by Sound Choices, AGF Management Ltd.

Insights and Market Perspectives

Author: Sound Choices

January 9, 2021

The content in the article below is meant for Canadian investors only.

To better position yourself for financial success in 2021 and beyond, here are some top tips to consider.

1 Automate Your Savings and Investing.

Setting up a Pre-Authorized Chequing Plan (PAC), i.e., a regularly scheduled contribution that comes right off your paycheque or out of your bank account, can help build your savings with minimal effort. By investing regularly and following a consistent investment plan, you can take advantage of the benefits of compound growth, regardless of how much is invested.

| Year | $100 PAC (5% Return) |

$500 PAC (5% Return) |

| 0 | $0 | $0 |

| 2 | $2,519 | $12,593 |

| 4 | $5,301 | $26,507 |

| 6 | $8,376 | $41,882 |

| 8 | $11,774 | $58,870 |

| 10 | $15,528 | $77,641 |

| 12 | $19,676 | $98,382 |

| 14 | $24,260 | $121,299 |

| 16 | $29,324 | $146,621 |

| 18 | $34,920 | $174,601 |

| 20 | $41,103 | $205,517 |

Don’t forget to increase your PAC or contribution amounts as you receive raises and get promotions.

Source: AGF Investments Inc. The table above is for illustrative purposes only. All of the rates and values referenced above are hypothetical and do not reflect actual investment or past performance, nor do they guarantee future performance. Based on hypothetical returns of 5% and monthly PAC contributions every year over the period. Every other year shown for illustrative purposes only.

2 Education Savings – Take Advantage of the Government Incentives

Did you know Registered Education Savings Plan (RESP) savings can be supplemented with government education savings initiatives? Read “Are you leaving money on the table?” to find out more.

If your child turns 15 this year and has never been a beneficiary of an RESP, you need to contribute at least $2,000 before the end of the year in order to receive the Canada Education Savings Grant (CESG) for 2021 and be eligible to receive the CESG for 2022 and 2023. Find out more at Is your child in high school?

3 Ensure Your Beneficiaries Are Up-To-Date

The beneficiary is the person or entity that will receive the proceeds from your account when you die.

By naming a beneficiary, you eliminate any doubt as to whom you want your money to go. If you haven’t specified one, the default is your estate – and there could be significant delays and paperwork involved to release the funds.

It’s up to you to make sure your beneficiaries reflect any changes in your life. Do they take into account any life events that have happened?

4 Make Use of Your Company Benefits

Many companies offer employee savings or contribution matching plans. Check with your Human Resources department to see if you can take advantage of any employee programs that will help you build your savings faster.

5 Consider a TFSA for any of your savings goals

Maybe you want to save for a dream vacation. Or a new car. Or to renovate your kitchen.

Does it really make a difference if you put the money into a Tax-Free Savings Account (TFSA), which can be used for any financial goal?

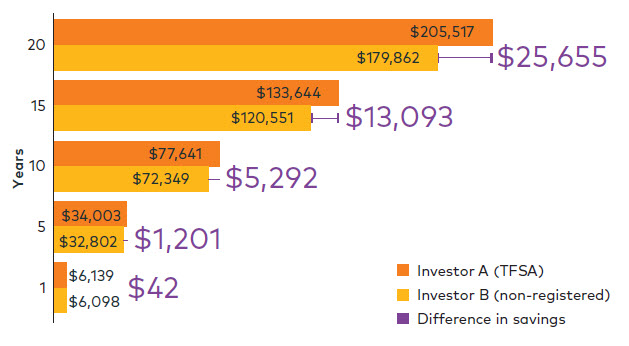

The chart shows the same amount of money ($500/month) being invested in the same product (a hypothetical investment with a 5% annual return). The only difference: Investor A chose a TFSA account, while Investor B chose a non-registered account. After one year, the amount may not seem significant, but it makes a big difference over a longer time period.

Source: AGF Investments Inc. Performance returns presented are hypothetical and for illustrative purposes only. It does not represent actual performance. Assumptions were made in the calculation of these returns including $500 invested at the beginning of each month in a hypothetical investment with a rate of return of 5%. Of the 5% return, distribution yield of 2.0% (distribution composed of 50% interest and 50% capital gain). Interest taxed in the year received, while unrealized capital gains were taxed at the end of the holding period. Marginal tax rate of 50% for interest and 25% for capital gains, distributions reinvested. Taxes paid from out of pocket (not from sale of shares). Trading costs and other fees associated with the portfolios are not included and trading prices and frequency implicit in the hypothetical performance may differ from what may have actually been realized at the time given prevailing market conditions. This performance simulation is for illustrative purposes only and does not reflect actual past performance nor does it guarantee future performance.

For more information on fulfilling any or all of these top tasks, contact your financial advisor. Don’t have a financial advisor? Before you start your search, read about working with a financial advisor.

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. AGF brings a disciplined approach to delivering excellence in investment management through its fundamental, quantitative, alternative and high-net-worth businesses focused on providing an exceptional client experience. AGF’s suite of investment solutions extends globally to a wide range of clients, from financial advisors and individual investors to institutional investors including pension plans, corporate plans, sovereign wealth funds and endowments and foundations.

For further information, please visit AGF.com.

© 2021 AGF Management Limited. All rights reserved.

This post was first published at the AGF Perspectives Blog.