by William Smead, Smead Capital Management

Dear fellow investors,

Totally Addressable Markets (TAM) are at the heart of what Charlie Munger calls the biggest euphoria episode he has ever seen in his career. We believe that the coming stock market failure emanating from the over-pricing of the U.S. stock market is closely tied to TAM. What is a totally addressable market? When is it useful to think about TAM? Answering these questions could tell us a great deal about where to be invested in the common stock market over the next five years.

Here is how the Corporate Finance Institute defines a Total Addressable Market:

The Total Addressable Market (TAM), also referred to as total available market, is the overall revenue opportunity that is available to a product or service if 100% market share was achieved. It helps determine the level of effort and funding that a person or company should put into a new business line.

The concept of total addressable market is important for startups and existing businesses because the estimates of effort and funding required allow them to prioritize specific products, customer segments, and business opportunities. Where there are potential investors and buyers of the business, company executives can use TAM to provide a viable value proposition.

The best way for us to explain a TAM is to think of the bottled water business. There are 7 billion people in the world and they all require water. If we start a bottled water company and make one million bottles of water at a dollar per bottle and sell them for $0.90 per bottle, we’d have $900,000 in revenue. In the second year, if we make 2 million bottles of water at a dollar apiece and sell them for $0.90 per bottle, we’d have $1.8 million in sales and have grown our revenue 100%. Investors over the last few years would have flocked to our stock market debut as they salivated over 100% revenue growth and an addressable market of 7 billion people.

However, there is a very important set of limitations that needs to be placed on companies which appeal based on the TAM. First, it is better to be realistic about the market you want to address. Are there other players already ahead of you? Are there bigger players than you? Are their potential future players who will do what we learned in our college econ classes and burn off the marginal profit by entering the business?

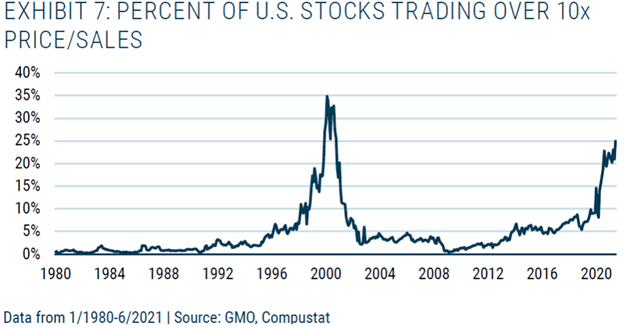

Second, Amazon, Netflix and others have taught investors in TAM companies the wrong lesson. Rarely do the capital markets continue to fund a money-losing business for many years and come out ahead. Since Amazon, Tesla and Netflix did it, now everyone thinks they can do it. In 2020-2021, this led to more goofy rapid sales growth stocks with large capitalizations in the S&P 500 Index and many goofy SPACs and IPOs, also.

Third, the lesson which has been handed out viciously the last six months is tied to what you are paying to participate in the TAM. It is one thing to hope your fintech or clean energy or SAAS company or brilliant internet woogie company is going to make it through the haystack as the winning needle. It is entirely predicated on the confidence cheap money has put into the stock market. This has blown massive wind into the sails of over-confident momentum investors. The nice thing about 2022 is that motley fools like to fleece Millennial folks now in TAM stocks as much as they liked to fleece baby boomer TAM investors back in 1999. If you think we are wrong, name five internet success stories besides eBay (EBAY) and Amazon which existed in 1999 and survived to 2015. Billions of dollars of capital were destroyed by TAMnation.

Here is the good news. You can find a favorable entry point on a company with a good TAM if you are willing to sit through some abuse to get to a long-term success story. Two examples come to mind. Demographic studies show that the group behind the Millennials, Gen Z, will match it in size as a population group. Where do 15-25-year-old folks hang out? The answer is at the Class A shopping malls. Since there will be as many as 95 million Gen Zs, we’d like to address that market via Simon Property Group (SPG) and Macerich (MAC). These stocks have pulled back substantially and offer impressive dividend yields while we wait.

Despite a sharp recent pullback in price, home builders have a very attractive coterie (TAM) of Millennials about to form households. These 28-42-year-old folks have been late to the party, but have what Freddie Mac calls a five-million-house shortage staring them in the face. Only some of the major builders like D.R. Horton (DHI), Lennar (LEN) and NVR (NVR) can satisfy this addressable market. This is because the home building market used to be fragmented and dependent on the leveraging of their balance sheet to develop raw land. Horton builds on 24% self-developed land, Lennar builds on 32% self-developed land and NVR builds 0% self-developed land. These companies build 20% of the homes built in the U.S. and scale is beginning to dominate the addressable market.

The point is that a TAM is good if you can invest in satisfying the addressable market in a reasonably priced common stock. If you want to chase dreams, you could be going to join the other suckers diving into the haystack and suffer TAMnation.

As always, fear stock market failure!

Warm regards,

William Smead

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Bill Smead, CIO, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

©2022 Smead Capital Management, Inc. All rights reserved.

This Missive and others are available at www.smeadcap.com.