by Matt Peden and Jeff Feng, Portfolio Managers, Invesco Canada

Many investment managers apply strict portfolio constraints under the guise of risk management best practices. These often include limits in sector over-/under-weightings, geographic concentrations, minimum levels of portfolio holdings and/or market capitalization requirements. The challenge around these types of curbs is that while they are designed to reduce potential return variance, typically in relation to a particular benchmark, they also can considerably constrain excess return potential.

Overly restricting a potential investment universe can work against active managers’ ability to fully exploit research and market mispricing opportunities. To help illustrate this, think of constraints from the perspective of retail consumers.

A consumer who is free to purchase from any retailer without restriction can make more informed choices –and likely better purchases in terms of price, quality and overall value –than consumers who must spread purchases across at least fifty different retailers, restrict purchases from retailers headquartered in certain countries and/or only make purchases from retailers with a minimum of $1billion in annual sales. Applying the same logic to investment management suggests that greater selection choice combined with effective security research can offer a more favorable position to generate excess returns.

The illusion of risk mitigation

Additionally, we believe conventional constraints frequently provide only an illusion of risk mitigation, without necessarily reducing actual risk exposures. For example, country constraints usually categorize companies based on the location of their senior managements or the exchanges on which they are listed. However, where a business derives its underlying revenue is much more indicative of its risk profile. AB InBev1 (3.72% of portfolio for Invesco International Companies Fund, as at Dec. 31, 2019), the world’s largest brewer2, is classified as a Belgian company. Yet, only an extremely small percentage of the company’s current revenues come from Belgium – about 57% are generated in emerging markets, with a significant portion coming from the U.S. and Brazil.

Such situations are far more common than investors may realize, due to the many global businesses headquartered and listed in smaller countries.

Similarly, sector limitations can also be problematic given the somewhat blurred nature of industry classifications. Beyond energy, materials and financials, few businesses fit neatly into a sector where constituents are consistently more highly correlated within than outside the segment. Moreover, the industrials sector often serves as a catchall for niche businesses that are challenging to classify.

Or consider when S&P and MSCI decided to shift several prominent companies from the technology sector to the newly renamed communications services (formerly telecommunications services). Are Netflix, Facebook, TripAdvisor and Google more closely correlated with traditional communication stalwarts like AT&T and Verizon? Truly understanding how a company generates revenues and its underlying business prospects are much more insightful into risk exposures then what may be an arbitrary, and at times even potentially misleading, classification.

Independent thought to drive alpha potential

Our deep conviction to unconstrained portfolio management is backed by a disciplined commitment to in-depth proprietary research. Through a combination of high turnover and excessive diversification, many active managers simply lack sufficient time and/or internal resources to conduct adequate research on companies through source documentation and direct management meetings. Consequently, it can be common to utilize broker-generated research to supplement their internal research capabilities and permit them to rapidly gather filtered information and recommendations as to what they should be buying and selling.

In contrast, our approach is to conduct extremely detailed research on a select group of companies by combing through publicly available source documentation and publications covering competitors, customers, suppliers and other pertinent industry participants. This is supplemented by frequent company management meetings, allowing us to largely avoid mass-distributed – and often short-term-oriented – industry research.

Our focus on independent research allows us to draw different conclusions than the broader market, which has historically been instrumental in our ability to generate repeatable, long-term alpha across our portfolios.

Current case study: A growing emphasis on small-cap securities

To see how our unconstrained, high conviction approach can translate into active portfolio positioning, consider market capitalization exposure in the Invesco International Companies Fund. This portfolio operates with only one real constraint, limiting emerging market content to 30%. If eliminated, the portfolio could, at times, become an emerging markets mandate, which we already offer investors in the Invesco Emerging Markets Class.

The absence of constraints invariably produces meaningful portfolio shifts in sector, country and market capitalization exposures over time, based on where our research uncovers greater relative business and underlying growth value. With this in mind, a notable market capitalization shift has occurred in the portfolio over the past 24 months. Small-cap exposure has doubled from 19% at the end of the third quarter 2017 to 38% at the end the third quarter 20193. As with all of our portfolio holdings, this underlying shift has been based solely on individual security idea generation, not any form of top-down calls. However, there naturally have been some overarching market drivers that have made the broad small-cap segment relatively more attractive over the past few years.

