by Morgan Harting, AllianceBernstein

Emerging-market (EM) asset returns substantially lagged their developed-market (DM) counterparts over the last decade. In 2020 so far, EM equity performance has been on par with DM equities. Are we at an inflection point?

After a challenging start to the year, investor flows across both EM equity and bond markets recently turned positive. In fact, October 2020 marked the fifth consecutive month of positive flows into EM bonds and the fourth consecutive one into EM equities. This suggests that the rally in sentiment is gaining some momentum, supported by an improving fundamental outlook for emerging markets and attractive valuation levels of EM equities and bonds, relative to their DM peers.

Will this trend hold? And how can investors make the most of the wide range of opportunities across EM assets?

Key Indicators Turning Positive

EM economies have started to recover from the impact of COVID-19. North Asian countries, including China, South Korea and Taiwan, have been most effective in fighting the virus, resulting in a milder decline in economic activity during the crisis and an earlier rebound than DM.

For example, both manufacturing activity in EM and North Asian exports have picked up strongly in recent weeks. Other regions, such as Latin America, are starting to follow suit. There were signs of this during October, when EM equities outperformed DM stocks. In our view, solid EM stock performance probably reflects recent successes by the worst-hit EM nations in controlling the virus, while some DM counterparts, such as the UK and France, have had to reintroduce nationwide lockdowns. As a result, we expect economic activity in EM countries to strongly outperform developed regions in 2021 (Display below).

The recovery is further supported by central bank policy, with rate cuts and stimulus packages aimed at supporting growth. We believe this backdrop is sustainable as inflation is expected to be low, so pressure for higher rates will likely be modest.

Moreover, recent US dollar weakness is helping EM companies and countries that have dollar borrowings to access capital markets and repay their debts. Crucially, it eases the pressure on indebted EM governments and allows their central banks to maintain dovish policies. The US Fed’s “lower for longer” interest-rate policy could keep the dollar subdued. A weak dollar supports EM investor risk appetite and is typically associated with strong EM equity and high-yield (HY) bond returns.

Valuations of EM assets are also encouraging. With EM company earnings expected to grow at over 30% next year, their stock prices look particularly cheap versus DM. For example, the price/earnings to growth ratio, which measures a stock’s valuation relative to its growth potential, is just 0.44 in EM—about half the DM ratio of 0.82. In EM bond markets, HY credit spreads look very attractive too, near 10-year highs relative to US HY. Wide spreads signal greater opportunity because, when bond spreads narrow, prices rise and generate returns for investors.

In our view, there is further room for EM assets to benefit in the recovery phase. Yet many investors are still on the sidelines, particularly in EM equity. Institutional ownership of EM equities is currently at 7% of overall assets under management (AUM)—as low as it’s been since just before the strong rally in 2017 when the MSCI EM index returned 37%.

Why the reluctance to invest in EM assets? For one, EM investing is generally seen to be relatively risky. It’s true that increased near-term volatility can be expected in the current environment of elevated uncertainty around the pace of global economic recovery, the recent spike in COVID-19 cases in Europe and the transition of administration in the US. But we expect EM to benefit from US reengagement with multilateral institutions like the World Trade Organization under a Biden presidency. Greater trade certainty, which is also likely under a Biden administration, could aid export-oriented EM countries too.

The Power of an Unconstrained Multi-Asset Approach

Investors in single asset classes may miss much of the EM opportunity, in our view. At this pivotal time, investors should position their portfolios to capitalize on developments across the EM spectrum, including in smaller EM countries and companies. By efficiently combining allocations in EM stocks, bonds and currencies, investors gain flexibility to access the wide range of opportunities being signaled by fundamental, valuation and technical measures.

