We're now a few trading days into the second half of the year, and with not much going on this Friday after July 4th, we thought now was as good of a time as any to highlight some year-to-date performance numbers.

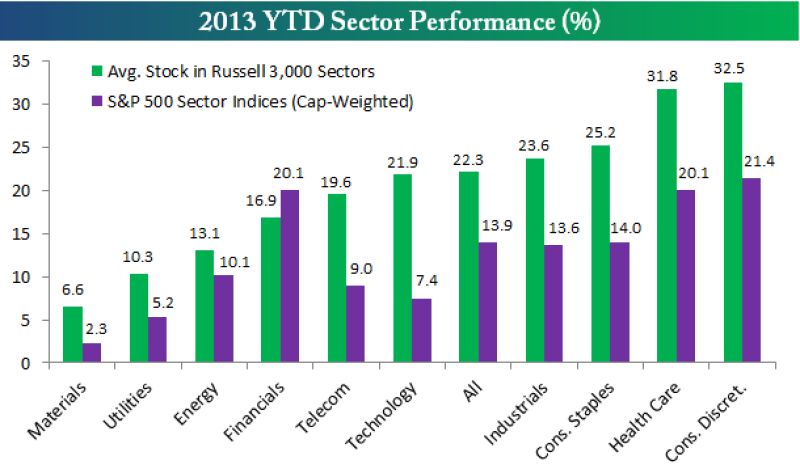

Below is a chart showing the YTD performance of the S&P 500 and its ten sectors (purple bars) along with the average YTD performance of stocks in the Russell 3,000 by sector (green bars). As you'll see in the chart, while 2013 has been a great year for the largecap S&P 500, it has been an even better year when you include all of the midcap and smallcap stocks that make up the US equity market. (The Russell 3,000 is made up of all Russell 1,000 -- large and midcaps -- and Russell 2,000 -- smallcaps -- stocks and represents 98% of the US stock market.)

As shown below, the cap-weighted S&P 500 is currently up 13.9% year to date, but the average stock in the Russell 3,000 is up 22.3%! The S&P 500 Consumer Discretionary sector is up 21.4% YTD, but the average Consumer Discretionary stock in the Russell 3,000 is up significantly more than that at 32.5%. Technology stocks have done much better in 2013 than the S&P 500 Technology sector suggests as well. Due to Apple's struggles, the S&P 500 Tech sector is up just 7.4% YTD, but the average Technology stock in the Russell 3,000 is up 21.9%. The only sector where largecaps are doing better than midcaps and smallcaps is the Financials. As shown, the S&P 500 Financial sector is up 20.1% YTD, while the average Financial stock in the Russell 3,000 is up 16.9%. These results within the Financial sector coincide with a post we did a couple of weeks ago on the impact that Dodd-Frank might be having on smaller financial firms.

As mentioned above, the average Russell 3,000 stock is up 22.3% year to date. Of the stocks that make up the Russell 3,000, 81.8% are in the green so far this year, while 86 stocks in the index are up more than 100%. Below is a list of the 50 best performing Russell 3,000 stocks so far in 2013. As shown, Revolution Lighting Technologies (RVLT) is up the most with a gain of 479.92%, followed by Clovis Oncology (CLVS) and YRC Worldwide (YRCW). Some other notables on the list include Tesla (TSLA), Best Buy (BBY) and Netflix (NFLX). Outside of these names, however, you've probably never heard of most of the stocks. If you're looking for new ideas, why not take some time to become familiarized with this year's big winners. It can't hurt!

Copyright © Bespoke Investment Group