by Don Vialoux, EquityClock.com

Technical Notes Yesterday

Incyte Corp (INCY), a NASDAQ 100 stock moved below $82.98 extending an intermediate uptrend.

Take Two Interactive (TTWO), a NASDAQ 100 moved below $151.63 completing a double top pattern.

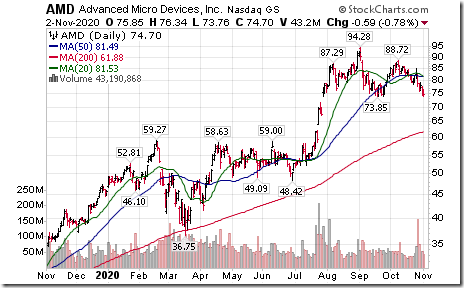

Advanced Micro Devices (AMD), a NASDAQ 100 stock moved below $73.85 completing a double top pattern.

Trader’s Corner

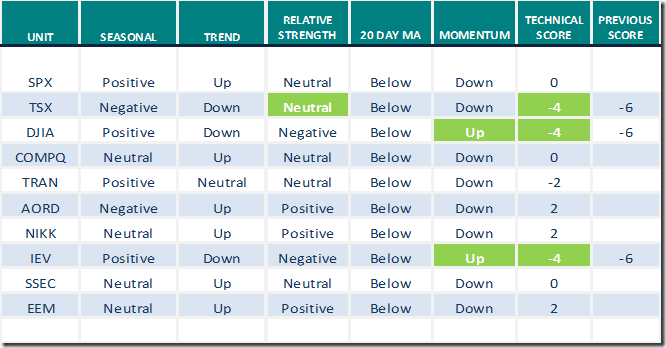

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for November 2nd 2020

Green: Increase from previous day

Red: Decrease from previous day

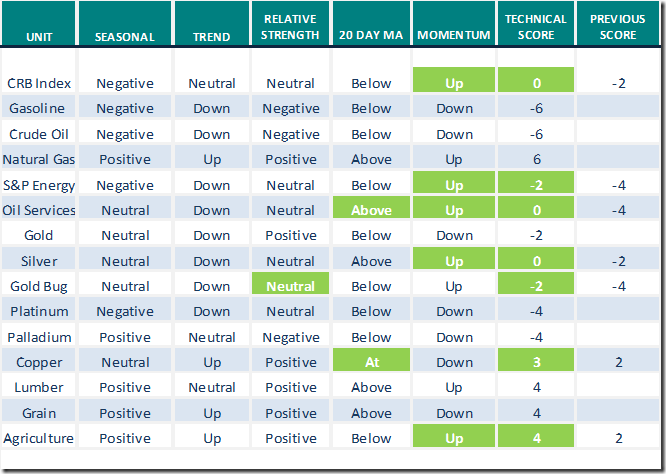

Commodities

Daily Seasonal/Technical Commodities Trends for November 2nd 2020

Green: Increase from previous day

Red: Decrease from previous day

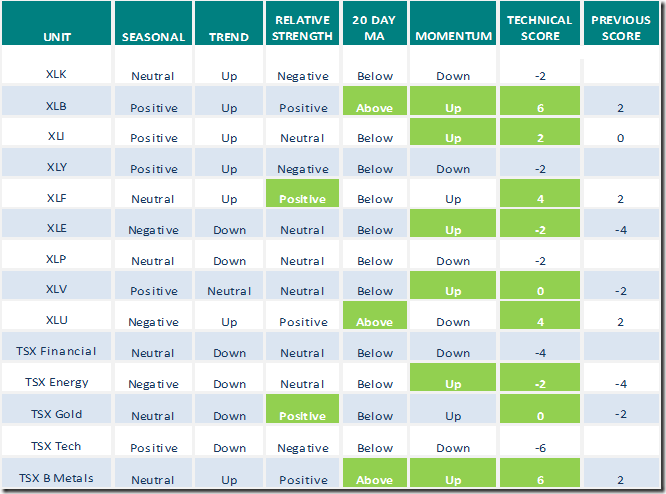

Sectors

Daily Seasonal/Technical Sector Trends for November 2nd 2020

Green: Increase from previous day

Red: Decrease from previous day

Technical Scoop

Thank you to David Chapman and www.EnrichedInvesting.com for a link to the weekly report. Headline reads, “Winter discontented, golden haven, not oversold, downward energy, diverging gas, stormy south”. Following is the link:

S&P 500 Momentum Barometer

The Barometer advanced 13.83 to 44.29 yesterday. It changed from intermediate oversold to intermediate neutral on a move above 40.00.

TSX Momentum Barometer

The Barometer added 10.90 to 39.34 yesterday. It remains intermediate oversold.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

|

|

|

|

This post was originally publised at Vialoux's Tech Talk.