by William Smead, Smead Capital Management

Dear fellow investors,

We have been reading a book written by David Carey and John Morris called King of Capital. It is the story of the Blackstone company and its key founder, Stephen Schwarzman. An economic history from the 1980s through today is included and lays out some excellent reminders of certain disciplines which can create wealth in picking public companies to invest in.

Value Investing Works

Schwarzman and Blackstone could see that fortunes were made by buying companies in the 1980s via borrowed money. A slice of equity was combined with major borrowing to buy asset-rich and free-cash-flow producing companies. These companies were available due to depressed stock prices. The general market as represented by the Dow Jones Industrial Average went nowhere from 1964 to 1981, even as inflation caused the underlying assets/operating results to become dramatically more valuable.

Investing Side-By-Side

Blackstone formed investor pools of capital where they would be paid a management fee and a cut of the profits made in their deals. In turn, Blackstone invested its own capital in the deals that were chosen. Our portfolio managers and employees have significant investments in our stock picking strategy and it is high in relation to our liquid net worth. This so called “skin in the game” is something we believe establishes sincerity and transparency.

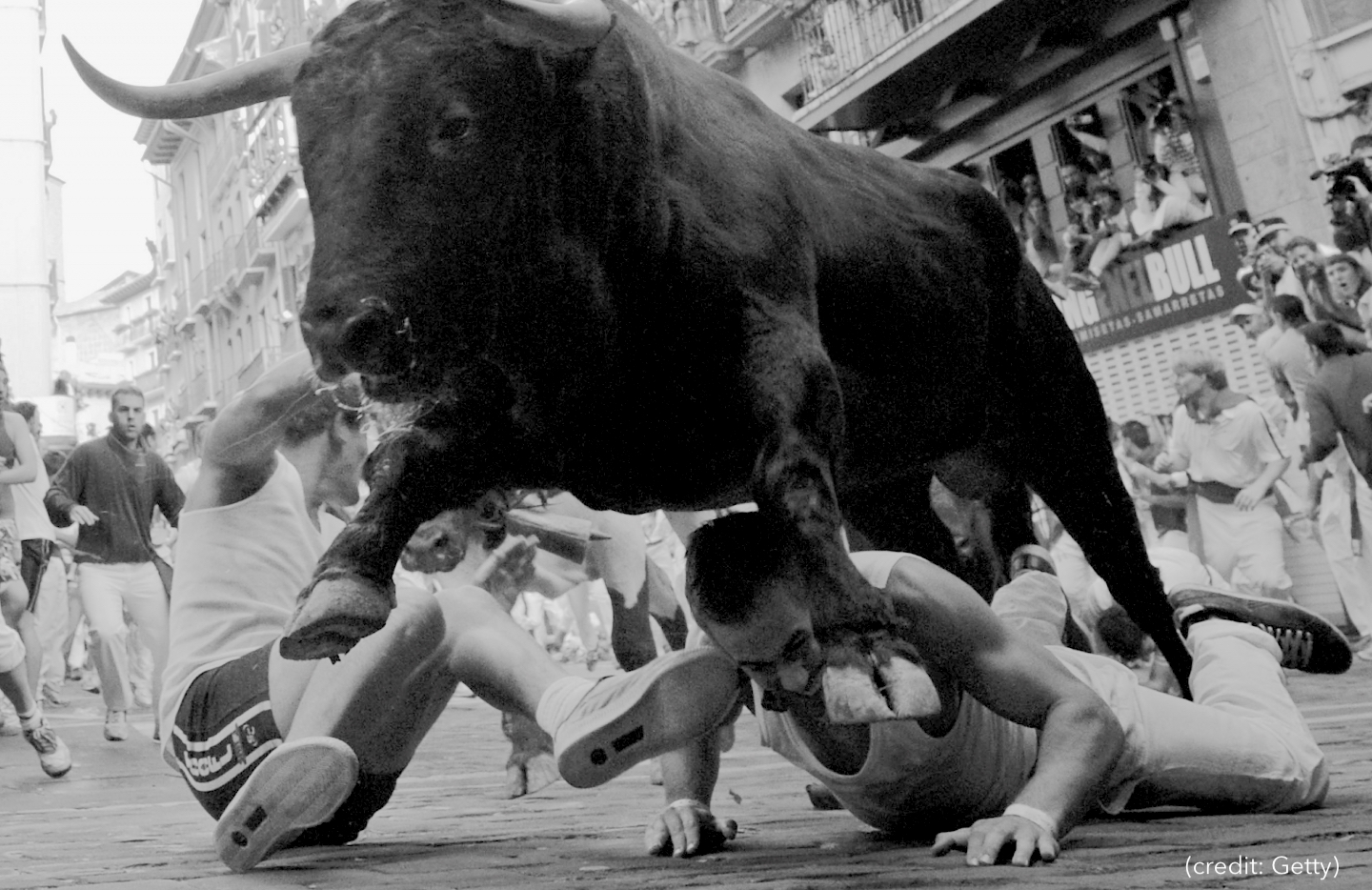

Taking Risks in Distressed Industries/Sectors

Blackstone has practiced contrarian investing almost exclusively over the decades. Here is what Schwarzman said after raising their first $635 million dollar fund:

“I was exceptionally nervous and putting pressure on everyone to close,” Schwarzman says. He worked the phones, and on Thursday, October 15, 1987, Blackstone wrapped up the fund at around $635 million, with some mop-up legal work on Friday.

