by Jennifer DeLong, AllianceBernstein

The COVID-19 crisis poses a big challenge for employers to rationalize the benefits they offer to employees. With budgets stretched and every dollar scrutinized, tough choices loom on DC plan offerings, in addition to programs like financial wellness.

Strong Financial Wellness Uptake—But Need for a Revamp

About 65% of plan sponsors say they offer a financial wellness program today, much higher than the 43% reported in our previous ongoing survey, Inside the Minds of Plan Sponsors. Among plans with $250 million and more in assets, 74% offer such programs.

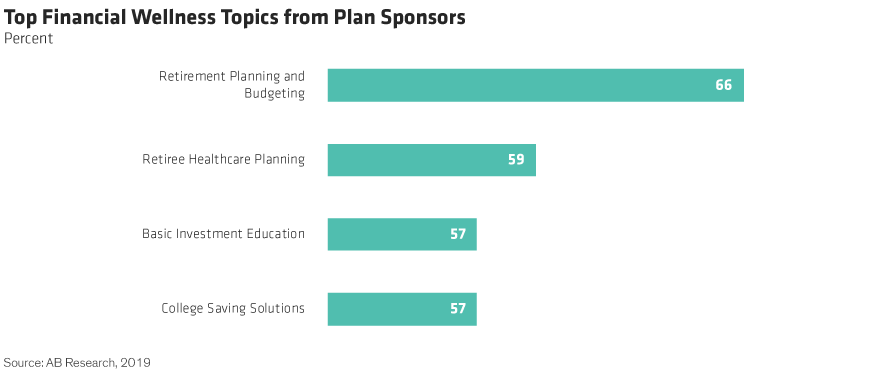

The most popular topics: retirement planning and budgeting (66%), retiree healthcare planning (59%), basic investment education (57%) and college saving solutions (57%) (Display). And now more than ever, employees may be open to additional learning about budgeting and saving to create an emergency fund that better prepares them for the future.

Employees are more engaged, too—the median participation rate in financial wellness programs is up to 50% from 30% in our last survey. However, most participants (52%) have accessed financial wellness programs through big, in-person group meetings, which now may prove challenging to do.

These programs are even more meaningful during a crisis, but today’s social distancing requires a revamp that may include online channels, small or individual teleconferencing or videoconferencing, and chatbots (software for online chats). All of this comes when participants may be tiring of lengthy online to-do lists.

Weighing Costs and Benefits in a Budget-Stretched Environment

Widespread economic uncertainty has changed the financial course for many participants—even those fortunate enough to have had access to financial wellness programs. As the impact of the pandemic plays out, plan sponsors offering financial wellness programs and other initiatives may soon have to choose between maintaining those programs and keeping their matches.

For larger plans, financial-wellness programs tend to be table stakes—a minimum requirement to compete with other large firms for talent. For smaller firms, the cost of those programs must be weighed against not only the program’s effectiveness but also the need to deliver other plan benefits.

The most common ways plan sponsors gather intelligence on effectiveness is through employee surveys (73%) and productivity reports (66%). Based on what sponsors told us, plans that offered financial wellness programs saw employees more engaged (61%), productive/focused (60%) and with a positive perception of the firm (60%).

These results suggest that financial wellness programs are indeed effective. But for many plan sponsors, there’s a question: Are these programs effective enough to justify the expense versus other needed benefits, including matching?

Broader Communications: Assessing Content and Delivery

Our survey also took a closer look at broader plan communications. Just under half of plan sponsors—and a higher percentage of large- to mega-size plans—said their communications initiatives will focus most on increasing savings, improving investment-option knowledge, fostering higher participation, improving financial literacy and encouraging appropriate asset allocation. These are always practical topics, and even more so in the current environment.

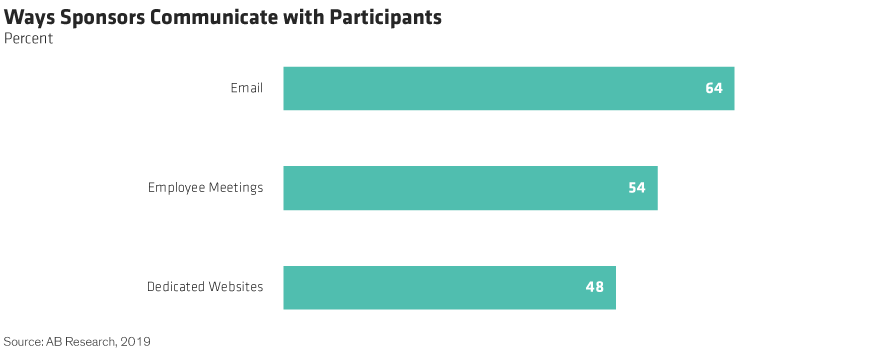

To connect with participants, plan sponsors tend to use traditional methods: email (64%), employee meetings (54%) and dedicated websites (48%) (Display). But many sponsors are open to new approaches—flexibility that’s being tested in the COVID-19 pandemic. As mentioned earlier, plan sponsors that prioritize in-person employee meetings must rethink their approach, with many participants working from home indefinitely.

Innovation through technology is especially top-of-mind. Some two-thirds of plan sponsors (65%) say that they’re very interested in any technology that gives participants a more personalized approach to retirement saving (72% among larger and mega plans). Custom solutions are a big reason why eight in 10 plan sponsors (82%) offer investment options and tools—such as income calculators—designed specifically for participants nearing retirement.

Effective content must be combined with the right delivery medium to keep the human element in the balance. Videoconferencing software, for example, can be effective but takes time to master and can create fatigue if overused. For those who now work, learn and shop from home, the constant “online all day” can be as tiring, frustrating and counterproductive as it is convenient.

High Communications Marks…But Room to Raise the Bar

Most plan sponsors gave themselves high grades on communications—but still see more that can be done to improve them. Almost eight in 10 sponsors (78%) are at least confident that their communications provide the means for participants to take control of their investment decisions. Still, 46% (up from 25% last time) said they could be more effective.

COVID-19 has highlighted the need for investor education. An earlier AB survey of plan participants revealed shortcomings on financial-literacy basics. Of eight questions, only 33% of participants got more than five right. More literacy emphasis is likely: a recent US Supreme Court ruling essentially said plan sponsors can’t assume that providing disclosure documents translates to full investment understanding.

Given the current environment, financial wellness programs are even more important. The number of plan sponsors who offer them is up in recent years, but it remains to be seen how many of these programs survive a time of budget uncertainty. It’s a stressful time, with acute participant needs for fiduciary leadership and also expertise to help them navigate provisions of the CARES Act.

Based on our survey results, many more sponsors are getting there. But there’s always more that can be done to make communications more impactful, and to ensure that financial wellness programs are relevant during this challenging period—and others to come.

Jennifer DeLong is Head of Defined Contribution at AllianceBernstein (AB).

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.

This post was first published at the official blog of AllianceBernstein..