by Liz Ann Sonders, Brad Sorensen, Jeffrey Kleintop, Charles Schwab and Company

Key Points

- Markets seem to have found a good balance between economic/earnings growth and trade concerns, allowing stocks to move back toward the top end of their 2018 range. But that balance can end quickly and investors should remain diversified and disciplined.

- Earnings season has largely bested elevated expectations but we’ve seen disappointments punished severely. Trade concerns remain top of mind but a few glimmers of hope dot the headlines as well. Meanwhile, the Fed held rates steady and is searching for balance between growth and inflation.

- Central banks remain in focus globally, with yield curves being closely watched. The Fed has expressed little concern but financial conditions have gotten tighter this year, which has implications for markets.

“Happiness is not a matter of intensity but of balance, order, rhythm and harmony.”

- Thomas Merton

Goldilocks peaks her head out

After searching for direction, it appears stocks have found some balance, at least for now. Major U.S. indexes have moved out toward the high end their recent ranges; with the NASDAQ recently hitting a new high and the S&P 500 threatening to do so, before again pulling back on continued trade tensions.

Stocks have moved toward top of recent range—but still vulnerable to pullbacks

Gains appear to have been fueled by a mix of continuing good economic news, with second quarter real gross domestic product (GDP) growth coming in at an annualized rate of 4.1% according to the Bureau of Economic Analysis. More than $20 billion was pulled from stock-focused mutual funds and exchange-traded funds (ETFs) in June, according to Morningstar—capping the third worst first half for equity flows in the past decade. The trend doesn’t appear to be changing as investors redeemed another $11.6 billion from domestic stock funds in the three weeks ended July 18. That healthy conflict between optimism and skepticism can be a good mix for stocks, as we’ve seen recently; but can also change relatively quickly so staying disciplined and not chasing returns remains important.

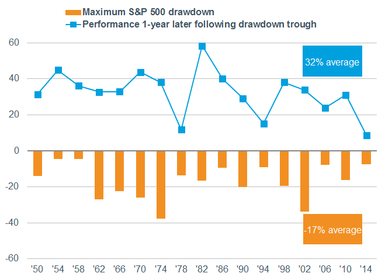

One reason for caution is that we’re entering what has traditionally been a tough time for equities. As we’ve noted before, midterm election years have been rough for stocks, with the average decline or “drawdown” being 17% in the S&P 500 since 1950, with much of the weakness clustered in the summer months. However, going from each of those midterm drawdowns’ troughs, the subsequent one-year performance was a strong 32%. History certainly doesn’t guarantee the future, but it does give us some reason for a bit of caution over the next couple of months.

Midterm years have had historical problems

Source: Charles Schwab, Macrobond, Standard and Poor’s. Past performance is no guarantee of future results.

Trade continues to dominate

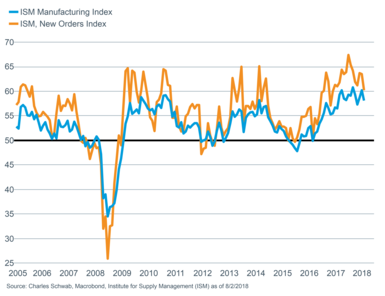

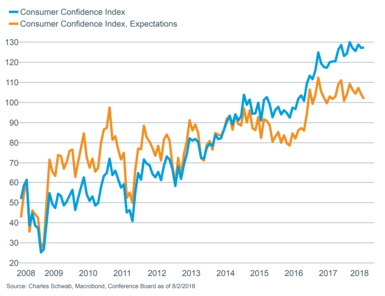

Also raising our level of caution is the ongoing trade disputes going on between the United States and China, among other countries. Investors are digesting concerns increasingly being mentioned on corporate conference calls during second quarter earnings season so far; but have yet to see significant impact on the economy. Confidence surveys remain elevated, with regional surveys such as the Richmond Fed Survey remaining well in territory depicting expansion; while the national Institute of Supply Management’s (ISM) Manufacturing Index remained elevated at 58.1, although down slightly from the previous month. The weakness in the new orders component was more pronounced. In fact, ISM has been noting that many respondents to their monthly survey mentioned trade concerns. ISM chairman Timothy Fiore has this to say on August 1: “We’re seeing a lot of comments from the respondents about evaluating whether to manufacture something in the U.S. or make it in Canada or make it in Mexico. If the end market is Europe or China, then you’re going to want to move it outside the U.S. at this point.” For now, the consumer seems relatively unconcerned about the possibility of higher costs due to increased tariffs as consumer confidence also remains elevated. However, there is a wide gap between consumers’ current confidence (higher) and their future expectations (lower).

Trade doesn’t appear to be denting confidence to a great degree…yet

We were modestly encouraged by the results of the meeting between President Trump and European Commission President Jean-Claude Juncker, which resulted in a standing down of the escalating tensions between the two regions. Of course, no firm agreements were agreed to, other than to hold off on further tariffs for the time being, so things could still escalate. And of course there have been no signs of thawing between China and the United States, with the Trump administration now threatening to up the tariff rate on $200 billion worth of Chinese goods from the proposed 10% to 25%. For now, only the European developments, as well as some apparent progress with NAFTA deals, give us some hope that we may not descend into a full global trade war.

Despite trade-related concerns, companies largely bested even elevated consensus earnings expectations, with Thomson Reuters reporting that 80% of the 380 companies in the S&P 500 having reported so far have beaten earnings estimates, well above the average beat rate of 68.3%. Even with these better results, estimates for the remainder of 2018 and calendar year 2019 continue to move higher.

