by Hubert Marleau, Market Economist, Palos Management

April 13, 2024

It is now clear that the pace of disinflation has stalled, with the headline and core CPI still up 3.5% and 3.8% respectively year-on-year in March . Most of the increase came exclusively from the service category in what appears to be at face value a discontinuing trend of disinflation. Indeed, inflation concerns have sprung back because the numbers help to validate that the hotter-than anticipated readings in January and February did reflect the growing thinking that 3% inflation is the best number we can hope for. In a March survey, the NY Fed’s Center for Macroeconomic data showed that one-year ahead inflation expectations had remained unchanged at 3.0% for a third consecutive month. (Incidentally, a recent NFIB survey conducted in April showed that 25% of the firms who responded cited inflation as their single most important problem, up from 20% earlier in the year.)

Since 3 makes a trend, a third consecutive month of unexpectedly disappointing inflation was too much for the markets to handle, because it warranted a big shift in the Fed’s policy direction. Indeed, this misjudgement quickly derailed the case for a June rate-cut. The reaction was brutal because the financial markets were priced on over-optimistic assumptions. Thus the S&P 500 crumbled to 5161, with 10 of its 11 sectors falling, while 10-year bond yields soared to 4.56% and the dollar raged against all the major currencies on Wednesday. On Friday, it suffered another ferocious attack to end the week at 5123 for a weekly overall decline of 81 points or 1.6%.

However, it was not as bad as it looked, because the spike in food, energy and durables seems to be over and done with. As a matter of fact, super-core inflation, to which the Fed gives special attention because it's the ingredient that usually influences wage rates, has behaved rather well of late. When all is said and done, it seems to be connected to strength of demand, which could weaken because the personal savings rate has tumbled to 3.6%, a low for this cycle. The Producer Price Index offered some relief, rising only 0.2% m/m in March to register a y/y increase of only 2.1%, less than originally expected. (Unrounded, it looked even better: 0.15%.) Meanwhile, the PCE report, the Fed’s preferred inflation gauge, which is due on April 26, calculates inflation more precisely than the CPI and tends to be about 0.5% less the CPI on yearly basis. That means 3.0% y/y.

Upon reflection, the stock market may have overreacted to the downside. The boiling water of higher interest rates will not likely kill the ongoing expansion of corporate earnings. As is often the case, inflation can help businesses, especially those with pricing power, in maintaining their profit margins and raking in sales revenue. Indeed, earnings growth seems to be expanding beyond the so-called “Magnificent Seven.” Analysts covering S&P 500 companies officially expect first-quarter earnings to increase by 2.5% in Q1. Over the past month, however, a rising number of them have increased earnings guidance. Many top-down strategies believe that they could beat profit estimates by as much as 4.5% on average in Q1, with sales and earnings rising throughout 2024 and 2025. The earnings season should be quite interesting.

Generally, Wall Street analysts are holding their forecast that S&P 500 earnings per share for 2024, 2025 and 2026 will reach $250, $275 and $300, respectively. My 2024 S&P 500 objective is 5450. Wells Fargo’s Christopher Harvey just put Wall Street’s highest forecast for the S&P 500 for 2024 at 5535, joining his peers at Goldman Sachs, Bank of America, Oppenheimer, UBS and Societe Generale. Incidentally, in terms of gold, the benchmark for stocks is nowhere near the historical tops. The S&P 500 is 2.2x richer than gold, much less than the 5.5 peak of 2000.

