by Tom Brakke, Research Puzzle

I think the choice of “big versus little” in the equity markets is interesting right now. It’s all gone one way for many years and it seems like that’s the way it will always be. But relative returns are cyclical and many investors have learned to lean in the direction of smaller stocks. The market has a way of dealing with that.

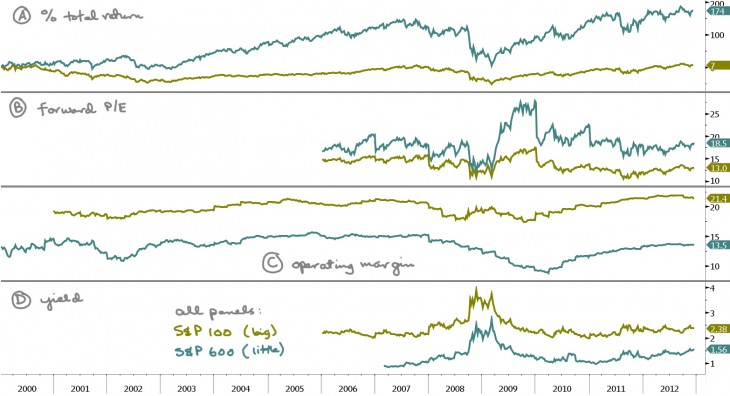

The chart shows Bloomberg data for two indexes, although the platform has limited history for some metrics, so I’ve provided whatever is available. The indexes I used are the S&P 100 for the biggest stocks (OEF is an ETF that mimics it) and the S&P 600 for the little ones (likewise, IJR).

The panels:

A) The difference in return since the beginning of 2000 is amazing. On a relative return chart, the number would be -61% for big stocks versus little ones.

B) It’s too bad that the P/Es don’t go back further, because then you could see the valuation bubble that led to the underperformance for the big stocks. During the time shown, the big stocks have gotten relatively cheaper (for devotees of the PEG ratio, the estimated growth rates are 13% and 10%, but read this before playing with fire).

C) The operating margins probably don’t have much room for improvement. Sales growth has been weak and earnings growth is not too hot either. It seems like something’s gotta give.

D) Larger stocks also carry heftier dividend yields than small ones, which is great for now, but that puts many of them at risk if interest rates start to rise and fundamentals of the companies don’t offset the rate sensitivity.

If you had to bet for big versus little over the next ten years, what would you do? (Chart: Bloomberg terminal.)

Copyright © http://researchpuzzle.com