by Lance Roberts, Clarity Financial

Last week, investors received a “warning shot” about the dangers of “passive indexing.”

While the idea of “passive indexing” sounds harmless enough, we have spilled a lot of ink on this site digging into the relative dangers of it.

The biggest risk to investors is when “passive indexers” turn into “panic sellers.”

We witnessed it all first-hand last week.

The “sell off” proved our previous premise of the flaws of “passive investing.”

“While it is believed ETF investors have become ‘passive,’ the reality is they have simply become ‘active’ investors in a different form. As the markets decline, there will be a slow realization ‘this decline’ is something more than a ‘buy the dip’ opportunity. As losses mount, the anxiety of those ‘losses’ mounts until individuals seek to ‘avert further loss’ by selling.”

I have also stated that while “robo-advisors” are the new “shiny toy” for the markets to play with, and inexperienced investors to be lured into, when a crash does come, individuals will not be willing to just “ride it out.” To wit:

“The websites of two of the country’s biggest robo-advisers — Wealthfront Inc. and Betterment LLC — crashed on Monday as the S&P 500 Index sank. Complaints quickly spread across Reddit and other internet sites from people who had trouble logging onto their accounts.”

Yea….it’s that psychology thing.

Individuals just simply refuse to act “rationally” by holding their investments as they watch losses mount.

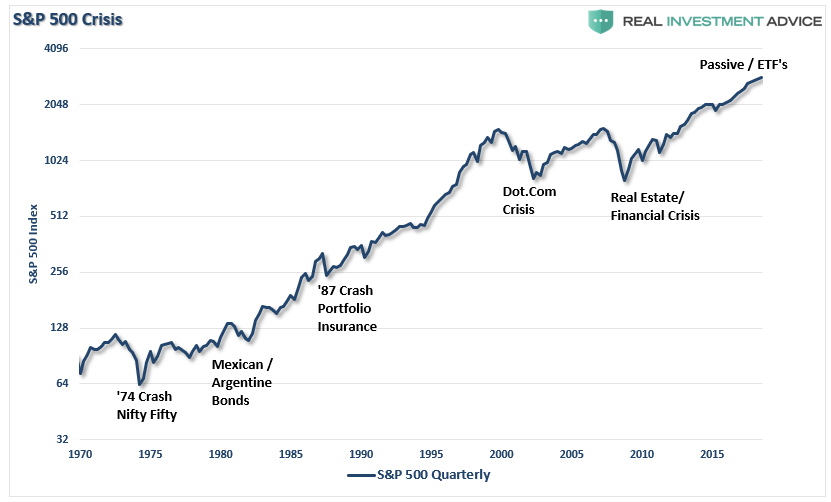

This behavioral bias of investors is one of the most serious risks arising from ETFs as the concentration of too much capital in too few places. But this concentration risk in ETF’s is not the first time this has occurred:

- In the early 70’s it was the “Nifty Fifty” stocks,

- Then Mexican and Argentine bonds a few years after that

- “Portfolio Insurance” was the “thing” in the mid -80’s

- Dot.com anything was a great investment in 1999

- Real estate has been a boom/bust cycle roughly every other decade, but 2006 was a doozy

- Today, it’s ETF’s and Bitcoin

Risk concentration always seems rational at the beginning, and the initial successes of the trends it creates can be self-reinforcing.

Until it goes in the other direction.

While the sell-off last week was not particularly unusual, it was the uniformity of the price moves which revealed the fallacy “passive investing” as investors headed for the door all at the same time.

Such a uniform sell-off is indicative of what we have been warning about for the last several months. For price chasing investors, last week’s plunge should serve as a warning.

“With everyone crowded into the ‘ETF Theater,’ the ‘exit’ problem should be of serious concern. Unfortunately, for most investors, they are likely stuck at the very back of the theater.

However, I am suggesting that remaining fully invested in the financial markets without a thorough understanding of your ‘risk exposure’ will likely not have the desired end result you have been promised.

