by Robert Neilson, Invesco Canada

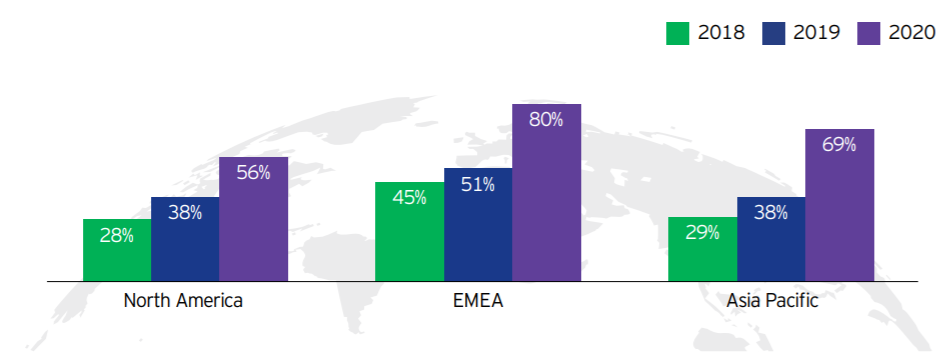

The Invesco 2020 Global Fixed Income Study provides hard evidence that a sea change has taken place over the last 18 months with respect to environmental, social, and governance (ESG) approaches in fixed income. The survey polled 159 fixed income professionals worldwide, accounting for around US$20 trillion of assets.1 The study shows significant and universal increases from 2019 to 2020 in terms of incorporation of ESG in fixed income (Exhibit 1).

Exhibit 1: Incorporating ESG in fixed income

(% of respondents who incorporate ESG in their fixed income portfolio)

Source: Invesco Global Fixed Income Study, May 2020. Sample size: 2018 = 79, 2019 = 107, 2020 = 147. EMEA = Europe, Middle East, and Africa

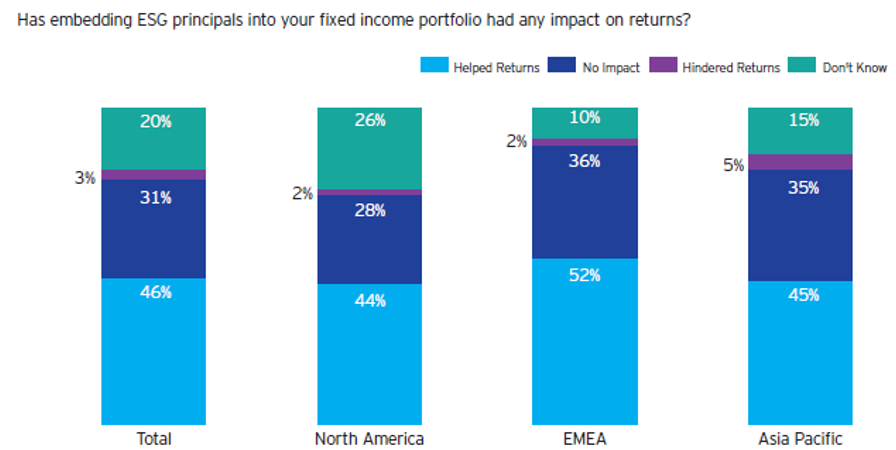

What’s behind the increase? One driving force has been, first and foremost, a sense of social responsibility. But a secondary driver that emerged from the 2020 study is a sense that ESG could help enhance returns and manage credit risk. The study found that, compared to 2019, there was no longer a concern that adopting ESG in fixed income would necessarily hinder performance in portfolios. On the contrary, a majority of firms responded that they believed ESG either had no impact relative to non-ESG based approaches, or that it actually helped returns. This was true across the major geographic regions (Exhibit 2).

Exhibit 2: ESG is now broadly viewed as enhancing rather than hindering investment returns

Source: Invesco Global Fixed Income Study, May 2020. Sample size: Total = 112, North America = 43, EMEA = 48, Asia Pacific = 21. EMEA = Europe, Middle East, and Africa.

