"The YOLO crowd is back with a vengeance." says Alfonso Peccatiello, CEO & Chief Macro Strategist at The Macro Compass.

Over the last month, we have observed nearly bankrupt companies rallying 100%+ in a single day and companies reporting awful earnings staging a 20%+ rally the day after. He calls it a "big Meme Rally" and has two objectives to cover in his piece: to look back and quantitatively assess the mechanics behind the rally and to answer the big question: if bond yields are rising and cash-like products now yield 5%, how on Earth is it that we are witnessing such a high-beta rally, and is this the start of a new bull market?

Peccatiello explains that the Fed was all about tighter financial conditions, which is jargon for less animal spirits: a stronger US Dollar, higher borrowing costs, and lower multiples. However, something abruptly changed. Disinflationary prints led to a relief rally in the bond market, and Powell did not fight back.

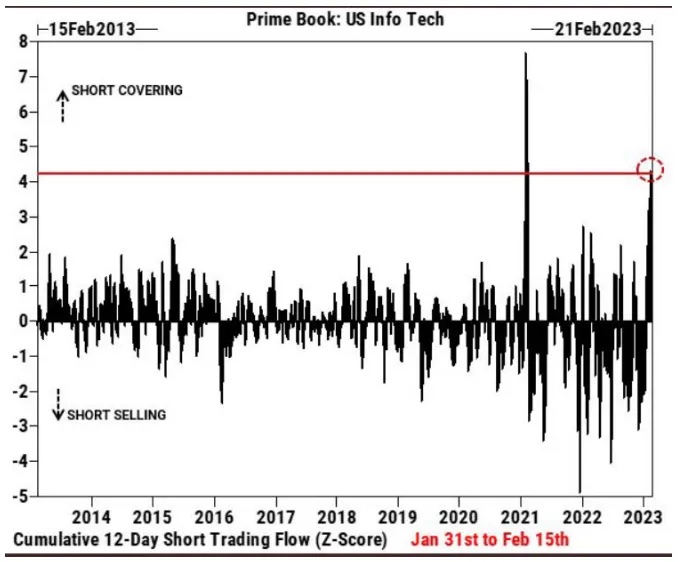

He says that mechanical buying flows from leveraged investors kicked in on a very large scale. Commodity Trading Advisors (CTAs), risk parity, and volatility-targeting funds use volatility as one of their buying/selling signals. These mechanical flows can be large and have a disproportionate effect on two types of stocks: the most shorted and hated stocks out there and the least liquid and more flow-prone sectors in the market. Peccatiello shows that the short squeeze has been gigantic so far and is well reflected in charts from Goldman Sachs.

Are we in a new bull market?

He points to some interesting inconsistencies in the market. US front-end nominal rates have moved by over 2 standard deviations on a 1-month rolling basis, and long-dated real yields trade above 100 bps. The US Dollar is strengthening against most major currencies, and bond, stock, and FX implied volatility struggles to decline further. Systematic vol-targeting accounts might have exhausted most of their buying needs, and yet the Nasdaq and the Russell are 3-6% up over the last month.

Peccatiello raises two realities that we must face: markets can remain irrational longer than we can remain solvent, and long-lasting bull markets require rapidly expanding valuations and/or strong earnings growth. Peccatiello reflects on the fact that the Dot-Com bubble and the US housing market frenzy happened with Fed Funds around 5-6%, not 0%.

He believes that it is hard to make the case for rapidly expanding valuations, given that core services ex-housing CPI is still running at over 4% annualized levels and the US labor market keeps adding jobs at an underlying realistic pace of 150-200k new jobs per month.

His view is that the Fed will be forced to keep risk-free rates at 5%+ for 9-12 months at least, which means the housing market and the real economy must handle 7-8% borrowing rates for a long time to come.

Peccatiello does not YOLO here, and he quips, "I will have fun staying poor."

For the full scope, go to The Macro Compass:

The Macro Compass: To YOLO or Not to YOLO?