by Tom Brakke, Research Puzzle

The March 28 Bloomberg Brief for structured notes opened with this line: “U.S. investors are betting soaring stocks can deliver higher yields through structured notes that potentially expose them to large losses and lock up capital for as long as 20 years.”

It later says, “The equity-tied securities depend on the performance of large stock indexes and eventually pay coupons as high as 15 percent a year, as long as they’re not redeemed early and markets don’t plunge.”

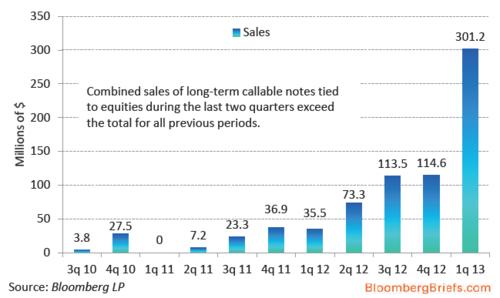

Here’s a graph of the “sales surge” that the article’s headline describes for these things:

For reference, see an earlier posting on sure things and structured products (Apple edition) and one from Accelerant that begins: “While structured products are often marketed with one-page fact sheets, they are usually highly complex.”

According to Bloomberg, the notes in the tall bar on the chart include variable coupons, call dates, and “barriers” beyond which the protection implied in the structure disappears.

Sales surge, but understanding is in a bear market.

Copyright © Research Puzzle