by Tom Nelson, CFA, Head of Asset Allocation Portfolio Solutions, Franklin Templeton Solutions, & Miles Sampson, CFA, Senior Research Analyst, Franklin Templeton Investment Solutions

If the Fed pauses, will that revive risk assets? Tom Nelson and Miles Sampson of Franklin Templeton Investment Solutions weigh in on the investment implications of the latest US central bank actions.

Fed pause amidst economic uncertainty?

The Federal Reserve (Fed) hiked interest rates 25 basis points at its May policy meeting, taking the upper end of its target to 5.25%. The Fed also indicated that it may pause rate hikes as it observes how the economy is reacting to its ongoing policy moves. We agree with the Fed that the outlook is uncertain: weak manufacturing, regional bank turmoil and declining corporate profitability are coinciding with a resilient labor market and consumer spending.

Our view is that there is a high probability that US growth will continue to weaken and enter recession later this year. We continue to rely on leading economic indicators, where the growth rate is at a negative level that has historically coincided with US recessions.

Exhibit 1: Leading Economic Indicators at Recessionary Levels (right click to enlarge image)

Multi-asset implications of a Fed pause

Despite the economic uncertainty, a natural question arises: Can a Fed pause propel risk assets higher? Looking back on 2022, it’s fair to say that increasingly restrictive monetary policy caused much of the weak asset performance. Shouldn’t risky assets rally if “peak Fed” is in place?

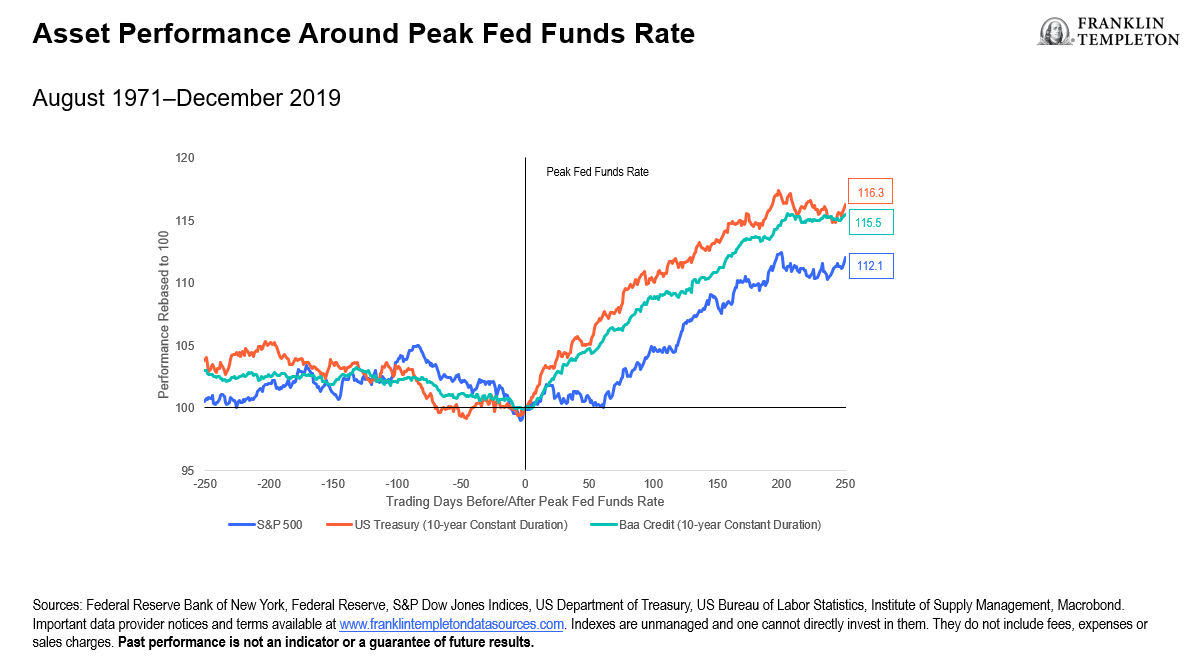

Historically, we have seen a rally across asset classes following a peak in the fed funds rate. Many assets—Treasuries, corporate credit and equities—have done well. Notably, equities, which should outperform less risky assets over time, perform slightly worse than both.

Exhibit 2: Most Assets Have Rallied Around Peak Fed Funds Rate (right click to enlarge image)