As I stated often, my job is to participate in the markets while keeping a measured approach to capital preservation. Since it is considered ‘bearish’ to point out the potential ‘risks’ that could lead to rapid capital destruction; then I guess you can call me a ‘bear.’

Just make sure you understand I am still in ‘theater,’ I am just moving much closer to the ‘exit.’”

As we have previously discussed, when the “robot trading algorithms” begin to reverse, it will not be a slow and methodical process but rather a stampede with little regard to price, valuation or fundamental measures as the exit will become very narrow.

That Wasn’t THE Crash…

Fortunately, while the price decline was indeed sharp, and a “rude awakening” for investors, it was not a “crash.”

It was just a correction within the ongoing “bullish trend.”

For now.

But nonetheless, the media has been quick to repeatedly point out the decline was the worst since 2008.

That certainly sounds bad.

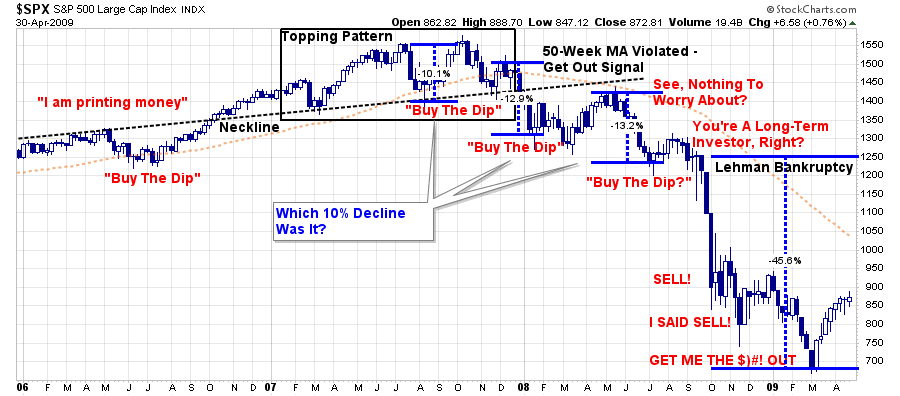

The question is “which” 10% decline was it?

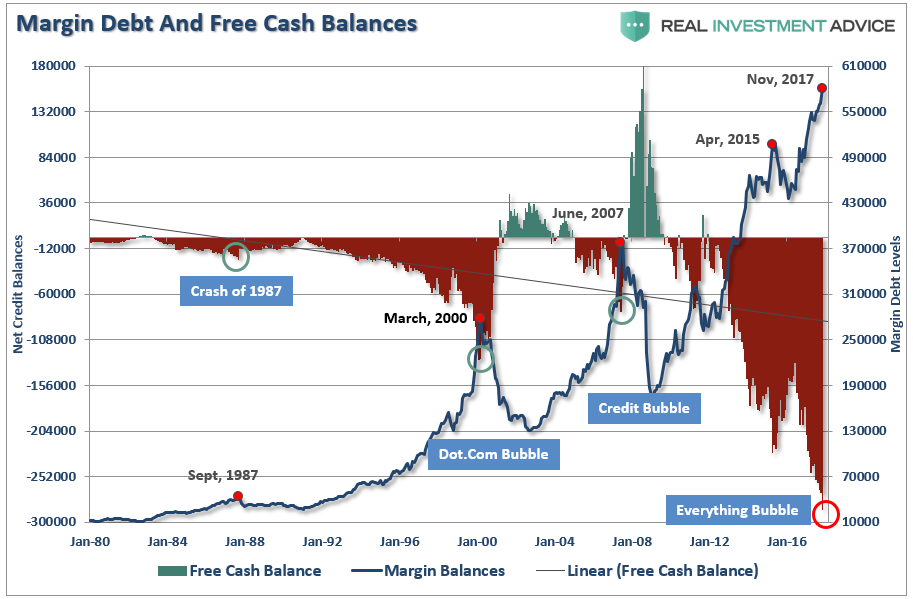

From the amount of “digital ink” being spilled to telling investors “not to worry,” and given the fact markets remain in their currently “bullish trend,” this was probably the first. Regardless, as shown above, it was only a glimpse at what will eventually be the “real” decline when leverage is eventually clipped. I warned of this previously:

“At some point, that reversion process will take hold. It is then investor ‘psychology’ will collide with ‘margin debt’ and ETF liquidity. It will be the equivalent of striking a match, lighting a stick of dynamite and throwing it into a tanker full of gasoline.