The following Monday the U.S. stock markets nose-dived 23 percent. Black Monday, as it became known, was the biggest one-day drop since 1914, outstripping even the 1929 sell-off that ushered in the Great Depression. If Blackstone hadn’t tied up contractual loose ends before the crash, undoubtedly many investors would have backed out. Instead, Blackstone could boast of raising the largest first-time leveraged buyout fund up to that time.”

This story has been repeated over and over by Blackstone in all the various sectors which became the present day “private equity” world. This came as Blackstone spread itself to everything from stocks, fixed income of all forms, real estate, vulture investing and venture capital.

Don’t Go to the Game, Let the Game Come to You

Some very talented people have worked at Blackstone over the decades. These talented people had expertise in specific areas of private equity investing. However, the biggest disappointment in the company came from chasing the excitement in the tech bubble of the late 1990s. Blackstone could see all the wealth being created around them by venture capital investors. They formed a tech investing group and proceeded to squander millions of dollars from 1999-2003. Here is how the book describes the pressure to make a foray into the tech mania:

“With some venture funds chalking up returns of 100, 200, and even 300 percent a year, the lure of venture investing proved irresistible, and pension funds and endowments began redirecting more money to investment funds that specialized in start-ups and other technology companies. To these investors, venture capital, private equity, and real estate were all in the category of “alternative assets”—alternatives that offered higher returns than their mainstay investments in stocks and bonds.”

“Venture firms, which had attracted a mere $10 billion in 1995, hauled in more than $59 billion in 1999, nearly the sum for buyout funds that year. More venture capital was raised in 1998 and 1999 than in the entire history of the industry through 1997, and in 2000 venture firms raked in $105 billion, for the first time surpassing buyout funds, which drew only $82 billion.”

“Blackstone couldn’t help but feel the pressure to jump on the bandwagon. Bret Pearlman, who became a partner in 2000, and other younger deal makers were lobbying to invest more in the tech sphere, and junior employees were clamoring to be paid partly in Internet company stocks, the preferred currency of New Economy workers.

The firm was hearing it from some investors, too. When Schwarzman hit the road in 1999 to raise money for Blackstone’s new mezzanine debt fund, which would lend money to midsized businesses, one potential investor who preferred venture funds just scoffed. “I make more money in a month than you make in a year in your mezz fund if things go well,” he told Schwarzman.

“We had enormous pressure here to be doing those deals,” Schwarzman says. “We were viewed as not being modern.”

It was all irksome to Schwarzman, who thought the prices being paid for Internet companies were ridiculous. But with firms like Doerr and Khosla’s reaping stupendous returns selling their tech start-ups in IPOs, it was hard not to be tugged in that direction. “As you got to the 1999 period and into 2000, the amount of money people were making[…]”

Schwarzman’s misgivings ended up being accurate as Blackstone got punished and took some of its biggest losses in company history when the tech bubble broke!

You Can’t Win Them All

Numerous talented people worked for Blackstone over the decades. One thing they had in common was that they rolled a dud every third or fourth deal. There is no successful investment selection discipline that exists without making mistakes. Many times, in Blackstone’s case, the mistake was made on a company or property which they were very familiar with. These mistakes were just as much a part of their success story as the biggest successes were.

Our View of the Blackstone Story

Warren Buffett says, “Invest in a company as if the stock market won’t be open for the next five years.” At Smead Capital Management, we try to do in already public company shares, many of the same things that Blackstone has done in private equity. First, we seek value in undervalued assets and underestimated business models. Second, our people are invested side-by-side with our investors.

Third, we like to make investments which meet our eight criteria for common stock selection at what John Templeton called, “The point of maximum pessimism!” He said, “If you can see the light at the end of the tunnel, you are too late!” Fourth, we try as much as possible to patiently wait for wonderful companies to get dumped into our lap by temporarily difficult and distressful events. Whether it is Costco (COST) divorcing American Express (AXP) or Amazon (AMZN) going into the grocery business to open us up to Target (TGT) or Apple (AAPL) suing Qualcomm (QCOM), we are glad to have the door opened to us.

Lastly, we are very conscious of the fact that we will be wrong on as many as 40% of our picks. However, by holding our successful investments longer than most of our competitors, we believe we will gain more on the overall portfolio by letting our winners run.

In conclusion, we make very liquid investments illiquid by taking our share of the company off the market for an extended period in companies which typically have very strong balance sheets. We use no leverage ourselves in running the strategy, and in many cases, we own the individual stocks for well over a decade. This low turnover and value-oriented approach appears very similar to what companies like Blackstone do in more illiquid markets using borrowed money. Other than practicing our discipline, we fear stock market failure!

Warm regards,

William Smead

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Bill Smead, CIO, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

©2021 Smead Capital Management, Inc. All rights reserved.

This Missive and others are available at www.smeadcap.com.