by Fidelity Viewpoints

Big dollars are flowing into water sustainability.

Key takeaways

- Aging infrastructure, extreme weather events, and pollution are threatening the planet's freshwater supply.

- Government spending and private-sector innovation are addressing the global water crisis, potentially creating fluid investment opportunities.

- Companies focused on water infrastructure, treatment, and technology may be poised to drink up some of the growing demand for water-related services.

Depending on where you live, it might be easy to be complacent about access to clean, safe water. But a time may come when simple routines like idly washing your hands or doing the dishes won't be such casual tasks. That's because the water we depend on faces what many experts believe is an accelerating crisis—from climate change, pollution, extreme weather events, and deteriorating infrastructure.

Indeed, the scope of the global water crisis is expanding, which has the potential to impact financial performance across numerous business sectors.

- About 2 billion people globally do not have access to safe drinking water and some 4.2 billion people do not have safely managed sanitation services.1

- Extreme weather events are becoming more frequent—like flooding in New York City and saltwater intruding into the Mississippi River—which is hindering aging infrastructure.

- Costs stemming from an increase in extreme weather events are mounting. According to the National Oceanic and Atmospheric Administration (NOAA), the earth has historically experienced 3 "billion-dollar disasters" per year. By 2021, the number had grown to 20 per year.

- Lake Mead, the largest manmade water reservoir in the US, bordering Colorado and Arizona, has experienced historically low levels in recent years amid drought, increased water demand, and the effects of climate change.

- Geopolitical risks and regional isolationism may amplify the water crisis, especially given that many developing nations depend on help from western countries.

Wave of investment

These are just a few flashpoints in our planet's increasingly fragile water security. It's possible that our freshwater supply may diminish, threatened by climate change, contamination, and drought. In fact, water scarcity is expected to worsen as the global population continues to boom. By 2030, demand for global freshwater is projected to exceed supply by 40%.2

The stakes are high—as the water crisis deepens, so too will the economic strain.

Good news is rippling to the surface in the form of government stimulus. In addition to programs across Europe, China, and the Middle East, the US Bipartisan Infrastructure Law provided $50 billion to improve the nation's drinking water and another $43 billion bolstering water infrastructure resilience.

At the same time, a sprawling range of companies involved in the water industry are increasingly responding to the needs of this pressing global crisis—and creating investment opportunities that, in some cases, may benefit from US infrastructure spending.

"Government stimulus is flowing into the water sector for the first time by a significant amount since the 1970s," says Brian Aronson, who manages the Fidelity® Water Sustainability Fund. "The good thing about the water sector is you can have quality investment theses in water-related stocks while also addressing other environmental and sustainable issues."

Buoyant water stocks

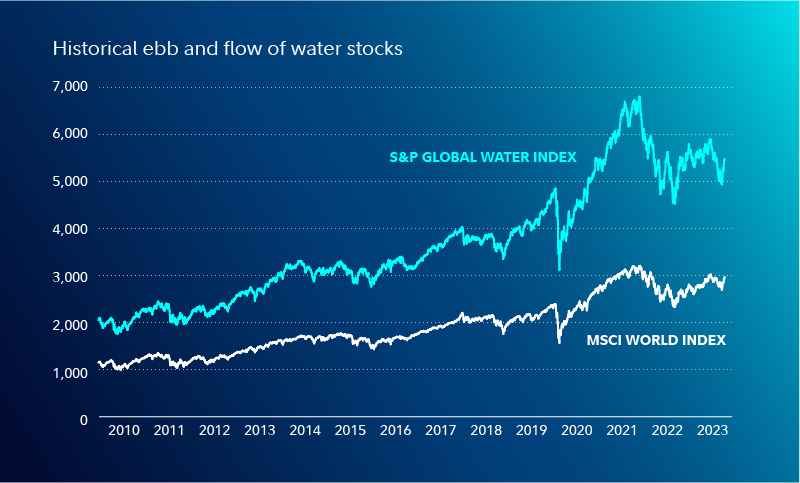

The water sector is less sensitive than the overall market to economic cycles, says Aronson, adding that government spending should help further position water stocks as defensive plays during downturns. The ongoing necessity to provide clean water, upgrade fragile infrastructure, and generate innovative water-management strategies should provide a tailwind to the sector. In fact, water-related stocks have made a splash for investors over the long term, as seen in the chart below:

Past performance is no guarantee of future results. Performance of the S&P Global Water Index compared with the MSCI World Index since 2010. Source: FactSet.

Companies at the intersection of water sustainability and potential investment opportunities span various sectors, including industrials, utilities, and technology. They encompass firms that manage water sources, purify water on a large scale (for instance, turning saltwater into drinking water), construct or maintain water infrastructure (like pumps and pipes), or develop technology for more efficient water usage and safety.

Water stress can affect many aspects of the economy, given that this resource is critical to just about everything. Take manufacturing, for example. Recent trends toward onshoring or nearshoring, driven by pandemic-related supply-chain hiccups, have seen large corporations building facilities closer to their primary markets. Aronson says these plans "must include ways of dealing with potential water shortages." In turn, demand may grow for wastewater recycling services.

Businesses in water-intensive industries—think beverages, technology, semiconductors—are increasingly under pressure to improve their water usage. It's estimated that a typical semiconductor plant gulps between 2 and 4 million gallons of water per day to clean equipment and rinse silicon wafers. Assisting semiconductor firms and other companies with strategic methods to advance their water management practices may present potential opportunities for water companies.

