by Christopher Gannatti, CFA, Global Head of Research, WisdomTree

Key Takeaways

- In 2025, the U.S. dollar faces renewed scrutiny as persistently high deficits, rising debt servicing costs and inflation around 3% cast doubt on its unshakable dominance.

- Bitcoin’s rolling volatility has structurally declined to the 30%–50% range as institutional adoption grows, narrowing its risk gap with gold and redefining how investors view digital assets.

- With gold surpassing $3,700/oz and both assets reacting to macro stress, investors may want to consider how Bitcoin and gold can serve as complementary hedges in an era of fiscal fragility.

In 2025, the U.S. dollar's image of unassailable strength is being rigorously questioned. The U.S. government budget deficit remains stubbornly elevated, hovering just north of 6% of gross domestic product (GDP), and the debt-to-

Gold: A Strategic Comeback

Gold isn't just riding a wave; it's leading one. Spot gold is now trading in the $3,600–$3,700 per ounce range, recently hitting intraday highs of above $3,700.4

Meanwhile, central banks have been in a gold accumulation mode. They purchased approximately 244 tonnes in Q1 and 166 tonnes in Q2, bringing total first-half net acquisitions to 410 tonnes, the strongest mid-year tally in years.5 Across 2025, Metals Focus projects total gold purchases to reach 1,000 tonnes, marking a fourth consecutive year of massive institutional buying.6

The story is well known, but still powerful: Gold doesn't default, it doesn't inflate away, and in a world testing the limits of sovereign liability, it could be among the most credible insurance policies on the table.

Bitcoin: The New Monetary Challenger

Bitcoin's presence in the conversation isn't accidental. With a circulating supply mathematically capped at 21 million coins,7 Bitcoin introduces a form of digital scarcity the world has never had before.8 Its network secures more than $2.1 trillion in market value, processing billions of dollars in transactions daily with no central authority.9 Unlike gold, which has a deep past, Bitcoin has a fast-moving present: It's programmable, it settles across borders in minutes, and it's attracting the interest of both sovereign entities and institutional allocators. In 2025, we're not just watching Bitcoin mature into a parallel monetary asset; we're watching it evolve into infrastructure for a new financial architecture. If gold is the archetype of enduring value, Bitcoin is the prototype of monetary innovation, and that juxtaposition is what makes the comparison so compelling right now.

Washington Pushes for Digital Asset Leadership

2025 has marked a decisive pivot in Washington's approach to crypto. Rather than sitting back, the Trump administration has begun to actively position the U.S. as the world's hub for digital financial technology. The policy goals are clear: protect investors, incentivize builders to stay onshore and ensure U.S. capital markets remain the deepest and most innovative. What had once been a regulatory patchwork is now giving way to a coordinated framework designed to bring digital assets into the mainstream of American finance.

From Stablecoins to Market Structure: The New Framework

The summer's legislative activity showed just how quickly the agenda is moving. The GENIUS Act, signed in early July, established the first comprehensive federal framework for stablecoins, requiring issuers to hold full reserves in dollars or Treasuries, effectively hard-wiring stablecoins into U.S. monetary policy.10 The House also passed the CLARITY Act, now awaiting Senate action, which would assign primary oversight of digital commodities to the Commodity Futures Trading Commission (CFTC) and end years of legal uncertainty.11 Alongside these moves, the House approved the Anti-CBDC12 Surveillance State Act, signaling a preference for private stablecoins over a government-issued retail CBDC.13 Taken together, these steps amount to a turning point: instead of ambiguity and enforcement by litigation, the U.S. is finally sketching a blueprint for how the crypto economy should operate.

Retirement Accounts and Wall Street's Embrace

Potentially, the boldest stroke came in August, when President Trump signed an executive order directing the Securities and Exchange Commission (SEC) to make room for crypto and other alternatives inside 401(k) and defined contribution plans.14 With approximately $43 trillion in U.S. retirement assets,15 even a sliver allocated to digital assets could transform adoption dynamics.

