by Edward D. Perks, CFA, and Gene Podkaminer, Franklin Templeton Mutli-Asset Solutions, Franklin Templeton Investments

Major Themes Driving Our Views

The Global Economy is Healing

Global economic activity is expanding after having passed through the trough in 2020’s second quarter and entered the recovery phase of the most severe hard-stop recession the world has ever seen. The nadir for business activity is behind us in most economies, although global trade is proving slower to recover than domestic consumption of goods.

The services sector of the economy has lagged, and we see signs that the pace of the rebound may have slowed. Efforts to return to normality have been incomplete. Attempts to restart mass tourism show that travelers remain cautious and the sudden reimposition of government restrictions will dissuade others. Although the locations have and will change, the growing realisation is that localized flare-ups of the virus are an ongoing threat.

As a result, we are not surprised to see a cooling of the pace of recovery in some of the high-frequency data that

are helping investors and policymakers monitor this fluid and fast-moving environment. Indicators of consumer spending on credit cards and bookings at restaurants have rolled over. We believed the recovery would be uneven since the very start of the COVID-19 crisis. Although the global economy is healing, we agree with the views of the central bankers, repeated recently by Bank of England (BoE) Governor Andrew Bailey, that the path forward remains extraordinarily uncertain.

Looking at the behaviour of consumers, they seem to reflect this uncertainty by building up precautionary savings. We expect lingering impacts from the coronavirus crisis on unemployment to determine how quickly these savings are spent. Expectations of a sharp rebound have become well-established and are increasingly discounted in current market levels for risk assets. Political uncertainty may also contribute to an outlook that remains less clear than usual and presents an ongoing drag on business investment intentions. We see the risks to recovery as tilted to the downside, in part due to the second-wave infection threat. As a result, this leaves us with a relatively cautious view, encapsulated in our theme that sees “ongoing headwinds to global growth.”

On the Lookout for Inflation

Inflation concerns are a growing feature of market discussions. Perhaps it is inevitable, after a prolonged period of subdued inflation, that thoughts turn to a new narrative. The level of fiscal and monetary stimulus that has been deployed to help offset the coronavirus recession amplifies such concerns.

Many analysts point to the volume of money central banks have created as they expand their balance sheets. However, the pace with which this money is circulating in the economy is equally important. Increased demand for credit is evident in record issuance of new corporate bonds. However, for now, it is unclear whether this is simply being used to bolster reserves or will be deployed to support future growth. Without significant investment, it is hard to see jobs being created in sufficient numbers to drive wages higher on a sustained basis.

