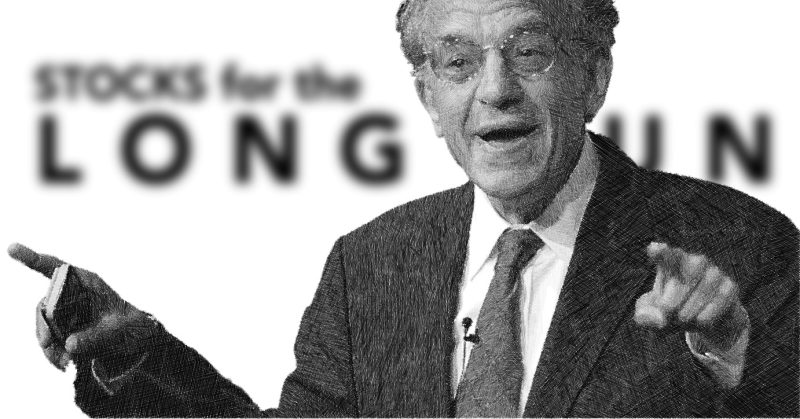

by Professor Jeremy J. Siegel Senior Economist to WisdomTree and Emeritus Professor of Finance at The Wharton School of the University of Pennsylvania

I have received a lot of blowback from my recommendation that the Federal Reserve (Fed) drop the Fed Runds Rate by 150 basis points (bps) over the next several weeks. Certainly, the data has come in stronger than I (and many others) have anticipated. Particularly surprising was the drop in jobless claims, now nearer to the midpoint of my 200k to 240k range after breaching the upper limit.

Nevertheless, I maintain my stance that the Fed has reached its target in the labor market and, if shelter is properly measured, is also at target on inflation. If they truly believe that the neutral Fed Funds Rate is 2.80%, they should be much closer to that number now. In fact, the Taylor Rule, and a host of other forward-looking policy rules, dictate a Fed Funds Rate below 4% at the current time.

The fact that GDP growth is tracking at about 2% this quarter does not change the story. 2% is virtually the Fed’s estimate of the neutral GDP growth rate. There is no overheating here. Commodity prices are also down considerably from their highs. Hopefully the Fed can better explain its methodology.

This week’s big event is Powell’s speech at the Jackson Hole Economic Symposium at 10 a.m. on Friday. I expect him to clear the path for a rate cut in September, but not divulge the size. He will say we are becoming more confident that inflation is moving towards our target, and that we can afford to loosen the degree of monetary restrictiveness. There is still much data to come; August inflation and payrolls as well as four more jobless claims.

The bounce-back in the market is a reflection of the relief that the economy is not falling into a recession. Technicians will want to see if it can breach new highs. If it falters, equities are likely to be range bound, at best, for the rest of the year.

Copyright © WisdomTree