When the ‘herding’ into ETF’s begins to reverse, it will not be a slow and methodical process but rather a stampede with little regard to price, valuation or fundamental measures.

Importantly, as prices decline it will trigger margin calls which will induce more indiscriminate selling. The forced redemption cycle will cause catastrophic spreads between the current bid and ask pricing for ETF’s. As investors are forced to dump positions to meet margin calls, the lack of buyers will form a vacuum causing rapid price declines which leave investors helpless on the sidelines watching years of capital appreciation vanish in moments. Don’t believe me? It happened in 2008 as the ‘Lehman Moment’ left investors helpless watching the crash.”

“Over a 3-week span, investors lost 29% of their capital and 44% over the entire 3-month period. This is what happens during a margin liquidation event. It is fast, furious and without remorse.”

Make no mistake we are sitting on a “full tank of gas.”

Don’t Just Stand There

One of the biggest problems facing investors is ultimately when “something goes wrong.” When this happens, the initial response is paralysis, followed by a bit of panic, before ultimately falling prey to the host of emotional mistakes that repeatedly plague investors time and again.

Currently, I do not believe that we have begun the next major corrective cycle just yet. There is simply too much momentum and bullish psychology in the market. Last week, the majority of the questions I received were not about “selling,” but rather is “now the time to ‘go all in?'”

The correction was most likely only that, for now.

However, this should be a clear “warning shot” to investors who have piled into ETF’s in the hopes indexing will offset the penalties of not paying attention to the risk they have taken on.

“While passive indexing works while all prices are rising, the reverse is also true.”