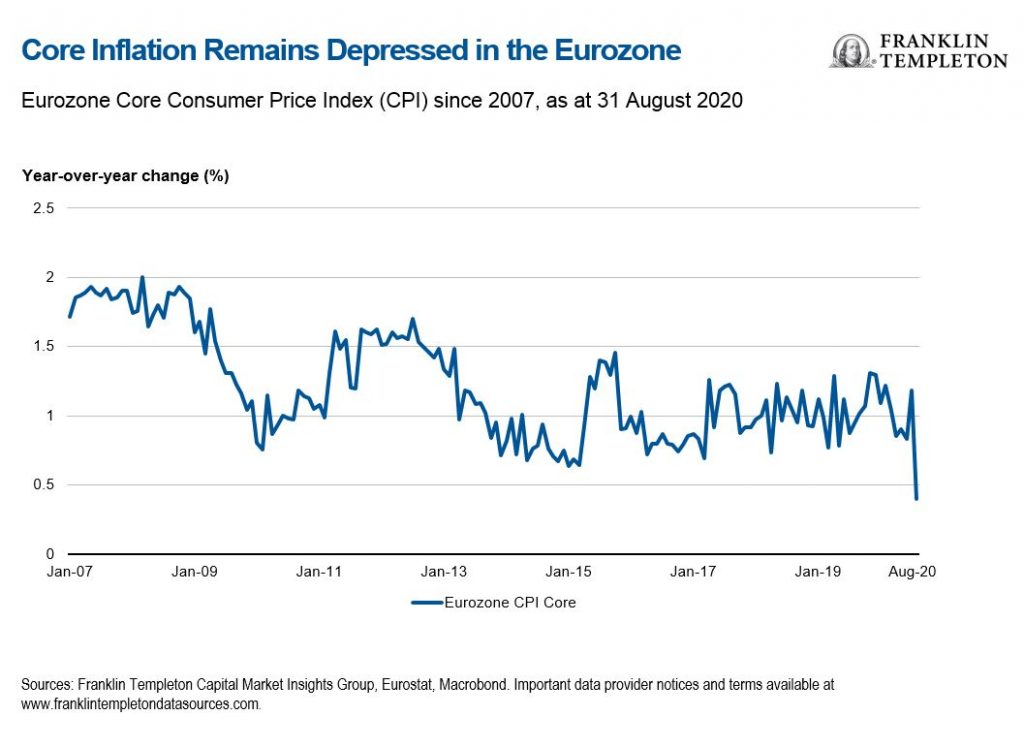

The actions of central banks suggest disinflationary forces are currently their greater concern. The US Federal Reserve (Fed) has announced that it is changing its monetary policy framework to target average inflation. Having failed to generate adequate levels of core inflation (the underlying level after the direct effect of food and energy price fluctuations has been excluded), expectations remain depressed in a range of economies. In the eurozone, core inflation dipped back to the lows seen over the last 10 years in the most recent data. This occurred despite supply disruptions and a desire to move production closer to home.

We believe that it is premature to call an end to globalisation, despite some examples of onshoring. We also remain sceptical of the link between rapidly expanding money supply and generalised inflation, as opposed to asset price gains. More broadly, we continue to believe changes in demand will be the main driver of inflation. Recent supply shocks may have lowered productive capacity, but the deceleration in global activity and rise in labor market slack that we have seen since 2019 will be much more powerful, in our view. This effect has been felt broadly, including in emerging markets,

reinforcing our theme of “subdued inflation across economies.”

Policy Support Remains Key

COVID-19 presents an ongoing headwind to the global economic recovery. However, we have seen consistent and unstinting support from independent central banks, together with coordinated fiscal policy. It is this policy response

that has eased the path through a deep global recession and allowed investors to look ahead to a period of recovery

and rebuilding. This is reflected in our final theme of a “dovish bias to policy.”

Fiscal policy has clearly helped to propel the rebound in activity—and financial markets—but we may be reaching the point where superficially good economic news has counterproductive effects. The recovery will not be secured without ongoing policy coordination, and this may be harder to achieve without the presence of a crisis to focus politicians’ minds. The pandemic has accelerated progress on a number of fronts, technological adoption among the most prominent.

Similarly, as we have commented on in recent editions of Allocation Views, few would doubt that the European Union

has accelerated the creation of a strong institutional framework. However, we are increasingly concerned that ongoing

fiscal stimulus will be harder to secure as we move through the recovery phase.

The approaching US election, and highly contested presidential race, compound the inherent difficulty in agreeing to ongoing support measures. With less than two months until the vote, it seems unlikely an ambitious package will be agreed upon that builds on earlier emergency relief. Indeed, it may prove difficult enough to pass continuing resolutions to keep the federal government running beyond the end of the fiscal year. Fears of an inconclusive or contested outcome make the election process itself contentious.

