by David Templeton, Horan Capital Advisors

An investment strategy some investors follow at the beginning of each year is investing in the Dogs of the Dow. As noted in prior posts, the Dow Dog strategy consists of selecting the ten stocks that have the highest dividend yield from the stocks in the Dow Jones Industrial Index (DJIA) after the close of business on the last trading day of the year. Once the ten stocks are determined, an investor would invest an equal dollar amount in each of the ten stocks and hold them for the entire year. The strategy has generated mixed results over the years.

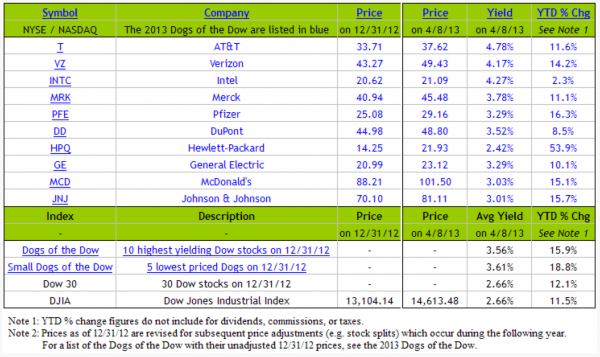

For the Dow Dog investor this year though, the dogs are outperforming the Dow Index as well as the S&P 500 Index (10.5% return YTD) as noted in the below table. As of the market's close today, the Dow Dogs have returned 15.9% versus the Dow Industrial Index return of 11.5%.

Source: Dogs of the Dow