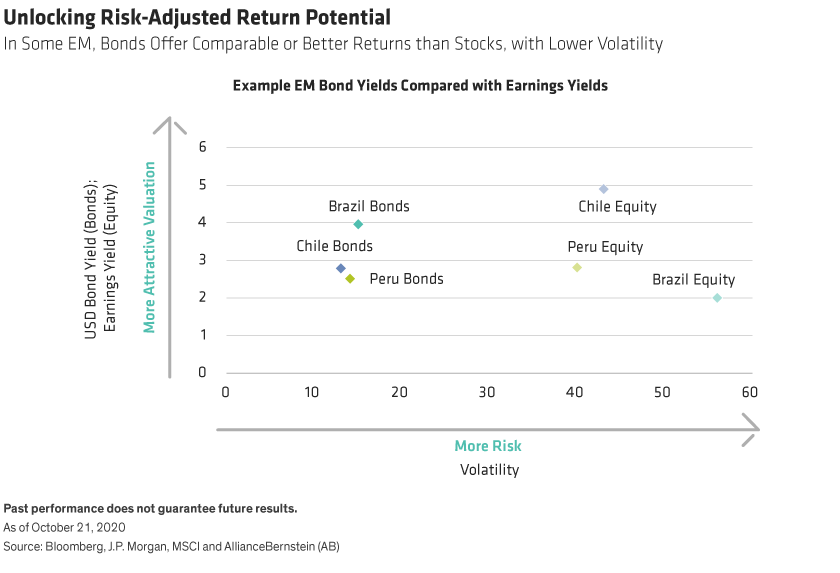

A dynamically managed EM multi-asset portfolio may provide returns comparable to equities, with much lower volatility and shallower drawdowns, in our view. It can also generate attractive levels of income. By looking across the complete spectrum of equity and bond markets, it is possible to select securities in each region that offer appealing risk-adjusted return potential. For instance, we believe Brazilian bonds with a yield of 4% look very attractive relative to highly volatile Brazilian equities, which have a lower earnings yield and look very expensive (Display below).

Within equities, EM benchmarks are biased to larger countries and companies. But in the current environment, opportunities abound in smaller countries and securities, in our view. Holdings in countries that have small weights in an index can still provide diversification and growth opportunities. Without constraints, investors can access smaller-market-cap countries such as Chile and Colombia, including those not included in the MSCI EM index, such as Panama and Ecuador. Investing across this wider spread of countries that are in different stages of their economic cycles and have different domestic drivers makes for a better risk/reward balance, we believe.

Change Brings Opportunity for Multi-Asset Investors

As the COVID-19 crisis unfolds, opportunities are presenting themselves in new and unusual ways. So far, North Asian countries have been fastest to recover from the impact of the virus. And technology companies in these regions benefited from work-from-home trends and shifts in consumer behavior. As we move forward, we expect these areas to continue to drive returns as long-term secular growth dynamics, such as the widespread rollout of 5G, will provide tailwinds to these companies.

But as fundamental trends improve, select investments in other Asian and Latin American regions may also provide attractive opportunities, most notably as COVID-19 cases decline in Brazil and India. Similarly, while tech stocks have led the recovery, some industries that lagged now look increasingly attractive. Active stock pickers can capture these opportunities, for example, by backing promising but lesser-known tech stocks, and carefully chosen businesses in smaller countries that are well positioned as the EM recovery gathers pace. Within fixed income, higher-risk EM debtor countries may benefit most from a recovery.

By investing across asset classes in a flexible multi-asset portfolio, we believe that investors can achieve EM equity-like returns at less risk than by investing solely in equities. At the same time, this type of unconstrained approach can help investors achieve relatively high yields—in a global environment where income is exceptionally hard to find.

Morgan Harting is Portfolio Manager—Multi-Asset Solutions at AllianceBernstein (AB)

Karen Watkin is Portfolio Manager—Multi-Asset Solutions at AllianceBernstein (AB)

The views expressed herein do not constitute research, investment advice or trade recommendations, do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time. AllianceBernstein Limited is authorized and regulated by the Financial Conduct Authority in the United Kingdom.

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein.

This post was first published at the official blog of AllianceBernstein..