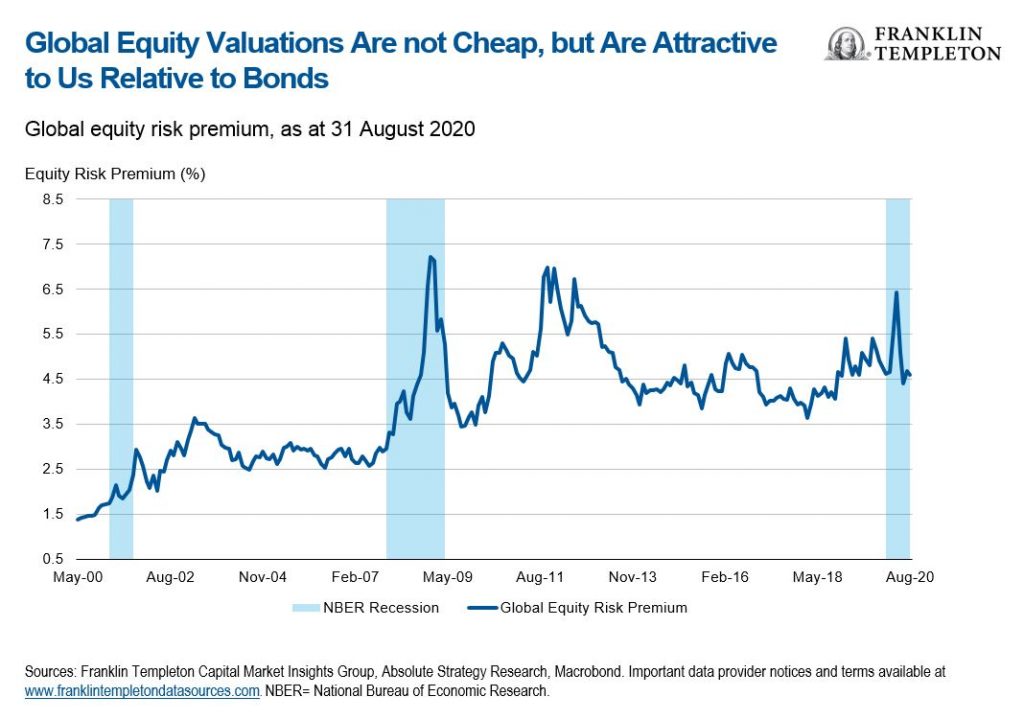

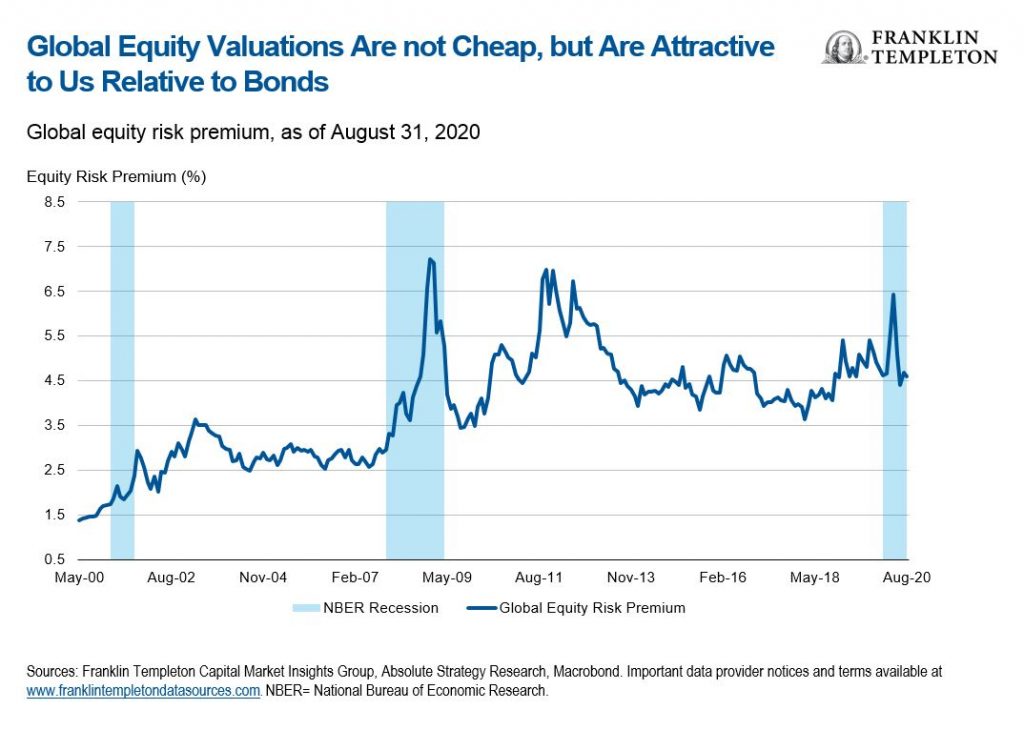

As a result, and after benefitting from a period of strong global equity market returns, we have eliminated our modestly higher conviction toward global equities over bonds and taken a neutral stance. In broad terms, bonds remain more highly valued and equity prospects are attractive relative to them in the longer term, in our view, but near-term risks temper our enthusiasm.

