Technical Notes for yesterday

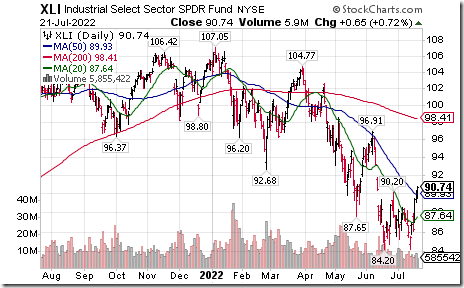

Industrial SPDRs $XLI moved above $90.20 completing a double bottom pattern.

Steel ETF $SLX moved above $49.88 completing a double bottom pattern. Nucor led the advance

Financials SPDRs $XLF moved above $32.87 completing a double bottom pattern.

Medical Devices iShares $IHI moved above $52.13 setting an intermediate uptrend.

More NASDAQ 100 stocks break resistance/resuming intermediate uptrends including $ILMN, $ASML, $INTU, $SYPS, CDNS, PTON and $TSLA.

S&P 100 stocks breaking resistance/resumed intermediate uptrends included $KMI, $CSX $ABT. $ORCL and $DHR

American Express $AXP a Dow Jones Industrial Average stock moved above $148.95 completing a double bottom pattern.

Japan iShares $EWJ moved above $54.06 completing a double bottom pattern

U.S. Telecom stocks are under technical pressure. AT&T $T moved below $18.42 and $Verizon moved below $47.41 extending an intermediate downtrend.

IBM $IBM moved below $125.80 extending an intermediate downtrend.

Canadian Technology stocks also have gained technical momentum. Canadian Technology iShares $XIT.TO moved above $34.41 completing a reverse Head & Shoulders pattern. Units were helped with breakouts by three prominent stocks in the ETF: Shopify Constellation Software and CGI Group.

Shopify $SHOP.TO a TSX 60 stock moved above $50.89 completing a double bottom pattern.

CGI Group $GIB.A.TO a TSX 60 stock moved above $109.10 extending an intermediate uptrend.

Constellation Software $CSU.TO a TSX 60 stock moved above $2,031.18 extending an intermediate uptrend.

Soybeans ETN $SOYB moved below $24.44 extending an intermediate downtrend.

Trader’s Corner

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for July 21st 2022

Green: Increase from previous day

Red: Decrease from previous day

Commodities

Daily Seasonal/Technical Commodities Trends for July 21st 2022

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for July 21st 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Interesting Study on Gold and Fed Fund changes

DO FED RATE DECISIONS AFFECT THE PRICE PATTERNS FOR GOLD? – July 21, 2022 – ETF Swings Delivered

S&P 500 Momentum Barometers

The intermediate term Barometer advanced another 7.00 to 57.00 yesterday. It remains Neutral. Trend remains up.

The long term Barometer added 1.80 to 22.80 yesterday. It remains Oversold. Trend is up.

TSX Momentum Barometers

The intermediate term Barometer added 2.52 to 39.92 yesterday. It remains Oversold. Upward trend was extended.

The long term Barometer slipped 0.42 to 28.99 yesterday. It remains Oversold.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed