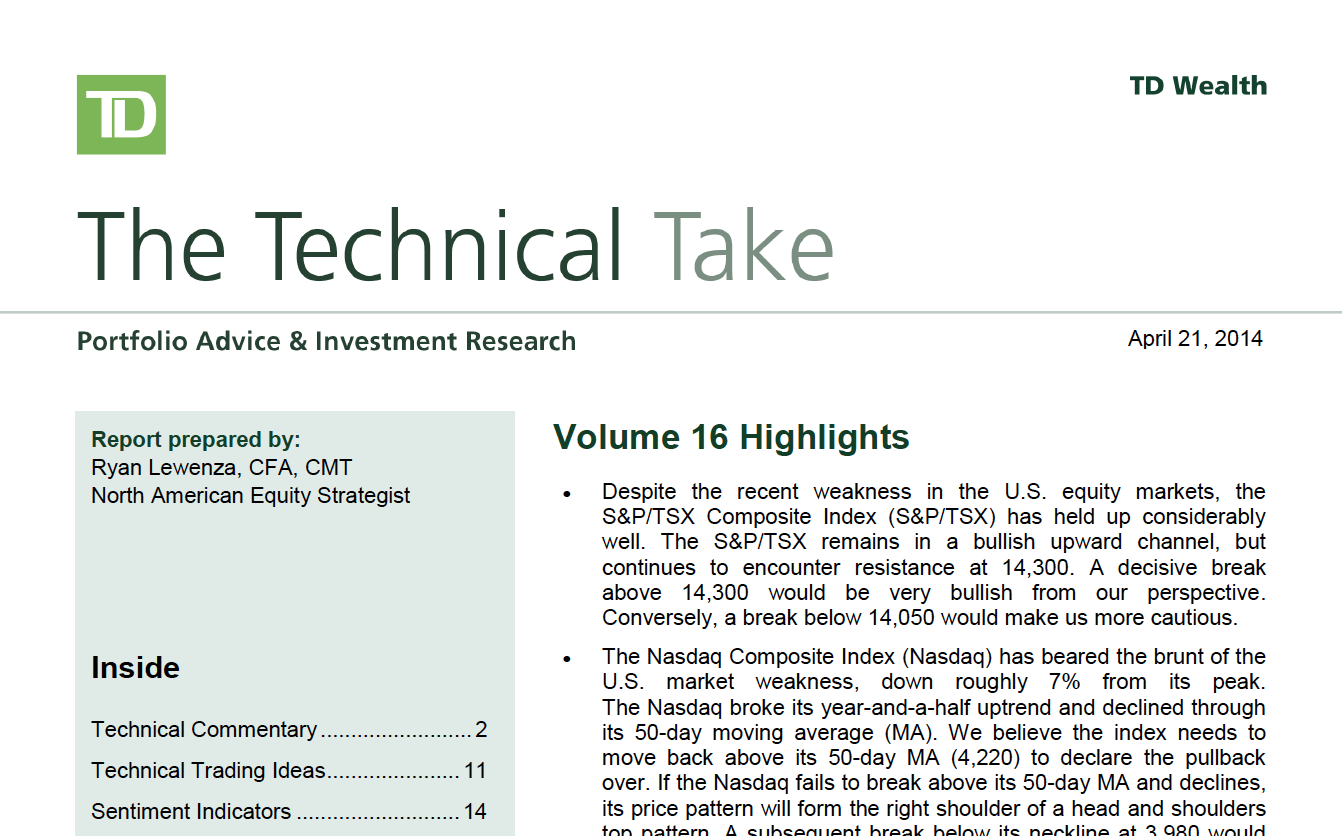

The energy sector and its related subsectors led U.S. equity markets on the upside yesterday. ‘Tis the season!

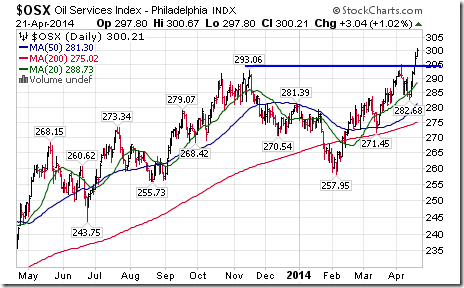

Stronger than consensus first quarter earnings reported by Netflix after the close yesterday is expected to boost interest in the technology sector. NFLX added 6% following the close. The sector and its ETFs have just moved above their 20 and 50 day moving averages. ‘Tis the season!