Practical Positioning

Nimble Management Required

Over recent years, we have highlighted periods of divergence between various financial markets and the global economy. Most often these divergences are explained by plentiful liquidity seeking a home, and by the search for yields better than those on cash holdings. Although we recognise the longer-term return potential for stocks, we believe politics may have a growing impact on financial markets. We are again pointing to shorter-term concerns that temper our enthusiasm.

More broadly, a period of elevated market volatility since early 2018, in contrast to the muted levels seen for much of the preceding 10 years, indicates that we are in a new volatility regime. As we discussed recently in our Allocation Views quarterly focus on global bonds, the effect of ample liquidity, which is likely to continue to be provided across developed economies, has propelled many markets to quite elevated levels. We have reflected this in a lower conviction toward corporate bonds generally. Overall, we retain a broadly neutral stance toward riskier assets. Our view balances policy support that aims to do whatever it takes with caution regarding valuations and politics. However, it still leaves us looking for alternatives.

Oil prices and other industrial commodities have rebounded, reflecting a better balance between supply and demand. While we anticipate a continued move higher and reflect this in a modestly higher conviction in commodities, it

does not appear to pose an immediate inflation risk more broadly. However, as we look for alternatives to both stocks

and bonds, exposures to assets that offer natural diversification and protection against unanticipated inflation are top of our wish list.

Real Assets Could Be the Alternative

By a significant margin, energy has been the most important factor driving consumer prices over recent years. Despite its relatively modest weight in the overall Consumer Price Index (CPI), oil has accounted for a large part of the volatility in headline CPI inflation. The fact that energy is considerably more volatile than most other components of CPI is not new or surprising.

Indeed, this is why central bankers and market-watchers tend to look at underlying “core” inflation, as we note

in our inflation outlook above. We have an interest in core inflation from a macroeconomic perspective, but it is headline inflation that has a direct impact on the return from certain real assets. Inflation-linked bonds’ capital value and income stream rise in direct proportion to the increase in the headline CPI (or other price index that certain countries’ bonds follow), delivering explicit inflation protection.

Today, unless oil prices continue to rebound, regaining levels seen late last year, the rate of headline inflation is

likely to remain depressed during the next few months. The longer-term impact is dependent on business investment, job creation and changes to consumer behaviour. For now, longer-term inflation expectations also remain relatively subdued.