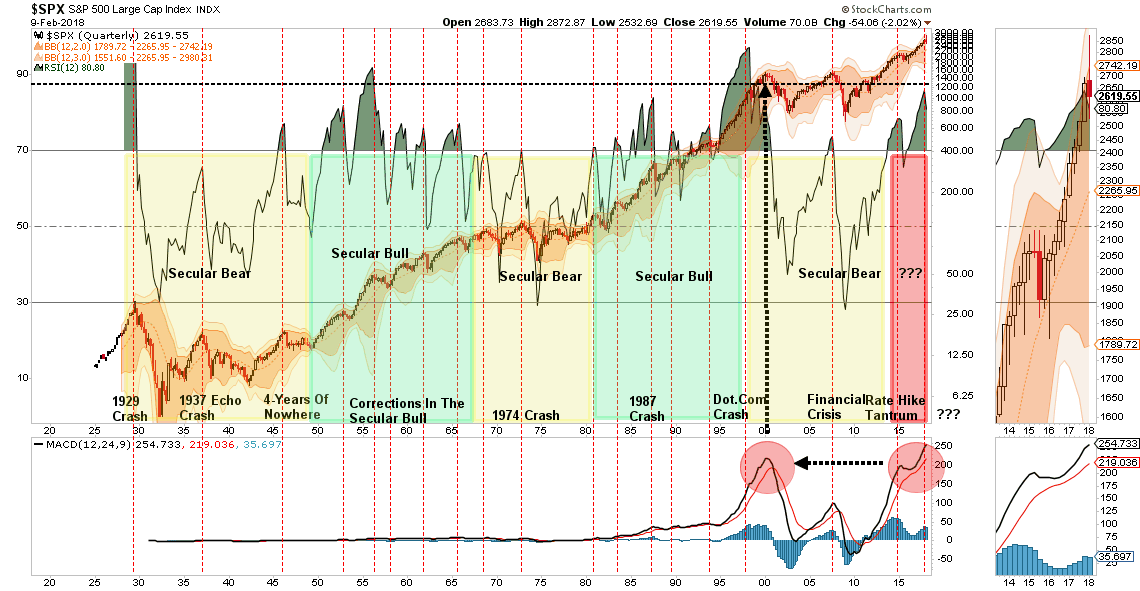

Importantly, it is only near peaks in extended bull markets that logic is dismissed for the seemingly easiest trend to make money. Today is no different as the chart below shows the odds are still heavily stacked against substantial market gains from current levels.

In the near term, over the next several months, or even a year, markets could very likely continue their bullish trend as long as nothing upsets the balance of investor confidence and market liquidity. However, of that, there is no guarantee.

As Ben Graham stated back in 1959:

“‘The more it changes, the more it’s the same thing.’ I have always thought this motto applied to the stock market better than anywhere else. Now the really important part of the proverb is the phrase, ‘the more it changes.’

The economic world has changed radically and will change even more. Most people think now that the essential nature of the stock market has been undergoing a corresponding change. But if my cliché is sound, then the stock market will continue to be essentially what it always was in the past, a place where a big bull market is inevitably followed by a big bear market.

In other words, a place where today’s free lunches are paid for doubly tomorrow. In the light of recent experience, I think the present level of the stock market is an extremely dangerous one.”

He is right, of course, things are little different now than they were then.

For every “bull market” there MUST be a “bear market.”

While “passive indexing” sounds like a winning approach to “pace” the markets during the late stages of an advance, it is worth remembering it will also “pace” just as well during the subsequent decline.

The correction had the “perma-bulls” scrambling to produce commentary as to why markets will continue to only rise. Unfortunately, that is not the way markets actually work over the long-term and why the basic rules of investing are REALLY hard to follow.

Think about it.

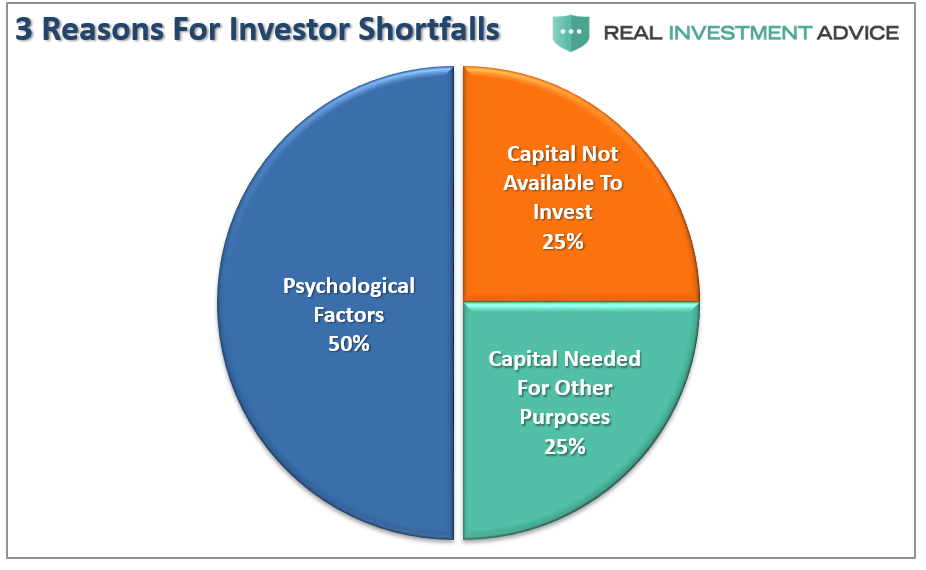

If investing was as easy as the media and Wall Street portray it to be, then everyone would be wealthy from investing. Right?

The vast majority aren’t because investing without a discipline and strategy has horrid consequences.

So, what’s your plan for when the real correction ultimately begins?