-

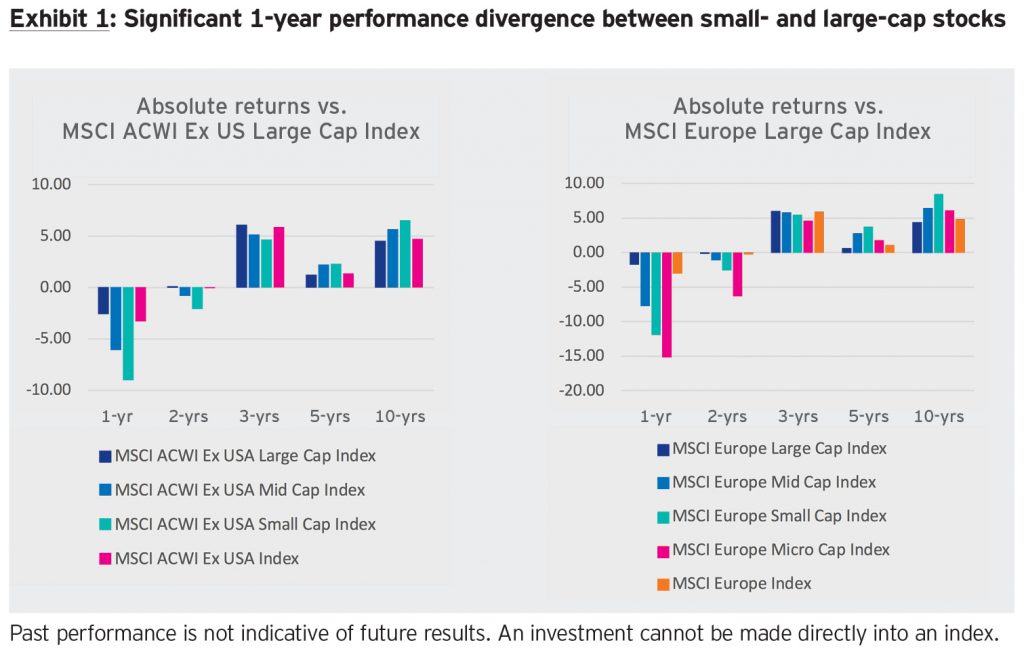

- A surge of passive flows into large-cap companies. Strong in-flows into passive vehicles (such as index-based exchange-traded funds) have likely helped fuel recent growing performance divergence between large- and small-cap stocks. As shown in Exhibit 1, small caps have lagged across the major global ex-U.S. markets in the past 12 months. One reason for this can be seen in an evaluation of the top international ETFs by sales flows. These vehicles are predominantly made up of large- and mid-cap stocks. This suggests that a substantial proportion of the passive flows have elevated larger-cap company share prices, while having a minimal impact on many smaller-cap companies that comprise a negligible percentage of most international indices. Further, for those small-cap companies that are index constituents, many strategies may not own them. Full replication is frequently inefficient and uneconomical, particularly for smaller, less liquid securities which have a negligible impact on index performance yet are relatively expensive to trade. Synthetic replication through computer assisted optimization allows passive funds to closely replicate underlying index performance without incurring the transaction costs of thinly traded securities.

-

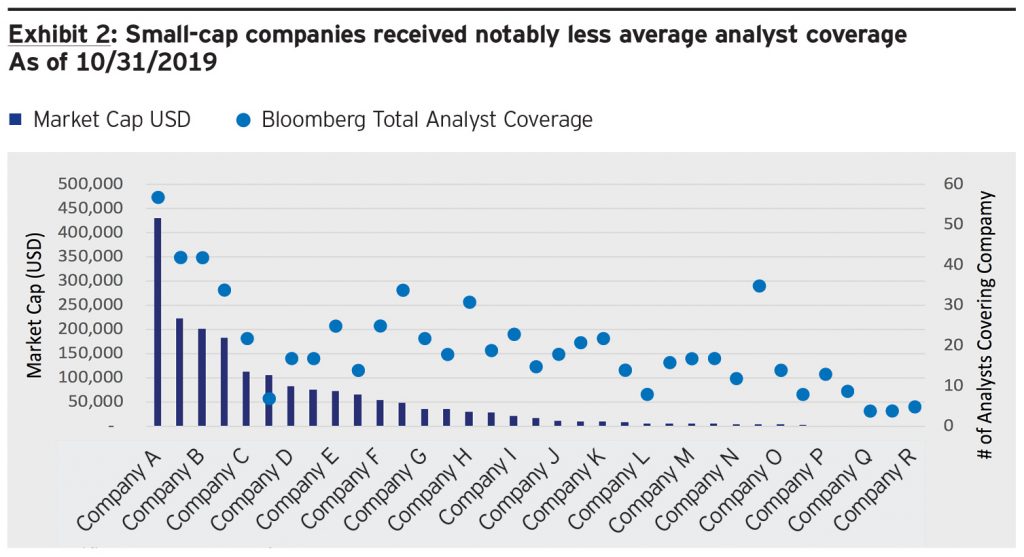

- Market biases toward large-cap stocks due to greater analyst research coverage. A second explanatory factor stems from the reliance of the investment community on broker-driven research. More brokers are producing frequent and extensive research on larger, more actively traded companies which garner greater commission revenues, while providing sparser, if any, coverage on smaller and more illiquid companies that may be less profitable to cover. To help illustrate this point, we examined the number of analysts covering each company in the Invesco International Companies Fund portfolio. Unsurprisingly, larger-cap companies received significantly greater – just over double, on average – analyst coverage than small companies (see Exhibit 2). The three smallest companies in the portfolio were covered by a mere four analysts, on average, most of whom were employed by small regional brokerages. We believe greater analyst coverage translates into more investor interest and more widespread ownership. Conversely, smaller and more illiquid companies are subject to thinner coverage likely to draw less portfolio manager interest. Hence, these companies may be more prone to be overlooked.

- Source: Invesco and Bloomberg LLC.

The pursuit of consistent excess returns over the long term

We believe avoiding common risk constraints can enable skilled active managers to arrive at a more optimal combination of investment ideas and therefore generate long-term excess returns. Over the past two years, our highly flexible portfolio approach combined with our independent research led us to double small-cap exposure in our international strategy, exploiting extensive broker coverage of larger, more liquid companies and strong in-flows into passive vehicles. We have already begun to see the benefits of this positioning, as the market has begun to recognize the merits of many of our small-cap company holdings.

Without the burden of excessive constraints, we are often able to buy into investment ideas at earlier stages and at more reasonable valuations, while passive vehicles and investors reliant on broker research and/or operating under constraints may be forced to buy at much higher valuations and at a later stage in the growth trajectory. Ultimately, we believe our approach can generate potential returns and provide you with confidence as we continue our efforts to grow your capital over time.

This post was first published at the official blog of Invesco Canada.