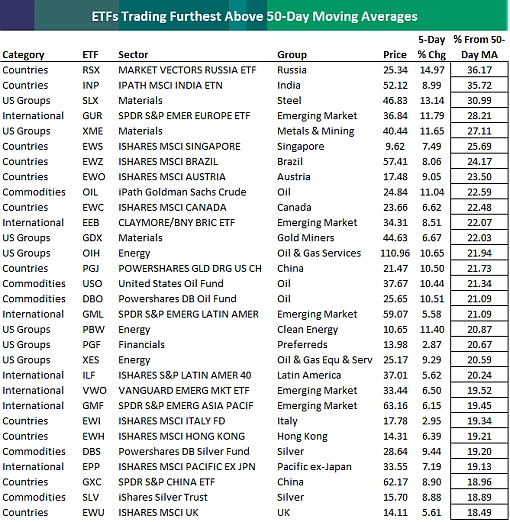

"With stocks rallying around the world, the many ETFs that track various equity markets have moved significantly above their 50-day moving averages. Below we highlight the most overbought ETFs in relation to their 50-day moving averages. As shown, the Russian stock market ETF (RSX) is the most overbought, trading 36.17% above its 50-day. India (INP) ranks second at 35.72%, followed by the steel ETF (SLX), emerging market Europe (GUR), metals and mining (XME), and Singapore (EWS). The majority of the ETFs on this list track countries. The rest are generally concentrated in the commodities area."

Source: Bespoke, June 2, 2009