The midterm election is now behind us, so we’ve highlighted our thoughts below on what Congress’ flip could mean for different asset classes, including specific sectors that stand to win or lose from policy developments.

Stocks

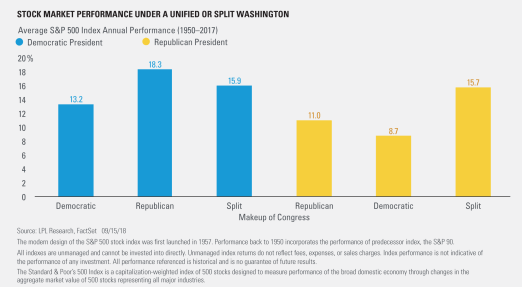

U.S. stocks staged a relief rally Wednesday as political uncertainty faded, and if history repeats itself, the gains could continue. As shown in the LPL Chart of the Day, a gridlocked Congress under a Republican president historically has been one of the best scenarios for stocks.

Though we think still-solid fundamentals can support equity gains, we also expect continued bouts of volatility based on political headlines and global concerns.

“The market’s underlying fear of uncertainty around the election is gone, clearing the way for what could be a strong year-end rally,” said LPL Research Chief Investment Strategist John Lynch. “Our focus will continue to be on the fundamentals supporting economic growth, the direction of interest rates, and the impact of record corporate profits on the financial markets.”

Rates

We believe the most important focus for rates continues to be Federal Reserve (Fed) policy. Regardless of the election’s outcome, we still maintain that the Fed will be less aggressive than currently feared. Our projections remain for another interest-rate hike in December, followed by just two increases in 2019. As a result, market interest rates should nudge higher, though accompanied by periodic and volatile temporary surges as deficit spending battles ensue.

Sectors

- Industrials. We believe infrastructure spending is a topic on which both parties are more closely aligned than outlined during the campaign season. Consequently, we expect some progress in this direction will be supportive of demand in the industrial and materials sectors.

- Defense. Defense spending is expected to be high even under divided government, though perhaps less so. Given that the two-year, $300 billion package of additional government spending enacted earlier this year was largely focused on defense, the outcome of the midterm doesn’t alter the trajectory of defense spending in 2019. We believe these trends also favor the industrial sector.

- Healthcare. Medicaid expansion may be in the cards under more Democratic leadership, while efforts to control drug prices are likely to continue. Healthcare has been the leading sector in the S&P 500 Index this year, but we expect headline risk to weigh on some industries within the sector, including big pharmaceuticals and biotech. On the other hand, recent developments bode well for managed care and hospital stocks.

- Energy. Deregulation efforts by Republicans may slow down, though executive orders remain in play. We believe excess production is still the primary determinant of oil prices, again minimizing the impact of the election on the space. We continue to market weight the energy sector.

- Financial services. While new leadership of the House Financial Services Committee may not be as supportive of the financial sector, it should be emphasized that less stringent bank stress tests (as regulated by the Fed) continue to favor the expansion of lending capacity, which is typically a boon to economic growth. Considering taxes, improved net interest margins and profit forecasts, we continue to overweight the financial services sector.

For more of our thoughts on the investment implications of a gridlocked Congress, check out next week’s Weekly Market Commentary.