Defining What We Mean by "Risk"

Before diving into the numbers, it's worth pausing on what we mean by "risk." Many investors instinctively hear the word and think of losses or volatility, but risk is not a fixed constant; it is contextual. A pension fund, a retail saver and a venture investor may all look at the same asset and perceive very different risks. For some, it's about the possibility of losing capital. For others, it's about volatility relative to their liabilities or benchmarks. And for many, it's about the chance that an asset simply fails to deliver when needed. In this piece, when we talk about risk, we're narrowing in on measurable price variability, specifically, volatility. Volatility is not a perfect definition of risk, but it is one of the most accessible ways to compare assets across time and across categories.

Rolling Volatility: A Common Yardstick

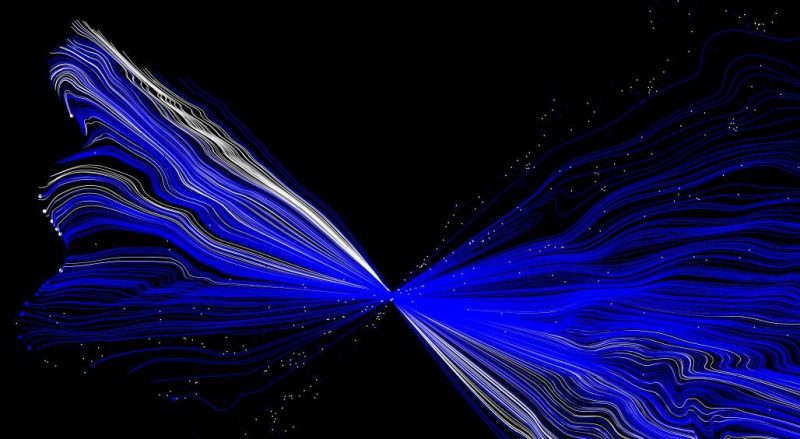

To make the comparison meaningful, we'll use rolling three-month and six-month volatility windows in figures 1a and 1b, respectively. This approach smooths out the noise of day-to-day swings and allows us to see whether risk is trending up, trending down or holding steady. And while Bitcoin is often labeled "digital gold," it's important to note that its comparator, gold, is far from risk-free. Over the past few decades, gold has regularly exhibited double-digit annualized volatility, higher than many investors assume for a monetary asset that has been trusted for thousands of years. By looking at rolling volatility for both Bitcoin and gold, we can place the common narrative of "Bitcoin as high risk" into proper context. What emerges is not a binary story of risky versus safe, but a spectrum where even the oldest monetary asset carries more variability than its reputation might suggest.

- Bitcoin's volatility reflects the macro shocks of the past five years. Look at the peaks in 2020–2021: they coincide with COVID-19's liquidity crisis and the surge of speculative inflows during the "easy money" era. Volatility spiked again around 2022 as inflation roared, the Fed tightened aggressively, and high-profile crypto failures (Luna, FTX) shook confidence. Since then, Bitcoin's swings have moderated, with 2024–2025 volatility compressing into the 30%–50% range, still high, but clearly trending toward greater stability as institutional adoption deepens.

- Gold remains calmer, but not static. While its three-month volatility mostly sits between 10% and 20%, the chart shows moments of uptick, such as in 2020 when investors scrambled for liquidity, and again in late 2024–early 2025 as geopolitical tensions and central bank buying pushed gold above $3,700/oz. The message is clear: gold may be centuries old, but even it reacts sharply to stress. The contrast is not "safe vs. risky," but degrees of movement under pressure, with Bitcoin beginning to look less like chaos and more like a higher-beta cousin of gold.

Figure 1a: Volatility in Context: Bitcoin vs. Gold (Three-Month Annualized Volatility)

Source: Bloomberg, as of 8/29/25. You cannot invest directly in an index. Historical performance is not an indication of future performance, and any investment may go down in value.

- Bitcoin's volatility smooths but still tells the macro story. Using a six-month lens, the extreme spikes of the three-month chart are muted, but the same episodes stand out: COVID-19 liquidity shocks in 2020, the 2021 boom and bust and the 2022 tightening cycle with crypto-specific failures. What changes is the perspective: instead of sudden bursts, the six-month series shows a clear arc of declining baseline volatility, from the 70%–100% range in 2020–21 down toward the 40%–50% range by 2024–25. That's the key insight: as adoption has broadened, Bitcoin's volatility profile has been compressing on a structural level.