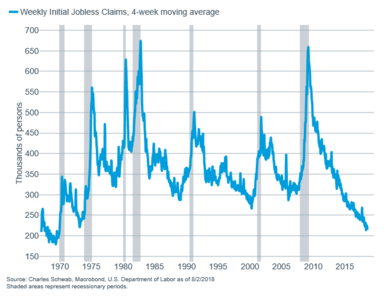

Corporate confidence and strength can also be seen in the labor market as jobless claims—the most leading of jobs indicators—recently hit the lowest level in more than 48 years.

Forward looking labor indicator remains historically positive

That’s backed up by the more lagging data out of the Bureau of Labor Statistics, which showed although a fewer-than-expected 157,000 jobs were added in July, the previous two months were revised higher by 59,000 jobs and the unemployment rate moving down to 3.9%. The tight labor market still isn’t resulting in a surge in wage gains as the average hourly earnings number rose a modest 2.7% year-over-year.

Fed continues to seek balance

Wage gains and the tight labor market are playing into the Federal Reserve’s plans for upcoming Federal Open Market Committee (FOMC) meetings. Their most recent meeting resulted in no action on rates, as expected; but the market is nearly fully pricing in a hike in September. The messaging from the FOMC lately—including from Fed Chair Jerome Powell—is that the Fed is no longer on “auto pilot.” Future moves will apparently be more reactive to economic developments, which could result in more volatility and uncertainty; especially given that every FOMC meeting starting in January will have a press conference tied to it (thereby making every meeting a “live” one).

Global balance also in focus?

There are headwinds to global growth including the trade worries and Fed rate hikes; but there are also some tailwinds like economic stimulus in the United States (tax cuts) and China. It seems like the global stock market went from focusing on the headwinds to the tailwinds in July with a 2.9% gain for the MSCI AC World Index. In fact, despite the ebb and flow of trade tensions and rising expectations for two more rate hikes by the Fed this year, July saw stock market gains every week after five months of weak performance; indicating at least a temporary balance between good and bad news.

July brought back the green for the world’s stocks

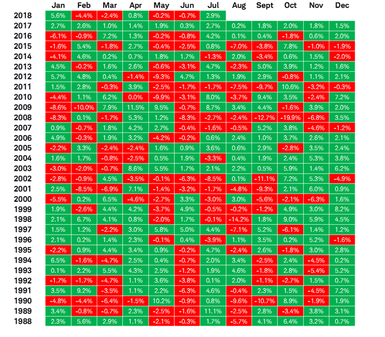

Monthly performance of MSCI AC World Index. Past performance is no indication of future results.

Source: Charles Schwab, Factset data as of 7/31/2018.

In July, the global manufacturing purchasing managers index (PMI)—the most timely monthly indicator of global economic growth—ticked down again and extended the slide this year to 52.7 from 54.5. In our view, this had led to investors seeing the global economy as a “glass half empty.” But the latest reading remains well above 50—the level that marks the line between growth and contraction—in our perception helping investors in July shift to a “glass half full” perspective about the global economy.

Glass half empty or half full?

Source: Charles Schwab, Bloomberg data as of 7/31/2018.

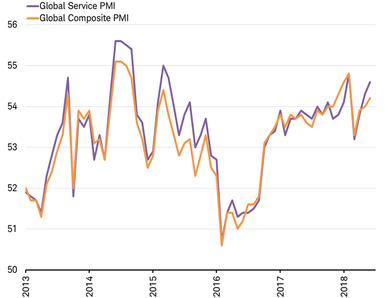

There are also signs of stabilizing economic momentum outside of manufacturing; such the rebound in recent months in the global service PMI to near the highest levels in a few years. This has lifted the overall composite PMI (which includes both manufacturing and services), as you can see in the chart below. This suggests the slide in the global manufacturing PMI may not extend all the way down to near 50 as it did in 2013 and 2016 when non-manufacturing indicators were also deteriorating.

Service sector rebound

Source: Charles Schwab, Bloomberg data as of 7/31/2018.

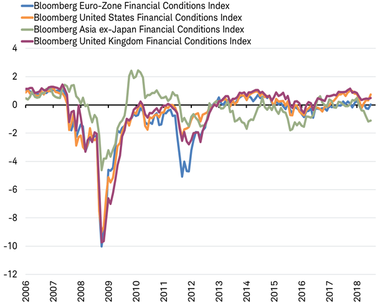

It is also important to note that after worsening earlier in the year, global financial conditions are now improving even in Asia, as you can see in the chart below. The stabilization in July of Asia’s financial conditions was led by central bank easing reflected in significantly lower interest rates in China, where the 3-month SHIBOR rate fell by more than one percentage point from mid-June to the end of July.

Global financial conditions improving

Source: Charles Schwab, Bloomberg data as of 7/31/2018.

The improvement outside of global manufacturing is encouraging. However, global stock markets could focus again on risks in August (last week we provided our Top Five Global Risks for Investors in 2018: Mid-Year Update). August has been a month known for volatility and has often been a month of losses for global stocks.

So what?

Tension between good news and investor concerns is often a good place for stocks to be, but that environment can change quickly; and with us entering a historically difficult seasonal time of the calendar for stocks, we urge discipline, including around diversification and rebalancing. Corporate earnings and the U.S. economy remain strong, but trade concerns, midterm elections and monetary policy concerns pose risks. We believe the secular bull market in the United States remains intact, but pullbacks are likely.

Copyright © Charles Schwab and Company