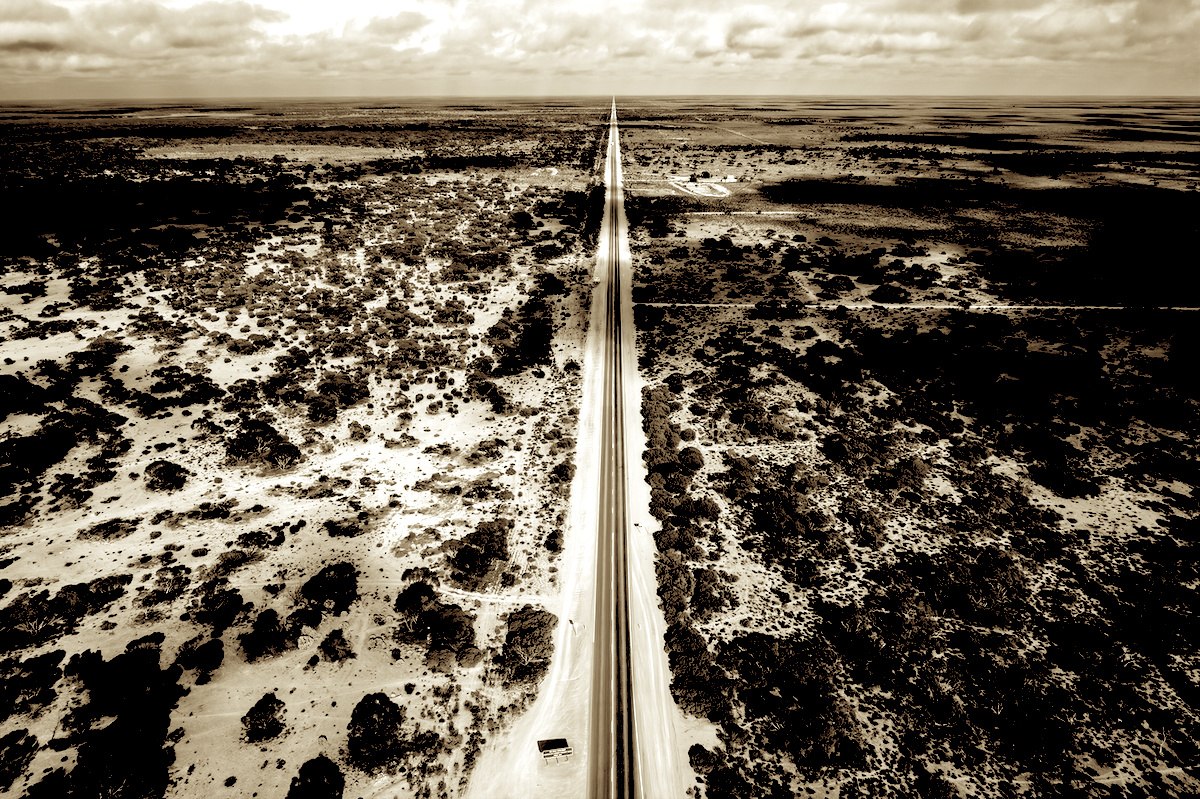

The point is that there is no “full-tilt” change in the Fed’s opinion like the one proposed by State Street’s call that the economic recovery is so fragile it will unleash a half-point cut in June; or by the infamous former Treasury Secretary, Larry Summer, who believes that inflation could get so bad that it would become plausible for the Fed to raise rates instead. Neither is happening. On the contrary, the monetary authorities have offered no hint that they are about to open up 2-side risks to the path of interest rates. Why? Inflation is not tamed, but it’s not raging anymore. It’s just stuck. Meanwhile, around the world, the various central banks (ECB, Canada, China) are still ready to start cutting rates in June. Switzerland has already begun. The net effect is that the dollar has strengthened, and bond traders have pared rate-cut expectations to one or two in the second half of 2024. Circumstances surrounding macro events essentially remain the same, the rationale being that as long as these do not materially change it is better to keep on trucking. Five-year bond yields (4.60%) are where they are because there is a broadening awareness that the neutral rate is higher than it was once. In this regard, the Fed’s policy rate (5.38%) is less than 100 points above the neutral rate, perhaps not enough to kill either growth or inflation.

At the time of writing, gold topped $2400 amid war risks in the Middle East and official buying by China. I can see why it rose. What is particularly remarkable is the weird message that gold futures is sending. The dollar had its best performance and bonds had its worst performance since gold prices broke out in February after a 3-year sideways consolidation. It’s not supposed to happen this way. Gold rallies usually don't correlate well with rising bond yields and a strong dollar. This phenomenon is complicated by the huge 7.0% premium that gold futures demand. In normal circumstances it would predict the coming of lower interest rates.

Last week I wrote: “The thing is that the equilibrium interest rate, which is the rate at which the Fed can consider borrowing costs to be neutral, is neither inflating or deflating demand in the economy. Higher productivity growth, an increasing supply of workers and strong physical investments, on which model-based estimates of the neutral rate are based, have lifted it to 3.00% from a long-time view of 2.5%. Given the optimistic perspective of productivity, the encouraging stepped-up prospect of immigration, and the fragile state of the U.S. government’s audit, I peg the neutral rate at 4.25%. In this regard, I don't think the policy rate can go any lower than the 4.25% to 4.50% range for this cycle, even if inflation were to fall to say 2.25% that the 3-year swaps are predicting.” A 3% inflation target supports the aforementioned statement.

Copyright © Palos Management