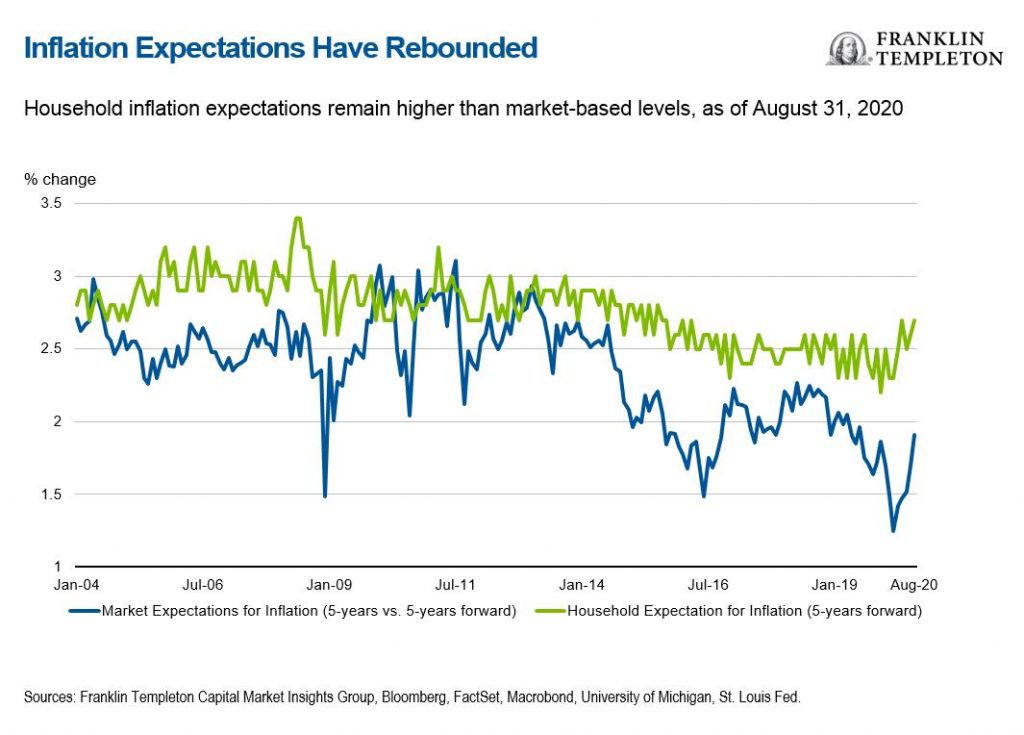

However, market-based expectations for inflation, derived from the yields of nominal and real return bonds, have swung violently this year. These so-called breakeven inflation rates (where the prospective return on nominal- and real-return bonds are equal) have responded directly to recent commodity price fluctuations. Looking more deeply, the level of breakeven inflation over the five-year period starting five years from now (5-year/5-year forward rate) has also followed a similar path. This largely reflects the relative illiquidity of real return bonds and swings in the risk premium for inflation uncertainty.

Having shown some signs of distress earlier in the year, the prompt action of central banks in ensuring that markets functioned smoothly has eliminated most of the dislocation in breakeven inflation rates. Some further modest increase in this market-based measure of long-term inflation rates may occur, but to see it move appreciably higher would require consumer expectations to become less well anchored. Such an event—where inflation actually exceeds the average levels now being targeted by the Fed—would likely be a catalyst for another regime change in monetary policy. The world’s leading central banks are not anticipating such an event in the foreseeable future, and it would likely result in weaker stock markets and higher bond yields.

We hold a growing confidence in the return potential of assets such as Treasury Inflation-Protected Securities

(TIPS) that can help to provide protection against rising inflation. In our base case, they are perhaps modestly

cheap. However, it is the combination of equity, bond and inflation “shocks” that could provide the environment

where holding a diversifying asset such as TIPS might notably enhance return potential and lower portfolio volatility.

Other Alternative Assets

Other alternative assets might show uncorrelated return potential as well. Real estate is widely viewed as providing some protection against a general rise in inflation. However, the coronavirus recession has impacted demand for offices and retail space, and the ability of tenants to continue to cover rent.

Similarly, any rise in bond yields could put pressure on property valuations through the current relatively subdued

yield. While directly held property might weather this storm, and even potentially benefit from a modest rise in inflation, we have adopted a more cautious stance on this asset class.

Casting the net more widely, we can see the attractions of assets that give exposure to totally un-correlated factors. Insurance-linked securities provide capital to back the global re-insurance market. This underwrites exposure to the risks associated with storms or other natural disasters, in return for annual premium income. Any losses in these areas would not typically be linked to moves in financial markets. This specialised, niche investment is unlikely to become a large part of traditional multi-asset portfolios, but it may be of interest to some investors.

