by Russ Koesterich, CFA, JD, Portfolio Manager, BlackRock

Key takeaways:

- Since early March bonds and growth stocks have rallied

- For the first time since 2021 bonds have resumed their role as an equity hedge

Russ Koesterich, CFA, JD, Managing Director and Portfolio Manager of Global Allocation discusses whether bonds can continue serving as an equity hedge.

Many things changed with the news of acute banking stress in Europe and the United States, not all of which were obvious at the time. Since early March bonds and growth stocks have rallied, and for the first time since 2021 bonds have resumed their role as an equity hedge.

I last discussed bonds as a hedge back in the fall. At the time I suggested that bonds were still acting as a source of risk rather than a risk mitigant. Near-term this has shifted as financial conditions have suddenly eased and recession fears have re-emerged. Longer-term, bond’s efficacy as a hedge will still likely depend on inflation.

Silver-lining of a banking scare

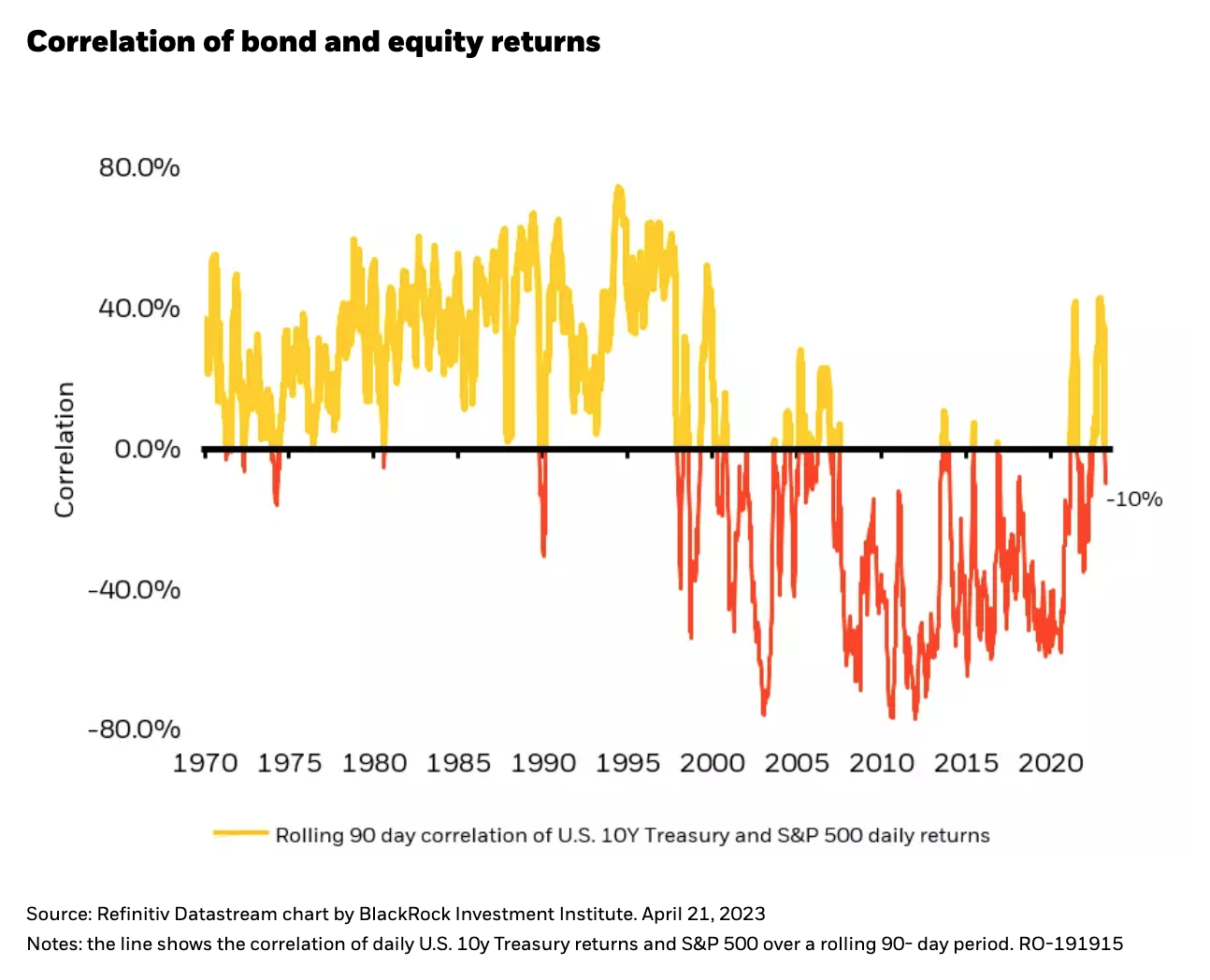

Whenever the dominant investment narrative shifts, asset correlations tend to change as well. Back in February investors’ chief concerns centered around stubborn inflation and an aggressive Federal Reserve. In that environment, stocks and bonds were still responding to the same underlying threat: higher rates. Conditions shifted abruptly with the Silicon Valley Bank failure. Suddenly, inflation seemed less of a threat and investor fears pivoted back towards recession. As the narrative flipped, so did stock/bond correlations (see Chart 1).

While abrupt, the shift was not unprecedented. The banking failures thrust lending conditions to the forefront of investor anxiety. There was, however, a silver lining: If banks were lending less, perhaps the Fed would not need to tighten as much. Bond yields, which had been heading higher, quickly reversed; real and nominal yields fell by around 50 bps. With real rates falling, the stock market surged, volatility fell, and financial conditions eased.

Easier financial conditions as measured by the Goldman Sachs Financial Conditions Index (FCI) support lower stock/bond correlation. Historically, stock/bond correlations have moved with changes in FCI. Since the end of the financial crisis, year-over-year changes in the FCI have explained nearly 30% of the variation in stock/bond correlations.

That said, while easier financial conditions support bonds role as a hedge in the near term, for the longer term investors need to continue to watch inflation. As I discussed last October, stock/bond correlations are more likely to be positive when inflation is more volatile. Today, using 3-year trailing core inflation, volatility remains at multi-decade highs. While inflation has moderated from its 2022 peak, it is likely to remain both higher and more volatile than during the preceding 20-years. This argues for more caution and suggests stock/bond correlations are likely to be less stable than during the previous decade.

For investors, there are a few takeaways. In the near term, a weaker economy and a Fed pivot will support bonds as a hedge. Longer term the efficacy of bonds as a hedge will likely rest with the Fed’s ability to not only bring inflation down but keep it down and stable.

Copyright © BlackRock