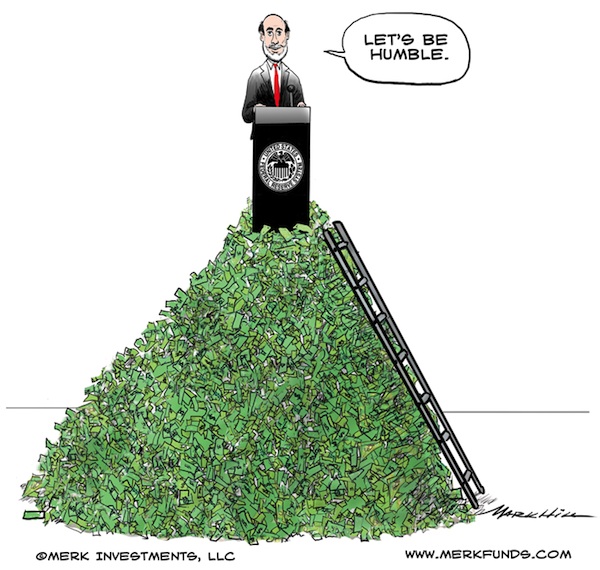

Bernanke: Be Humble

by Axel Merk, Merk Funds

“Humble” is typically not an attribute associated with the Federal Reserve (Fed), especially in light of the trillions of dollars recently printed. Yet, in his latest press conference Fed Chairman Bernanke called for humility: we must be humble in setting monetary policy! The problem is, Bernanke’s definition of the word “humble” appears to be something entirely different from what – in our humble opinion - common sense might expect.

We have previously argued that the only reason the Fed gets away with printing so much money is because that money doesn’t “stick”. Technically, the Fed doesn’t actually print money, but buys fixed income securities with ever-longer maturities (mortgage-backed securities and Treasury securities). To purchase those securities, money is literally created out of thin air; a simple computer entry is all that is required to credit the account of a bank at the Fed in return for the purchase of a security. These purchases are reflected as an increase in assets on the Fed’s balance sheet, with an offsetting increase in liabilities (cash in circulation – Federal Reserve notes – are a liability for the Fed). When proceeds from a maturing security are re-invested, no new money is being created, but the balance stays at an elevated level; as such, when QE1 or QE2 “ended”, the amount of money that had been printed was still in the system. Some economists argue that such policies don’t amount to “money printing” because banks haven’t done much with the money they received (the velocity of money has not shot up). Our response to that argument has been that if you were to give a baby a gun, just because the baby doesn’t shoot anyone, doesn’t mean it isn’t dangerous. So, to us, being humble should focus on being most concerned about the potential side effects of monetary easing.

A key reason why all the money that has been printed hasn’t made it to the real economy is because major deflationary forces are present, as a result of the financial crisis. In our assessment, in the run-up to the financial crisis, the Fed had lost control over the credit creation process. That is, consumers used their homes as ATMs, creating their own money. Similarly, financial institutions found ways to create their own money, e.g. increasing leverage by creating special investment vehicles (SIVs). In the goldilocks economy of much of the last decade, it was only rational for investors to take on more risk, to increase leverage. After all, house prices could never fall. However, starting in 2007, risk came back to the markets. As a result, it became similarly rational for investors to reduce leverage. Unfortunately for investment banks Bear Stearns and Lehman Brothers, they didn’t have sufficient liquid collateral to downsize. Similarly, many consumers buried in debt have been unable to downsize, causing elevated numbers of defaults on their obligations (mortgages, auto payments, credit cards…) It’s because policy makers initially lost control on the credit creation side that we are now witnessing a gargantuan effort to stem against deleveraging, deflationary forces. We believe this is a key reason why, with all the money spent and printed, the U.S. can only generate lackluster economic growth.

In this environment, it’s likely that the Fed can get away with just about anything in terms of monetary expansion. But should these policies work, should all the money that has been printed make it through to the real economy, the Fed may find itself in a tricky situation. Bernanke argues that he can raise interest rates in as little as 15 minutes to contain any inflationary fallout that might occur. In the early 1980s, former Fed Chair Paul Volcker raised rates to 20% to beat inflationary pressures. In those days, people complained, but because there was so much less leverage in the economy, it was bearable. In today’s environment, 6% appears to be the threshold for countries such as Spain before commentators believe the International Monetary Fund (IMF) has to come to the aid of the government. Wait. Paying 6% interest is considered unsustainable? What type of world are we now living in? More importantly, will the Fed have the will to potentially crush the economy in order to contain inflationary pressures? Anyone reading this and even considering that the Fed may hesitate proves that the Fed has lost credibility. Credibility requires the perception that the Fed will not hesitate to beat inflation.