by Lance Roberts, Clarity Financial

I have written about the “problem with passive” previously which mostly fell on “deaf ears.” Such should not be surprising after one of the longest advances in market history with virtually no volatility in 2017.

However, as they say, “payback is a bitch.”

This year started off with a January rush higher followed immediately by a 2-week sell-off that wiped out the entire advance. But then it was over, and the market began to stair step higher ultimately reaching all-time highs.

Once again, the “buy and hold” and “passive indexing” mantras were seemingly proved right.

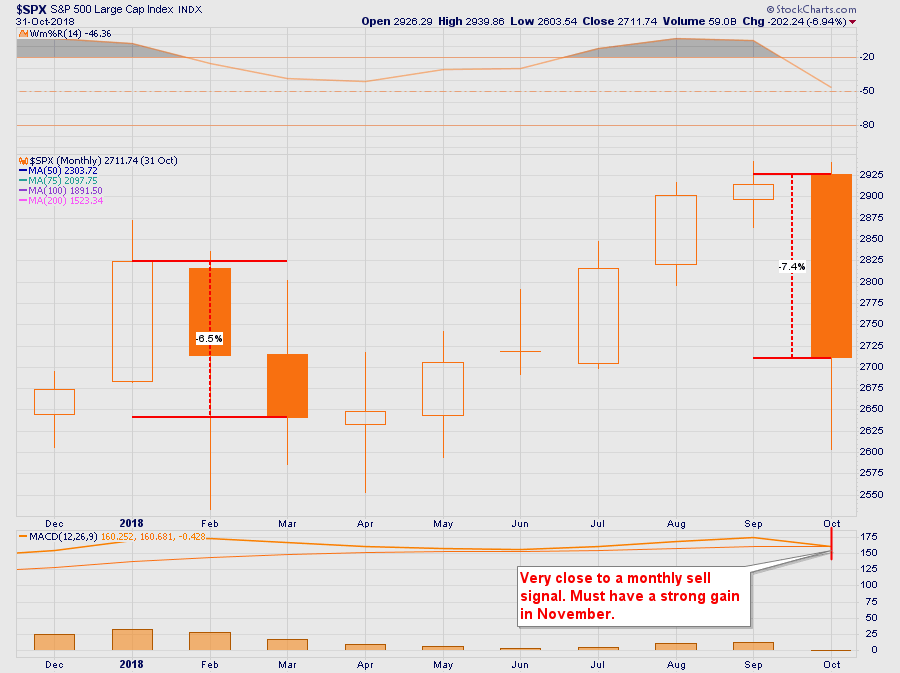

And then the month of October arrived and stocks plunged more in one month (-7.4%) as compared to the decline from the closing highs in January to the lows of March (-6.5%). (As noted, it is important that November musters a fairly strong rally to keep the monthly MACD sell signal from triggering. Such would denote a much more negative backdrop for stocks in the months ahead.)

Over the last couple of months, we have repeatedly warned our readers that a pickup in volatility in October was highly likely due to the strong advances made by the markets during the preceding summer months. At the beginning of September I penned:

“However, there are plenty of warning signs that the “good times” are nearing their end, which will likely surprise most everyone.”

Then I reiterated that point two weeks later. To wit:

“While we are long-biased in our portfolios currently, such doesn’t remain there is no risk to portfolios currently. With ongoing “trade war” rhetoric, political intrigue at the White House, and interest rates pushing back up to 3%, there is much which could spook the markets over the next 45-days.”