In contrast to the 2019 study, which found that most respondents had chosen not to purchase ESG-specific instruments in the fixed income space, the 2020 study showed that about half of the investors surveyed had invested in ESG-specific products or securities, and about 80% were intending to increase their allocations in the future.1

Green bonds may offer resilience during market stress

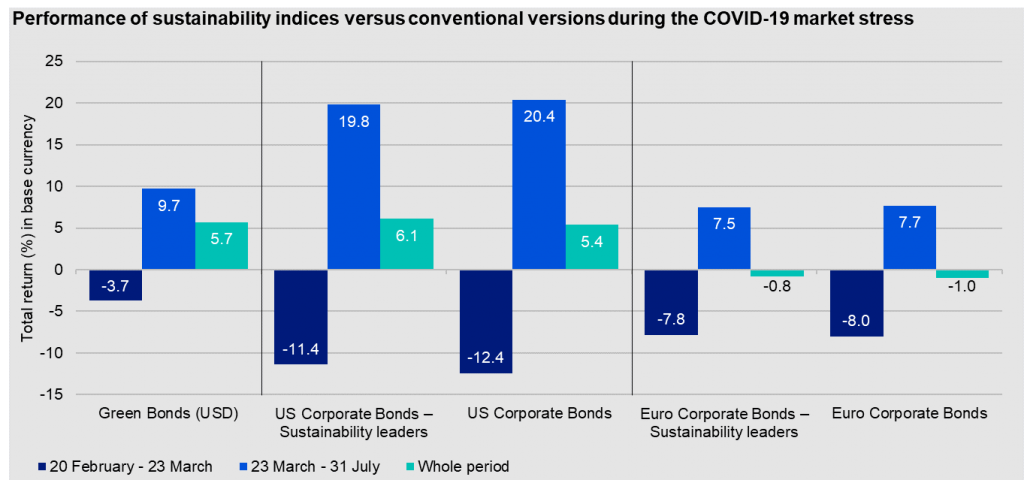

Green bonds — which are issued specifically to fund environmentally friendly projects — are a key vehicle for firms’ and clients’ ESG-specific investment objectives. In terms of performance, how has this asset class done? More specifically, how have they performed through the COVID-19 crisis? We looked at the period from Feb. 20, when spreads began to widen, through March 23, when spreads eventually peaked, and then the recovery period through the end of July.

During the market selloff, we observed that green bonds demonstrated a smaller downside compared to other markets (Exhibit 3). There are structural reasons behind this result. Green bonds tend to have a slightly higher credit-quality bias, are generally shorter in tenor, and are typically more weighted toward financials and utilities, the areas of the market that performed less poorly during the COVID-19 selloff. Conversely, they are not exposed to the energy and mining sectors, which were among the worst performing part of the market. On the other hand, the upside captured by green bonds as markets recovered was much less. Net-net, we believe this represents a positive overall picture for sustainable strategies through the crisis period.

Exhibit 3: ESG-focused indexes outperformed during the pandemic selloff

Source: Bloomberg Barclays, as of July 31, 2020. Feb. 20, 2020, signifies the start of the spread-widening period with index spreads peaking on March 23, 2020. Green bonds represented by the Bloomberg Barclays US Green Bond Index. US Corporate Bonds – Sustainability Leaders represented by the Bloomberg Barclays MSCI US Corporate Sustainability Index. US Corporate Bonds represented by the Bloomberg Barclays US Aggregate Corporate Index. Euro Corporate Bonds – Sustainability Leaders represented by the Bloomberg Barclays MSCI Euro Corporate Sustainability Index. Euro Corporate Bonds represented by the Bloomberg Barclays Euro Aggregate Corporate Index. Past performance does not guarantee future results. Investments may not be made directly in an index.

Invesco Fixed Income’s approach

At Invesco Fixed Income, our approach to ESG is rooted in a belief that evaluating environmental, social and governance criteria may lead to better long-term risk-adjusted returns. We believe that a link may exist between positive momentum in ESG characteristics and improving creditworthiness, which may be advantageous for fixed income prices. We integrate ESG into our fundamental research processes and determine which issuers are outpacing their peers.

This post was first published at the official blog of Invesco Canada.