- Gold is steadier, but the six-month view highlights subtle shifts. The longer window shows gold almost always sitting in the 10%–20% band, but with gentle rises around global stress points, 2020's dash for cash and the renewed geopolitical and central-bank buying cycle of 2024–25. What the six-month comparison really shows is scale: Gold's volatility changes, but it does so in smaller amplitude; Bitcoin's changes are larger but trending downward. The combination of the three- and six-month views gives investors both the immediacy of short-term shocks and the reassurance of longer-term convergence.

Figure 1b: Zooming out: Risk Looks Different at Six Months (Six-Month Annualized Volatility)

Source: Bloomberg, as of 8/29/25. You cannot invest directly in an index. Historical performance is not an indication of future performance, and any investment may go down in value.

From Perception to Measured Reality

For years, Bitcoin has carried the label of being "too risky," a caricature shaped by its volatile episodes and youth as an asset class. But looking at rolling volatility next to gold reframes that story. Yes, Bitcoin moves more, but the distance between the two assets is narrowing, and the trajectory is toward stabilization. Gold, meanwhile, is not nearly as placid as its reputation suggests; it too fluctuates in ways that matter to investors who prize capital preservation. Risk, as our analysis shows, is not a binary divide between "safe" and "dangerous." It is a spectrum, shifting with time and circumstance.

Why This Matters for 2025 and Beyond

The point isn't that Bitcoin and gold are interchangeable. It's that when investors think about protecting themselves from fiscal stress, dollar fragility or geopolitical shocks, both assets deserve a place in the conversation. Gold offers historical credibility and institutional comfort; Bitcoin offers innovation, programmability and digital scarcity. The key insight is that their risks may not be as far apart as the headlines suggest. For investors trying to navigate an uncertain 2025, the better question is not whether Bitcoin is "too risky," but how its evolving profile compares to gold, and could combining both offer a more resilient hedge against the dollar's unresolved challenges.

1 Source: "The Budget and Economic Outlook: 2025 to 2035," U.S. Congressional Budget Office, 2025.

2 Source: "Interest costs on the national debt: Monthly interest tracker" [data through July 2025], in Programs and Projects: Fiscal Policy by Peter G. Peterson Foundation, U.S. Bureau of the Fiscal Service, 2025.

3 Source: "Consumer Price Index for All Urban Consumers (CPI-U): U.S. city average, all items, July 2025" [news release], U.S. Department of Labor, U.S. Bureau of Labor Statistics, 8/12/25.

4 Source: Gold price per ounce, Bullion.com, 9/18/25.

5 Source: "Gold demand trends: Q1 2025 – Central bank demand" [data set], World Gold Council, 2025.

6 Source: P. Devitt, "Central banks on track for fourth year of massive gold purchases, Metals Focus says," Reuters, 6/5/25.

7 The final fraction of a Bitcoin is expected to be mined around the year 2140, when the supply hits 21 million coins.

8 Source: S. Nakamoto, "Bitcoin: A peer-to-peer electronic cash system," 2008.

9 Source: "Bitcoin (BTC) price and market statistics as of August 29, 2025," MidForex, 8/29/25.

10 Source: The GENIUS Act (stablecoins legislation, signed into law by President Trump in July 2025), U.S. Congress, 7/25, Public Law No: 118-XXX.

11 Source: The CLARITY Act (market structure bill, passed House, pending Senate), U.S. House of Representatives, 7/25, H.R. XXXX, 118th Congress.

12 CBDC stands for central bank digital currency.

13 Source: The Anti-CBDC Surveillance State Act (House-passed legislation restricting Fed's retail CBDC authority), U.S. House of Representatives, 7/25, H.R. XXXX, 118th Congress.

14 Source: “Democratizing Access to Alternative Assets for 401(k) Investors.” The White House, The United States Government, 8/7/25, www.whitehouse.gov/presidential-actions/2025/08/democratizing-access-to-alternative-assets-for-401k-investors/.

15 Source: "Retirement assets total $43.4 trillion in first quarter 2025," Quarterly Retirement Market Data, Investment Company Institute, 6/18/25.