by Brian Levitt, Global Market Strategist, Invesco

Key takeaways

- Fed independence matters - If markets perceive the Federal Reserve (Fed) as an extension of the executive branch, the consequences could be severe.

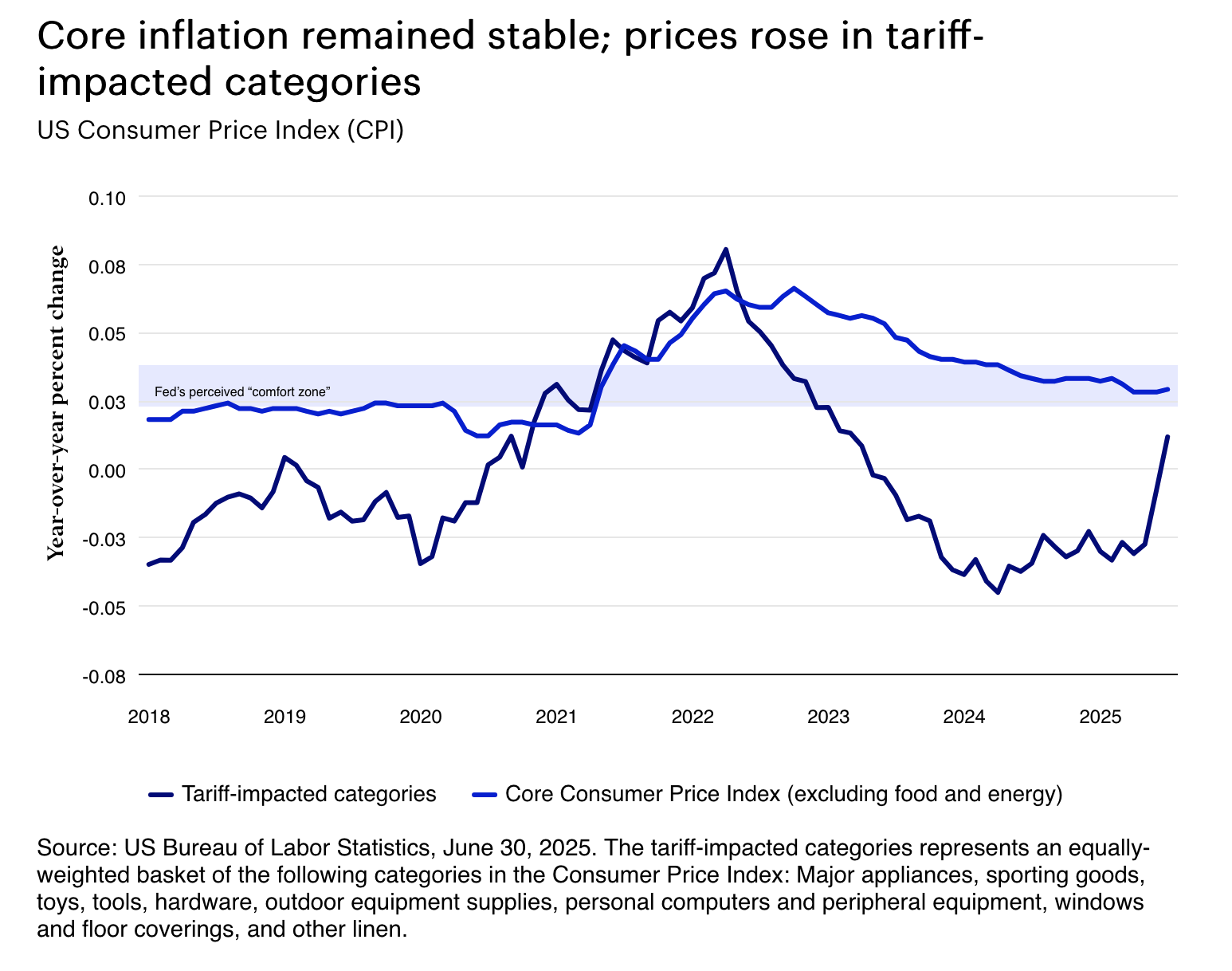

- Tariff-impacted prices - Prices are starting to rise in tariff-impacted categories like major appliances, sporting goods, toys, and household linens.

