by Don Vialoux, EquityClock.com

Technical Notes release yesterday at

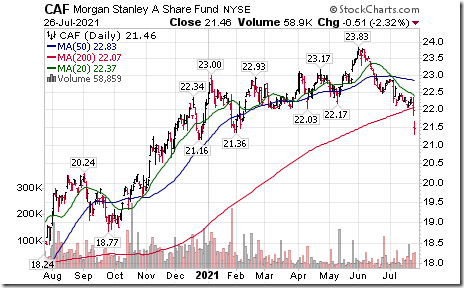

Morgan Stanley China A Fund $CAF a proxy for a portfolio of China A shares moved below intermediate support at $21.36. Reflecting general weakness in Chinese stocks following a crack down by the Chinese government on selected industries.

Chinese equities and related ETFs continue under technical pressure. Best example is $FXI an ETF priced in U.S. Dollars consisting of big cap Chinese stocks with a heavy weight in the financial services industry. Units moved below $42.72 extending an intermediate downtrend.

Another Chinese stock casualty! $JD a NASDAQ 100 stock moved below $66.55 extending an intermediate downtrend.

NetEase $NTES a NASDAQ 100 stock and Chinese based technology stock moved below $101.19 and $99.15 setting an intermediate downtrend.

Consumer Discretionary SPDRs $XLY moved above $183.79 to an all-time high extending an intermediate uptrend.

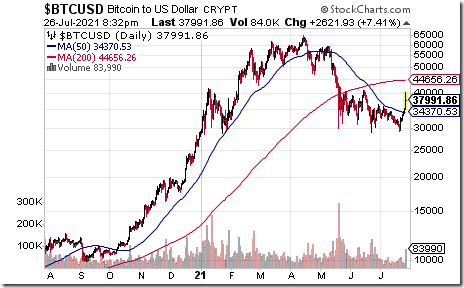

Bitcoin advanced 2,621.93 to $37,991.86 after Amazon announced plans to receive payment with Bitcoin.

Trader’s Corner

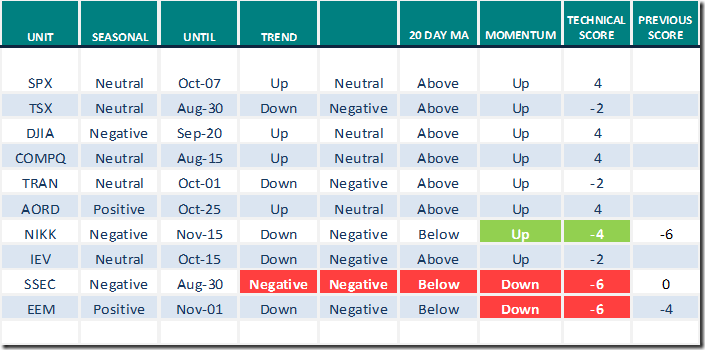

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for July 26th 2021

Green: Increase from previous day

Red: Decrease from previous day

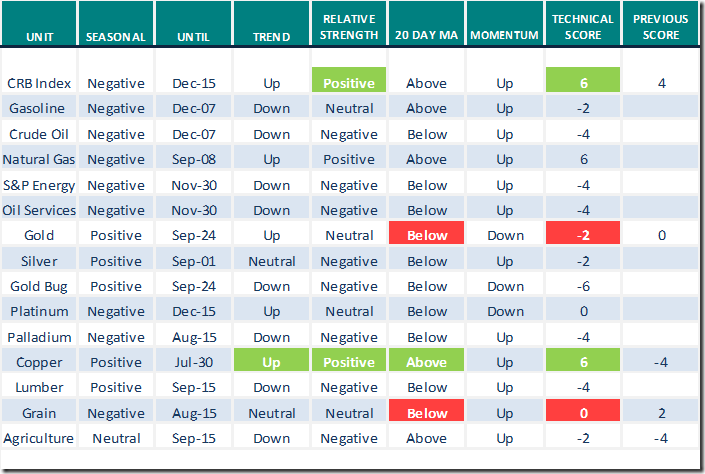

Commodities

Daily Seasonal/Technical Commodities Trends for July 26th 2021

Green: Increase from previous day

Red: Decrease from previous day

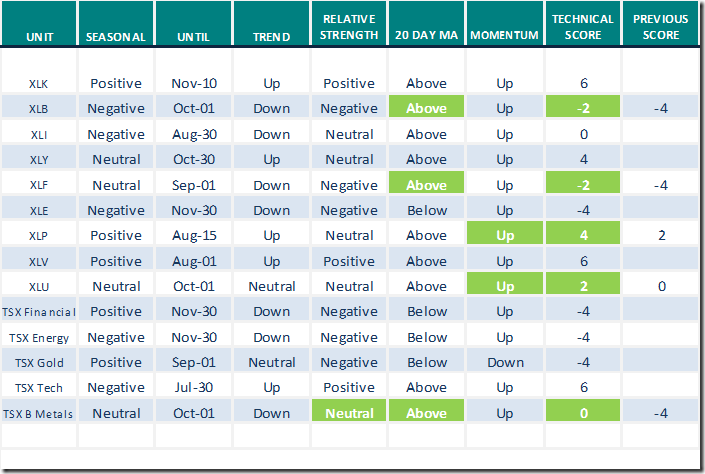

Sectors

Daily Seasonal/Technical Sector Trends for July 26th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

Report from uncommon Sense Investor

Thank you to Mark Bunting and www.uncommoninvestor.com to a link to the following report entitled “First Class Fintech Stocks to Watch”

10 First-Class Fintech Stocks to Watch | Kiplinger

S&P 500 Momentum Barometers

The intermediate term Barometer was unchanged at 54.51 yesterday. It remains Neutral.

The long term Barometer added 1.80 to 89.78 yesterday. It remains Extremely Overbought.

TSX Momentum Barometers

The intermediate term Barometer added 0.02 to 51.92 yesterday. It remains Neutral.

The long term Barometer gained 2.14 to 74.52 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.