by Jeff Rosenberg, Managing Director, Chief Investment Strategist, Fixed Income, Blackrock

The early February spike in equity market volatility came on the heels of fast-rising bond yields. Jeff explains what’s behind the quickening pace.

The early February spike in equity market volatility came on the heels of fast-rising bond yields. What’s behind the quickening pace? Our 2018 fixed income outlook—Fuel for (over)heating—offers one possible explanation: U.S. fiscal stimulus, confidence-inducing investment and a steady global expansion are reawakening investor inflation fears.

Markets do appear to have suddenly woken up to the prospect of an inflation comeback in the U.S., a key theme of our 2018 Global investment outlook. But we see others interrelated factors also behind the re-calibration of rate expectations, as we write in our new Global bond strategy Recalibration and repatriation.

Increasing Treasury supply

Supply of Treasury bonds is headed up, and demand is declining. We estimate net supply could increase by some $488 billion, just as an erstwhile reliable buyer, the Federal Reserve, is trimming re-investments. This upsets the supply/demand balance of Treasury bonds and portends higher rates.

The weakening U.S. dollar

A less obvious culprit behind rising rates in January was the weakening U.S. dollar. Low rates in the rest of the world anchor U.S. yields. That has been the story to explain low U.S. rates and a flattening yield curve. But fading confidence in dollar stability now could turn this causality on its head: A weakening dollar may push up rate differentials as non-U.S. investors repatriate assets.

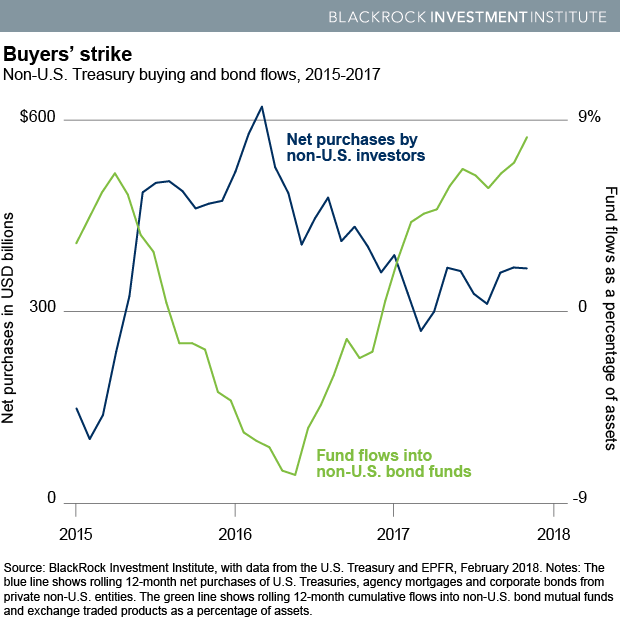

A flow of unhedged U.S. bond investments is headed back to the domestic markets of non-U.S. investors. This repatriation trend is showing itself in decreased foreign purchases of U.S. bonds and increased flows into non-U.S. bond funds, as the chart below shows.

Rising hedging costs have reduced the attractiveness of U.S. rates to foreign investors, and small dollar declines can wipe out any perceived benefit from higher U.S. yields for foreign investors. Other reasons for the flows may be prospects for higher returns at home as well as expectations for rising domestic interest rates. Lastly, rising oil prices may have sparked fears over a further dollar slide. This sort of repatriation is helping to dim the dollar’s prospects, lifting an anchor holding down yields on longer-dated U.S. rates.

The oil factor

Any further rise in oil prices could weigh on the dollar, making crude a contributor to the pullback from U.S. debt by unhedged foreign investors. How likely is this to happen? Supply discipline by traditional oil producers and strong global demand underpin high crude prices. Yet nimble U.S. shale production tends to kick in whenever prices are high, capping the upside. This potentially reduces the role of oil in any further dollar downdraft.

Bottom line

We see steadily steeper curves and higher rates improving the outlook for short versus long maturities. We particularly like two- to five-year bonds for their yield-duration ratios. Floating rate and inflation-linked instruments are attractive for their potential buffer against rising rates and inflation. We prefer an up-in-quality stance in credit, favoring investment grade over high yield. Read more market insights in our Global bond strategy.

Jeffrey Rosenberg, Managing Director, is BlackRock’s Chief Investment Strategist for Fixed Income, and a regular contributor to The Blog.

Copyright © Blackrock