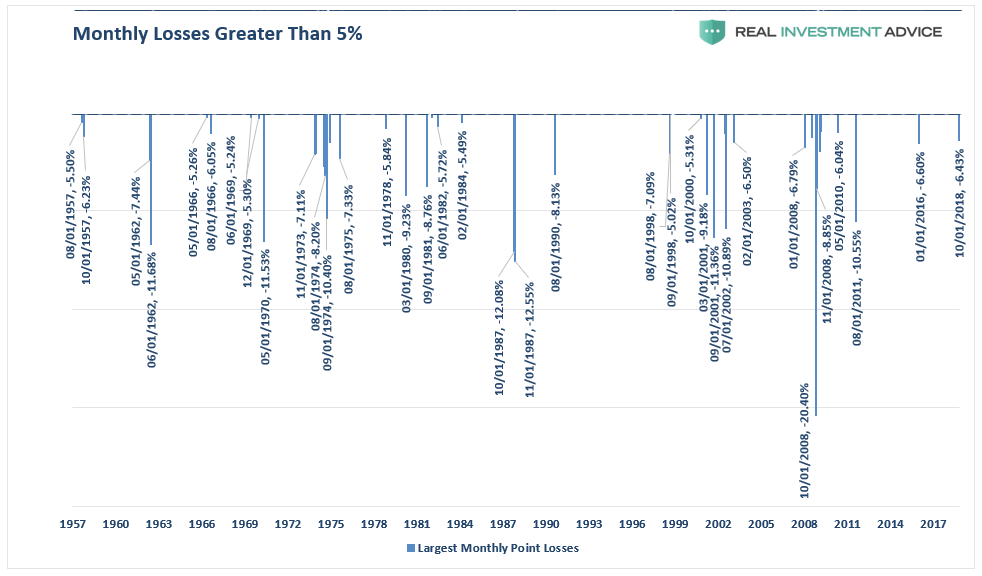

The chart below only shows months where the market lost more than 5%. You will notice clusters of losses during the centers of major bear markets such as 1974, 2000, and 2008.

So, with October behind us, the market should march back to all-time highs. Right? Maybe not, as this time is not like last time.

- The Fed is hiking rates versus either lowering or keeping them at zero.

- The Fed is reducing rather than increasing their balance sheet.

- The current Administration is insisting on a “trade war” which slows global growth.

- The economic cycle is mature rather than recovering.

- Record levels of debt at risk of rising rates versus a re-leveraging cycle with ultra-low rates.

- A mature housing, auto, and consumption cycle versus a recovery.

- Global central bank interventions have begun to taper versus expansion

- Peak earnings growth versus expansion

- Peak valuations versus expanding valuations

While the sell-off this past month was not particularly unusual, it was the break of material levels of support which was different. Furthermore, the uniformity of the price moves revealed the fallacy “passive investing” as investors headed for the door all at the same time. Such a uniform sell-off is indicative of what we have been warning about for the last several months and should serve as a warning.

“With everyone crowded into the ‘ETF Theater,’ the ‘exit’ problem should be of serious concern. Unfortunately, for most investors, they are likely stuck at the very back of the theater.

However, I am suggesting that remaining fully invested in the financial markets without a thorough understanding of your ‘risk exposure’ will likely not have the desired end result you have been promised.

As I stated often, my job is to participate in the markets while keeping a measured approach to capital preservation. Since it is considered ‘bearish’ to point out the potential ‘risks’ that could lead to rapid capital destruction; then I guess you can call me a ‘bear.’

Just make sure you understand I am still in ‘theater,’ I am just moving much closer to the ‘exit.’”

Despite the best of intentions, individual investors are NOT passive even though they are investing in “passive” vehicles. When these market swoons begin, the rush to liquidate entire baskets of stocks accelerate the decline making sell offs much more violent than what we have seen in the past.

This concentration of risk, lack of liquidity, and a market increasingly driven by “robot trading algorithms,” reversals are no longer a slow and methodical process but rather a stampede with little regard to price, valuation, or fundamental measures as the exit becomes very narrow.

October was just a “sampling” of what will happen to the markets when the next bear market begins.

Oh, I almost forgot, the other problem with the whole “passive investing” mantra is that “getting back to even” is not a successful investment strategy to begin with.

#YouHaveBeenWarned

Copyright © Clarity Financial