by Ayush Babel, Global Associate Director, Quantitative Research, & Jeremy Schwartz, CFA, Global Chief Investment Officer, WisdomTree

Backed by strong GDP growth and a relatively calm geopolitical environment, India has witnessed one of the best recoveries among the major economies since the Covid-19 crisis—and it hasn’t looked back. With national elections coming up next year, and opinion polls suggesting an historic third term for incumbent Prime Minister Narendra Modi, the country could reap the fruits of political stability and a number of reforms enacted by this government in the last decade, in the form of pro-business policies, reduced systemic corruption, and decreased bureaucracy and barriers to free markets. The prospects for sustained growth are further boosted by a host of macroeconomic factors that we discussed in a previous blog post. While India remains an attractive investment destination amid global geopolitical uncertainties, we wish to explore how India can be accessed in an efficient way with WisdomTree’s systemic, valuation-aware approach to portfolio construction.

Systematic, Broad-Based Access to Profitable Companies

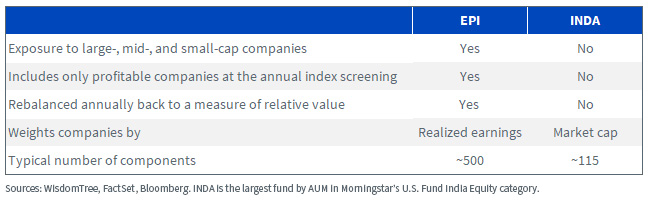

Launched in 2008, the WisdomTree India Earnings Fund (EPI) was the first U.S.-listed ETF to buy local shares in India. EPI tracks the performance of the WisdomTree India Earnings Index, which is designed to mitigate the valuation risk inherent in buying Indian equities. EPI's strategy represents the broadest possible cross-section of investable and profitable companies. The iShares MSCI India ETF (INDA), on the other hand, provides market cap-weighted exposure to Indian companies without any profitability screens, leading to a greater risk of including unprofitable companies.

India at a Reasonable Price

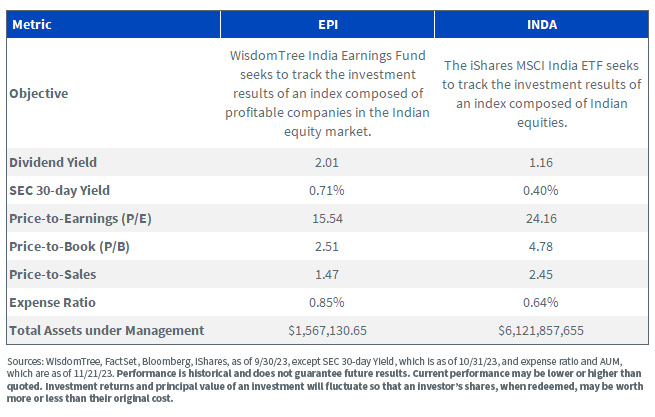

We believe that weighting by market cap tends to result in over-weighting in overvalued companies and under-weighting in undervalued ones. At WisdomTree, we optimize valuation, by weighting by earnings and eliminating unprofitable companies, allowing the most profitable companies to occupy more weight in the Index. This allows EPI to provide investors with access to the broad market, but at a more reasonable price. This approach can lead to better valuation characteristics across the board with potentially better dividend yields and cheaper price ratios.

This information must be preceded or accompanied by a prospectus. For the most recent month-end and standardized performance and to download the fund prospectus, click the respective ticker: EPI, INDA.

For definitions of terms in the table above, please visit the glossary.

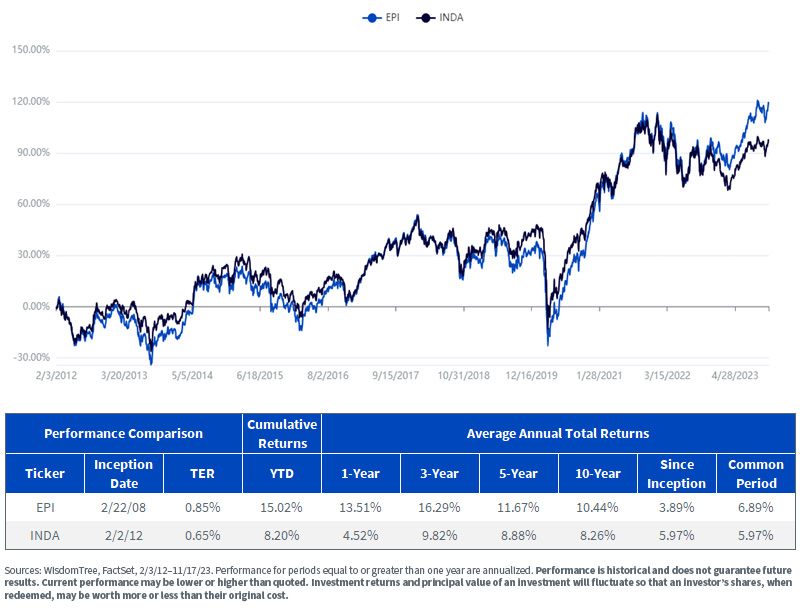

All That Can Translate to Better Performance

The earnings-weighted approach not only facilitates access to India at reasonable valuations but has also delivered consistent outperformance versus the market cap-weighted approach. This is evident in the below chart that shows EPI has outperformed INDA over their common period of existence, and even more decisively over the last five years.

For the most recent month-end and standardized performance and to download the fund prospectus, click the respective ticker: EPI, INDA.

Conclusion

China, with a weight of 29.9% in the MSCI EM Index compared to India’s 15.9%, as of October 31, 2023, has got there by dominating the emerging markets with sustained growth for the past two decades. However, its current position appears increasingly precarious. We attribute this vulnerability to the Chinese government’s excessive interference in private corporations, ongoing and sustained tensions with the U.S., and factors like growth saturation. These unique risks pose a significant threat to China’s future growth. The latest GDP growth figures underscore this shift, with India’s 7% growth outpacing China’s 3% in 2022, according to the World Bank. India possesses distinctive advantages, including a young population, relatively low per capita GDP, a growing middle class, a stable geopolitical and political environment, and a pro-business governance approach. These factors, reminiscent of the conditions that once propelled China’s sustained growth, position India as a potential growth engine for emerging markets in the coming decades.

Important Risks Related to this Article

The purpose of this material is to provide investors with a means to evaluate the investment methodology of the featured Funds and Indexes. It is the opinion of WisdomTree that all funds and indexes are managed differently and do not react the same to economic or market events. The investment objectives, strategies, policies or restrictions of other funds may differ, and more information can be found in their respective prospectuses. Therefore, we generally do not believe it is possible to make direct fund-to-fund comparisons in an effort to highlight the benefits of a fund versus another similarly managed fund. The information included in this material is based upon data obtained from FactSet and WisdomTree’s database, which are believed to be accurate. This material is not considered an offer to sell or a solicitation to buy shares of any other funds mentioned herein. These funds were chosen for comparison due to their similar investment objectives.

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. This Fund focuses its investments in India, thereby increasing the impact of events and developments associated with the region, which can adversely affect performance. Investments in emerging, offshore or frontier markets such as India are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. As this Fund has a high concentration in some sectors, the Fund can be adversely affected by changes in those sectors. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Copyright © WisdomTree