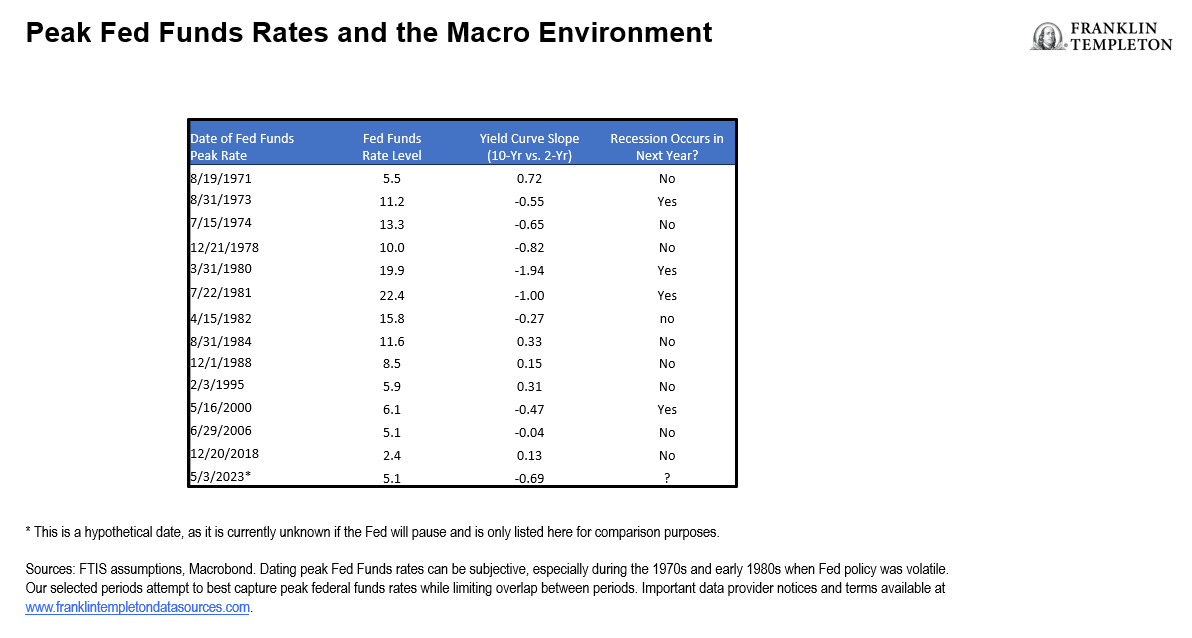

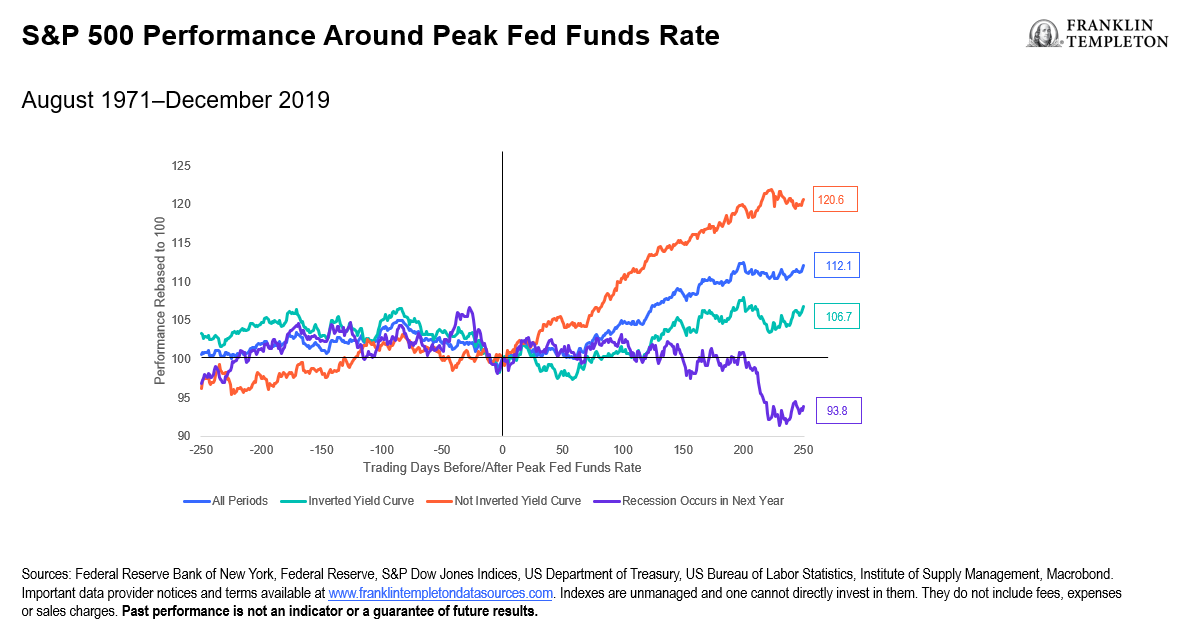

Digging further, our hunch is that not all Fed pauses are created equal. Some occur with varying levels of growth and inflation and at different stages of the business cycle. We focus on the business cycle and use the yield curve as a method to further classify Fed pauses. We also look at Fed pauses that were eventually followed by recessions in the next year. What we find confirms our hunch—the later we are in the business cycle, as highlighted by an inverted yield curve, the worse equity performance has been. If a recession eventually follows a Fed pause, equity performance tends to be outright negative.

Exhibit 3: Peak Fed Funds Rates Occur in Varying Macro Environments (right click to enlarge image)

Exhibit 4: Business Cycle Factors Can Overwhelm Fed Policy (right click to enlarge image)

Portfolio implications

We often debate whether growth or policy is a more important factor for risky asset performance. Over the past few years, it has felt like interest rates and Fed policy have been powerful drivers. The analysis above suggests that a Fed pause will not save the day for risky assets like equities, and that it is more prudent to be allocated to safer assets, like Treasuries and cash. We pay careful consideration to where we are in the business cycle and when our forecast of recession risk is high; these considerations further the case against equities. If the United States enters a recession, weak growth is likely to trump any policy easing. We remain positioned defensively in our portfolios, favoring assets like Treasuries and cash over equities. Within equities and credit, we currently prefer higher-quality assets.

WHAT ARE THE RISKS?

All investments involve risks, including the possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. The positioning of a specific portfolio may differ from the information presented herein due to various factors, including, but not limited to, allocations from the core portfolio and specific investment objectives, guidelines, strategy and restrictions of a portfolio.

Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions.

Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Investments in lower-rated bonds include higher risk of default and loss of principal. Changes in the credit rating of a bond, or in the credit rating or financial strength of a bond’s issuer, insurer or guarantor, may affect the bond’s value. In general, an investor is paid a higher yield to assume a greater degree of credit risk. The risks associated with higher-yielding, lower-rated debt securities include higher risk of default and loss of principal. Investments in foreign securities involve special risks including currency fluctuations, economic instability and political developments.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.