One of the best ways to help solve the water crisis, Aronson says, is addressing water conservation. There's water loss at multiple stops along the supply chain—from the utility to the faucet in the kitchen. In response, industrial water companies are investing in technologies to help shore up conservation. Companies including Xylem are developing advanced metering, which implements real-time tracking of water usage and identifies problems like leaks. The integration of new and innovative smart valves means water utility companies can follow a variety of data and analytics to fine-tune flow rates, pressure, and temperature. Meanwhile companies like Energy Recovery are creating technological advancements needed for water desalination.

"There are investment opportunities that can really leverage these factors," Aronson says.

One of the outcomes of climate change is more extreme weather events, which puts significant stress on already underfunded infrastructure. Increases in natural disasters, such as flooding, can lead to pollutants flowing into water sources.

"Extreme weather events are really exposing the problems that we have in the water sector," Aronson says. As such, utilities are required by the Environmental Protection Agency to assess water for contaminants on a more frequent basis. This requires increased investment in solutions for testing, measurement, diagnostics, and contaminant reduction.

Water sector risks

Aronson points out that government spending can sometimes be potentially delayed or repurposed for other areas. Furthermore, a new US administration could enter office and theoretically put the brakes on some of the spending earmarked for the water sector. However, clean water has historically enjoyed bipartisan support.

Inflation is another factor to consider. If inflationary pressures persist and interest rates remain higher for longer, utilities can potentially pass increased costs on to customer bills. However, utilities are often seen as proxies for the bond market, meaning that higher-for-longer interest rates could potentially make the dividend yield in the sector not as attractive as it has been historically.

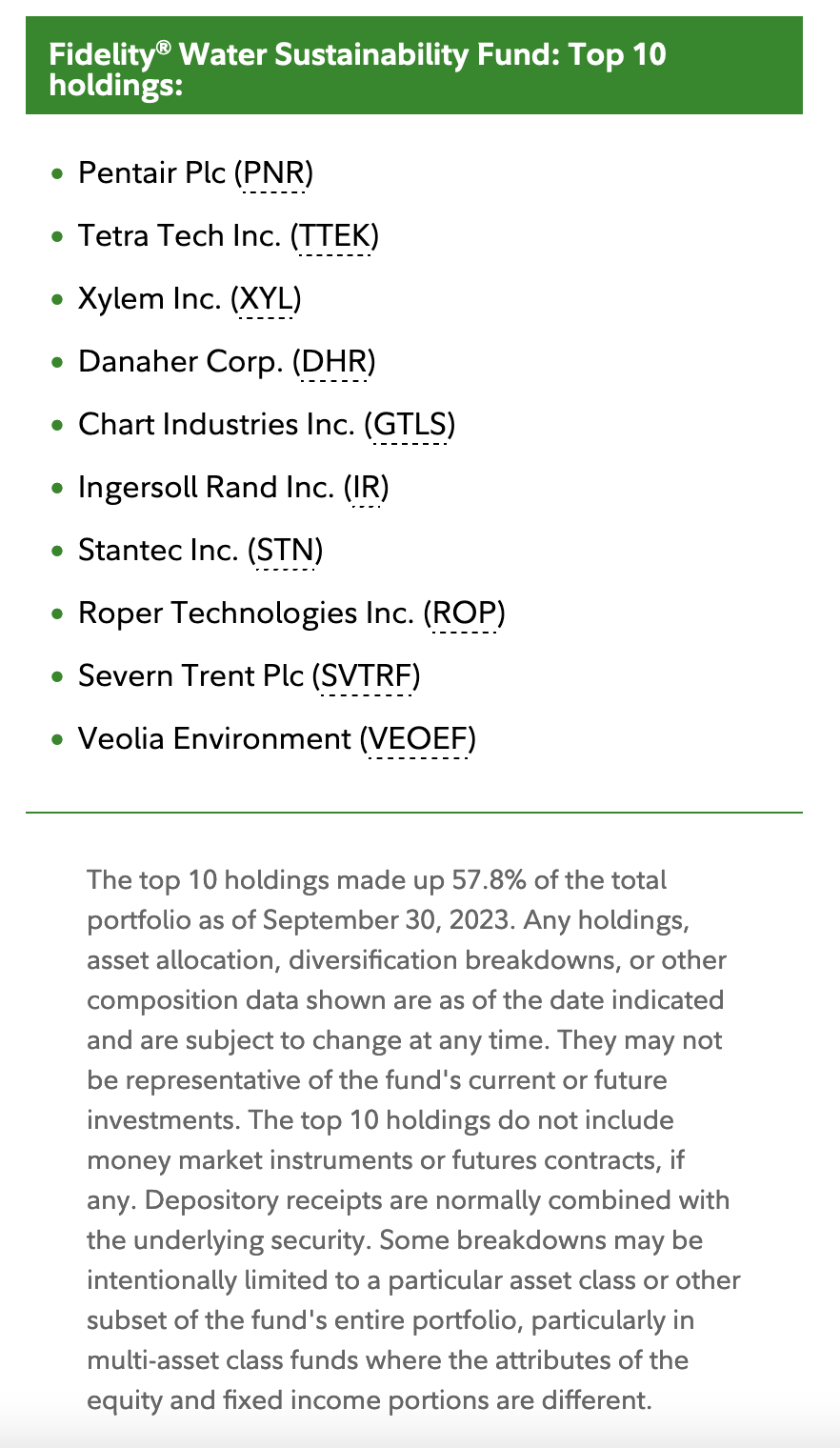

Fidelity® Water Sustainability Fund: Top 10 holdings:

Copyright © Fidelity Investments