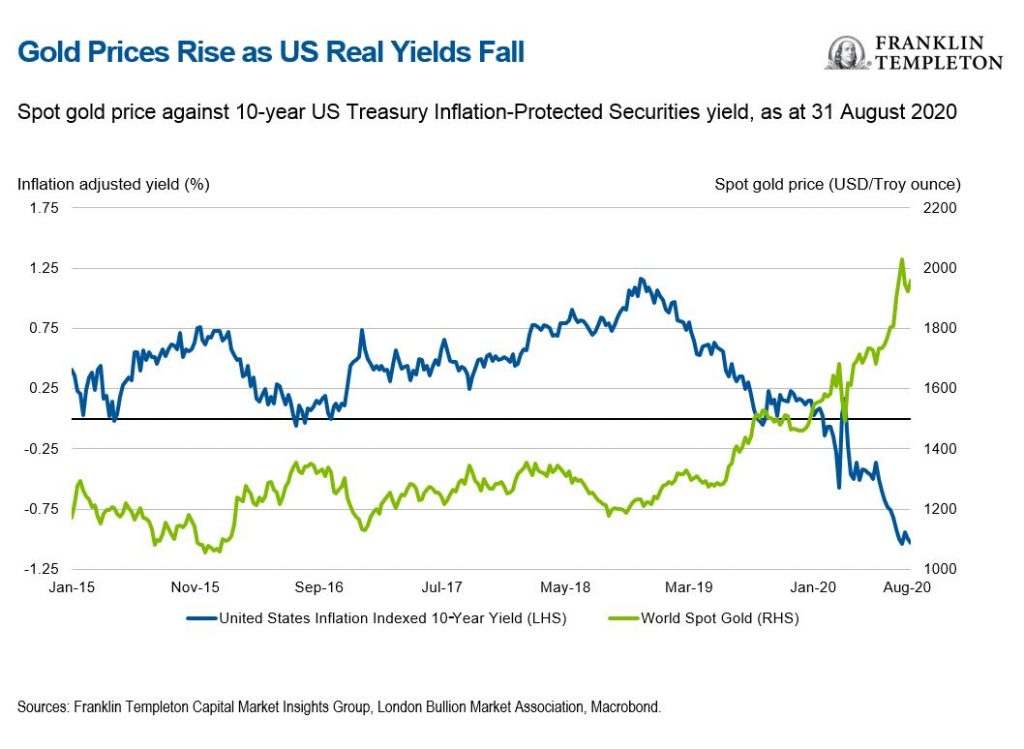

More topically, certain commodities may offer alternative diversification benefits. Precious metals such as gold may

not follow the same trend as industrial metals or broad commodities. At times of financial market or geopolitical stress, they can offer perceived safe-haven benefits and are viewed as a hedge against the debasement of fiat currencies. Our analysis of the drivers of precious metals shows that they would tend to fare better if the US dollar were to depreciate. Also, as an asset that generates no income, they compete better in a falling interest-rate environment.

The last few months have seen many of these factors come together to propel the price of gold higher, with a move into negative territory for the real yield available from TIPS seen as a key driver. In recent months, we have found the specific attractions of gold contributing to our modestly constructive view of commodities more broadly.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Templeton Distributors, Inc., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Templeton Distributors, Inc. is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. The positioning of a specific portfolio may differ from the information presented herein due to various factors, including, but not limited to, allocations from the core portfolio and specific investment objectives, guidelines, strategy and restrictions of a portfolio. There is no assurance any forecast, projection or estimate will be realised. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as the prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline.

Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with emerging markets are magnified in frontier markets.

Derivatives, including currency management strategies, involve costs and can create economic leverage in a portfolio which may result in significant volatility and cause the portfolio to participate in losses (as well as enable gains) on an amount that exceeds the portfolio’s initial investment. A strategy may not achieve the anticipated benefits, and may realise losses, when a counterparty fails to perform as promised. Currency rates may fluctuate significantly over short periods of time and can reduce returns. Investing in the natural resources sector involves special risks, including increased susceptibility to adverse economic and regulatory developments affecting the sector—prices of such securities can be volatile, particularly over the short term.

Real estate securities involve special risks, such as declines in the value of real estate and increased susceptibility to adverse economic or regulatory developments affecting the sector. Investments in REITs involve additional risks; since REITs typically are invested in a limited number of projects or in a particular market segment, they are more susceptible to adverse developments affecting a single project or market segment than more broadly diversified investments. Actively managed strategies could experience losses if the investment manager’s judgment about markets, interest rates or the attractiveness, relative values, liquidity or potential appreciation of particular investments made for a portfolio, proves to be incorrect. There can be no guarantee that an investment manager’s investment techniques or decisions will produce the desired results.

Diversification does not guarantee profit or protect against the risk of loss.

This post was first published at the official blog of Franklin Templeton Investments.