by Carl Tannenbaum, Chief Economist, Northern Trust

The “Great Moderation” was a golden era for the American economy. Between 1982 and 2008, the U.S. enjoyed three of the longest expansions in its history. Unemployment fell to levels that were previously thought to be unachievable. Thanks to the development of technology, productivity surged and inflation remained tame. Markets were ebullient. At times, the business cycle seemed to go into hibernation.

Some analysts are suggesting that history is about to repeat itself. Technology is once again in the forefront: artificial intelligence (AI) has the potential to raise output without stressing inflation. AI is already driving productivity and equity prices up, even though adoption is in the very early stages. But an examination of the past raises questions about prospects for an encore.

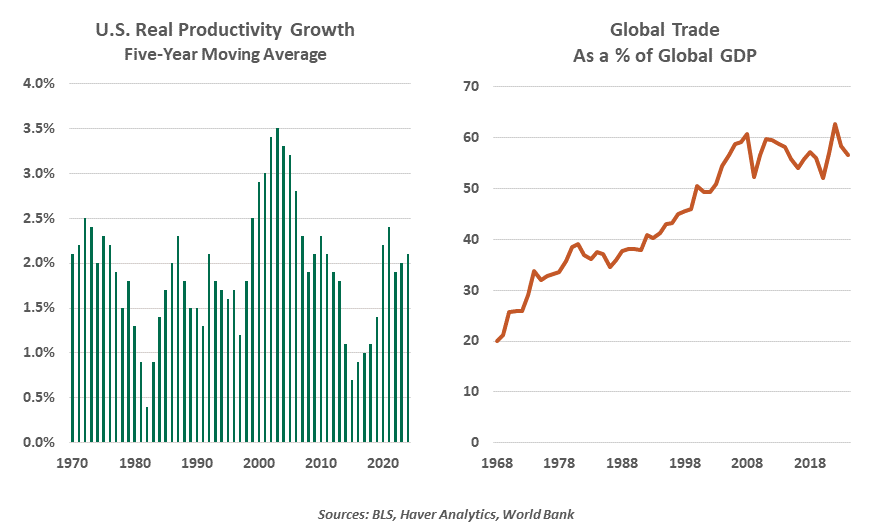

The Great Moderation was marked by two significant paradigm shifts. The first was technological: increased speed in accessing and synthesizing data made businesses more efficient, and the application of robotics revolutionized manufacturing. After a sluggish interval in the 1980s, productivity growth in the United States surged.

Technology is once again ascendent, but trade is in retreat.

Artificial intelligence (AI) promises the kind of boost to productivity that industrial automation and the internet provided in the 1990s and 2000s. U.S. productivity growth slumped at the end of the last decade, but has been resurgent. If sustained, this trend would boost potential economic growth, add to living standards and make debt somewhat more sustainable.

The second megatrend underlying the Great Moderation was globalization. The opening of international channels increased both supply and demand, relaxing the capacity constraints imposed by local conditions. Trade agreements and offshore investments opened the way to more efficient sourcing. Trade as a percentage of global gross domestic product expanded from 36% in 1983 to 59% in 2007.

But that fraction has been essentially stagnant since then. And it will almost certainly fall in the wake of the tariffs that have been implemented by the United States. Globalization reduced inflation; The Great Unwind will have the opposite effect.

There is a school of thought that the supply shock created by the new tariff regime will produce only a temporary impact on inflation. Price levels will adjust, but once settled at new heights, annual increases will return to normal levels. But many of us thought the same thing in 2021, only to see inflation broaden and increase quickly. It may be too soon to reassemble “team transitory.”

Alan Greenspan, who presided over the Federal Reserve during much of the Great Moderation, had the prescience to anticipate that the old rules no longer applied. Greenspan convinced his colleagues to keep rates low amid strong growth, a decision which was vindicated when inflation remained very well behaved. His 2000 biography was entitled “The Maestro,” reflective of the reverence in which he was held at the time.

Prospects for a comparable interval might lead the Fed to set interest rates lower for longer. But that strategy proved the downfall of the Great Moderation. Easy money contributed to a buildup of leverage in the economy, which when combined with the explosion of derivatives, formed the kindling for the events of 2008. Alan Greenspan’s legacy seemed secure when he retired from the Fed in 2006, but the crisis became an unfortunate epilogue.

We appear to be readying for another step-change in financial innovation, this time centering on stablecoins. Once again, financial regulation is being re-cast to support these new developments. Risks to financial stability could be rising, which might also recommend a cautious approach to monetary policy.

History rarely repeats itself, and rhymes only occasionally. Perhaps it would be best to moderate our expectations for another Great Moderation.

Copyright © Northern Trust