- Resilient markets - Markets continued to remain steady, but some industries could win or lose under the new One Big Beautiful Bill.

Austin Powers: Only two things scare me, and one is nuclear war.

Basil Exposition: What's the other?

Austin Powers: Excuse me?

Basil Exposition: What's the other thing that scares you?

Austin Powers: Carnies.

This month, I learned what truly scares me, and it’s not carnies. I enjoy carnivals. What unsettles me is the growing politicization of the US Federal Reserve (Fed).

Saying that the Fed’s independence is essential shouldn’t be controversial. One of its core responsibilities is to maintain price stability and anchor inflation expectations. If markets begin to perceive the Fed as an extension of the executive branch rather than an independent institution focused on its dual mandate, the consequences could be severe.

We don’t have to look far for a cautionary tale. In the 1970s, President Nixon’s pressure on Fed Chair Arthur Burns contributed to a period of elevated inflation and persistently high interest rates, conditions that weighed heavily on U.S. risk assets for years.1 I was born in that decade, but I have no desire to relive it. Besides, I’ve long since lost my polyester leisure suits!

Fortunately, President Trump denied reports that he plans to fire Fed Chair Jerome Powell. Here’s hoping that denial holds.

“Smashing, groovy, yay capitalism!”

It may be confirmation bias but…

… prices are starting to rise in categories affected by tariffs, such as major appliances, sporting goods, toys, and household linens, to name a few.2 We’re likely still in the early stages of these price increases.

Fortunately, the core Consumer Price Index (CPI) remains stable, as the pace of service price growth continues to slow.3 The rising prices of tariff-impacted goods, in our view, should be seen as a one-time price shock rather than the onset of a prolonged inflationary trend.

Since you asked

Q: Haven’t you always said that elections don’t matter as much for markets as investors believe? But aren’t there clear winners and losers in the One Big Beautiful Bill?

A: Thanks for listening! My point has always been that election outcomes don’t fundamentally alter the trajectory of the broad stock market. Just look at the S&P 500 Index returns from the past three inauguration dates through mid-July:4

- Trump (2017): +9.4%

- Biden (2021): +13.2%

- Trump (2025): +4.2%

May I rest my case?

While government fiscal policy can certainly create industry winners and losers, industry performance can also be shaped by the strength of the economy and the direction of monetary policy. Under the One Big Beautiful Bill Act (OBBBA), potential beneficiaries include defense and security contractors, semiconductor firms, fossil fuel and traditional energy companies, private education and charter schools, and construction firms.

On the flip side, industries that may face headwinds include public healthcare providers, insurance companies, renewable energy sectors, and low-income housing initiatives, to name a few.

It was said

“I suggest a little bull market for stocks and a little bear market for bonds. Nothing dramatic either way for now.”

– Bill Gross

Bill Gross, the “Bond King” likes stocks. I concur. Our preferred indicators signal below-trend growth, favoring higher-quality stocks and bonds. It’s making me less inclined to call for a bear market in bonds, but Gross did purposefully use the word “little.” Either way, “nothing dramatic” might be music to many investors’ ears following a rowdy first half of the year.

Phone a friend

I’m receiving questions about the so-called end of American exceptionalism. Consider me skeptical. I reached out to Ben Jones, my colleague in the UK, to get a better understanding of what’s meant by the end of American exceptionalism. His response:

“I don’t really like the term US exceptionalism. It’s far too blunt to really describe what’s going on now. My thesis is that the economies, markets, and currencies of other countries will begin to catch up after a prolonged period of its outperformance. I’m not suggesting that US stocks fall in absolute value over any meaningful time horizon. Rather, I just think that other markets could outperform the US because they’re starting to beat depressed expectations. The US will continue to have unique qualities that set it apart from many other nations. I have simply increased my exposure to assets outside the US and expect to maintain those positions.”

On the road again

My personal travels took me to Portugal for a quick summer vacation. Judging by the crowds, we were not the only tourists who decided to visit Lisbon and Porto this summer. The country is booming. I’m ashamed that our industry used to refer to it as one of the PIIGS (Portugal, Italy, Ireland, Greece, and Spain) of Europe.

Can summer please slow down?