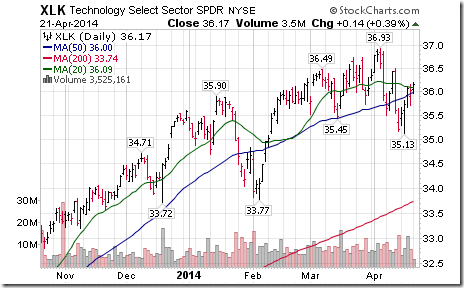

Gold equities and related ETFs were hit in early trading yesterday on rumors of a merger between Newmont Mining and Barrick Gold. Barrick quickly came under pressure and broke short term support.

Weakness in ABX triggered short term break downs in gold equity indices and related ETFs, but the sector recovered in late trading to close at a small loss.

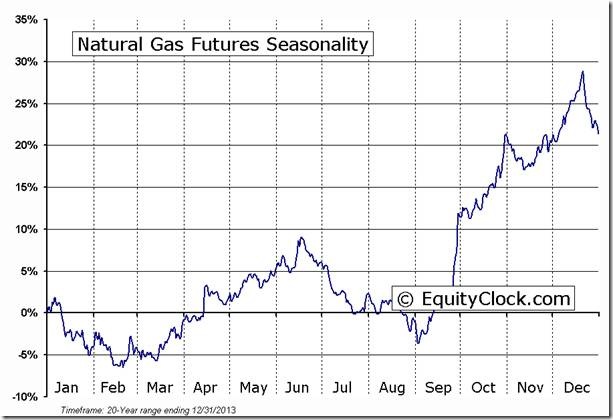

Natural gas prices briefly broke above resistance at $4.74 per MBtu, but backed off in late trading. The technical profile for natural gas is improving during a time when seasonal influences are mildly positive.

Strange momentum spurt in lumber yesterday! Reasons are unknown by the author.

Valeant popped 9% after the close on news that Bill Ackerman has teamed up with Valeant to acquire Allergan.

Allergan popped 21% after the close

Technical Action by Individual Equities Yesterday

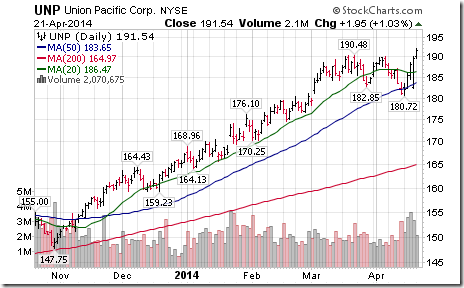

Technical action by S&P 500 stocks was quietly bullish. Seven S&P 500 stocks broke resistance (EXPD, FDX, HAS, OKE, PSX, UNP, WPX) and none broke support. HAS, OKE, PSX and UNP reached an all-time high.

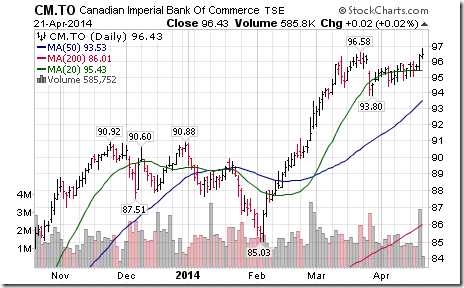

Notable among TSX 60 stocks was Commerce Bank. It broke to an all-time high.

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

Keith Richards Blog

Keith is taking a cautious stance on equity markets. Following is a link:

http://www.smartbounce.ca/?p=2879

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Investment Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Investment Management (Canada) Inc.

Horizons Seasonal Rotation ETF HAC April 21st 2014

Leave a Reply

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray

![clip_image002[4] clip_image002[4]](https://advisoranalyst.com/wp-content/uploads/2019/08/6396664eb924cae603e4508f6d2c72f9.png)