by Reid Menge, BlackRock Technology Equity Team

The metaverse might sound futuristic, but the investment opportunities are here and now, according to Reid Menge, Co-Portfolio Manager of the BlackRock Technology Opportunities Fund. He discusses avenues to enter this next great digital frontier and its rich investment potential.

Technology stocks have been battered to start 2022. The key culprit: Investor concerns about how higher interest rates might impact these companies’ long-term cash flows. While rate fears may continue to drive volatility in technology shares, we are confident in the long-term value available across the sector. One area capturing attention: the metaverse.

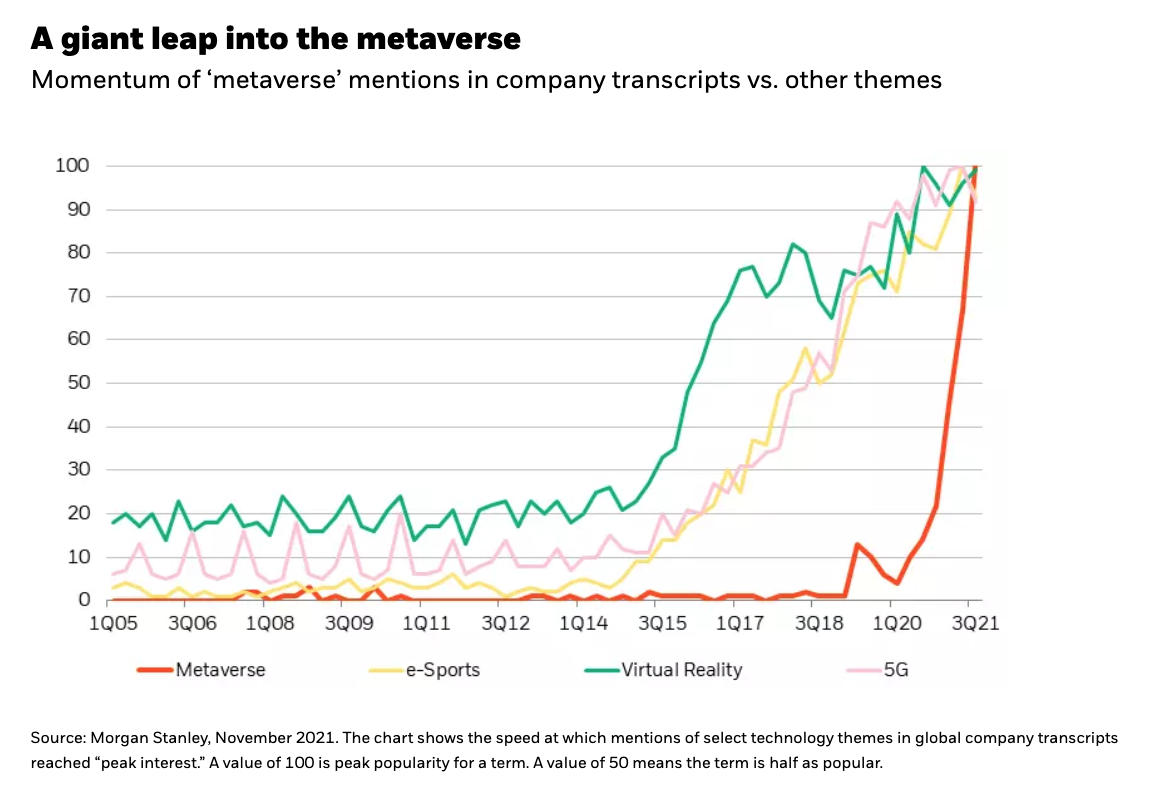

The term is increasingly popping up in headlines, around dinner tables and in company transcripts, as shown in the chart below.

A revolution in the making

Interest is piquing for good reason. The metaverse is an immersive virtual world built on established gaming, virtual reality (VR) and augmented reality (AR) elements. At this juncture, it is much like the internet of the early 1990s or the smartphone of the early 2000s: We expect it is going to be big, and very likely change people's daily lives. But we don't yet know exactly how, or how big the shift will be.

What we do know: Work and play will be affected. Virtual meetings will take on new life, but users also can be transported to the golf course as the home favorite tees off, or onto the stage as a rock band plays live to millions around the world.

Seizing the moment

Virtual worlds have existed for decades, so why is mass adoption finally becoming a reality? We see three key reasons:

- Next-generation hardware and increased computing power make it possible.

- The COVID-19 crisis accelerated a shift to digital lives. People are more comfortable working, shopping and socializing at home.

- Cryptocurrencies could allow transactions to take place seamlessly and globally in the metaverse.

Those who already spend time in virtual spaces are using old technology where the screen is the limiting factor. VR headsets and AR glasses, along with powerful 5G mobile networks, will take this to the next level.

We could see a breakthrough in AR glasses ― a version light and smart enough to be worn every day ― as soon as 2023. VR headsets will modernize as well but are less likely to be the “game changer” given they are not as easily worn on the move.

Timely investing ideas

The metaverse may not be mainstream until later this decade, but investment opportunities are available now.

Internet companies are gearing up. They want to provide both the platform and the hardware, avoiding the type of missed opportunity realized years before when smartphone manufacturers were allowed to control the hardware and the operating software. The big hardware companies are also racing to provide the next-generation technology.

Where to look for prospective metaverse investment gains? We see the most immediate opportunity in those companies that can supply the big internet, software and smartphone companies with the ingredients they need to develop glasses and headsets. Producing AR glasses that are wearable, fashionable and metaverse-functional will require a new generation of chips, batteries and lenses.

Once the hardware exists, we look to the services that can be accessed by the new devices, and the software that will shape the metaverse. We also like companies poised to play a key role in “building” the metaverse, designing and creating virtual worlds.

Perspective on the big picture

Admittedly, recent market volatility may distract many investors from the long-term potential embedded in the innovative tech companies that are shaping and powering the future. But we view tech as the fabric upon which today’s economy is built. Secular growth trends, such as digitalization of industries and an ever-growing reliance on data analytics, were accelerated during the pandemic and are multi-year transformations we expect to persist ― regardless of the pace of reopening or moves in interest rates. The metaverse is just one reminder of the vast opportunity driving long-term return for investors across the technology universe.

Reid Menge, BlackRock Technology Equity Team