by Kristina Hooper, Chief Global Market Strategist, Invesco

Key takeaways

- When will cuts start? – Perceptions change with each new data point and each new comment from central bankers. I believe June is the month to watch.

- The UK could go first – I expect the US Federal Reserve, the Bank of Canada, and the European Central Bank to cut rates in June, and the Bank of England to cut as soon as May.

- Analyzing each economy – I break down what each economy is experiencing in its labor market, inflation statistics, and inflation expectations — all factors in central banks’ game plan.

This past weekend, I had the privilege of watching the NCAA Women’s Final Four basketball tournament. It occurred to me while watching these extremely talented college athletes that each team is like a different economy, with its own strengths and weaknesses. Coaches build their game plans around their teams’ unique traits — and central bankers build their monetary policy plans around the inflation and growth conditions of their economies. And just as women’s college basketball has set new viewership records, all eyes are on which central bank will cut rates next. As each data point comes out (and central bankers comment on it), perceptions change about which central bank will begin to cut when.

Here’s an assessment of where I think Western developed market central banks stand now:

Canada: The economy is under pressure from higher interest rates

Labour market: Canada’s jobs report for March1 showed an unexpected net loss of 2,200 jobs, largely in the services sector. In addition, the unemployment rate increased to a new 26-month high of 6.1%. This represented the largest monthly increase in unemployment since the summer of 2022.

Inflation: Disinflationary progress has been significant, with the February reading of inflation2 at 2.8% year-over-year — well below expectations. And year-over-year core inflation has fallen from 2.4% in January to 2.1% in February. The Bank of Canada forecasts inflation will reach 2% by next year, but there appears to be significant fear among policymakers that inflation could experience a resurgence.

Inflation expectations: The Canadian Survey of Consumer Expectations3 showed that, while one-year ahead inflation expectations have eased very significantly in the last two years, they have recently stalled at a level well above historical norms. As the report explained, “Although they perceive inflation to be falling, consumers still expect near-term inflation to remain high.” In follow-up interviews, they said high interest rates are contributing to their expectations that inflation will remain elevated in the near term. One respondent explained, “It’s interest rates that Canada is imposing on us. That, for me, contributes to inflation.” Consumers perceive high inflation and high interest rates as twin evils: 61.7% of respondents said they are worse off because of higher inflation, and 36.07% say they are worse off because of high interest rates.

The Canadian economy is clearly under pressure as a result of higher interest rates, which ironically can contribute to higher inflation because of their impact on areas such as the cost of housing through higher mortgage rates. The good news is that fewer mortgage holders expect a major increase in their payments at renewal – presumably because they expect rate cuts. That seems to be filtering into improvement on consumer sentiment, although it is still poor: 52% of those surveyed expect economic activity in Canada to decline in the next 12 months (although that is down from 62% in the previous quarter).3

Bank of Canada speak: The summary of deliberations from the last Bank of Canada (BOC) meeting on March 6 show agreement on cutting rates this year if conditions continue to evolve as expected – although there are differing opinions on expected timing. We haven’t heard much in recent weeks in terms of BOC speak, although one speech stands out – from BOC Senior Deputy Governor Carolyn Rogers. The BOC released a report showing that Canada is being plagued by relatively low productivity, and Rogers sounded the alarm: "I'm saying that it's an emergency - it's time to break the glass."4 She said that businesses urgently need to boost investment to increase productivity and that an added benefit to higher productivity is that it would help insulate the economy against the threat of inflation. One powerful catalyst for greater investment could be lowering rates. Low productivity is an important consideration that might be overlooked by those who anticipate a more hawkish BOC.

When might the BOC cut rates? The Bank of Canada meets this week, so we could get more color on this, but at this time I would anticipate a first rate cut on June 5, which would be the next meeting after the April meeting.

United States: Markets grapple with mixed messaging from the Federal Reserve

Labour market: It’s a different story south of the Canadian border. The March US jobs report5 showed 303,000 jobs created, far more than expected, with February non-farm payrolls revised down just 5,000 to 270,000. In addition, the unemployment rate moved down slightly to 3.8%. The good news is that average hourly earnings were as expected: up 0.3% month-over-month and 4.1% year-over-year, which is down from 4.3% year-over-year in February. This was something of an ideal report; strong job growth and easing (albeit still-high) wage pressures.

Inflation: For March, core Personal Consumption Expenditures, the Federal Reserve’s (Fed) preferred measure of inflation, was 2.8% year-over-year, down slightly from 2.9% in February.6

Inflation expectations: The final University of Michigan Survey of Consumers for March showed five-year-ahead inflation expectations down to 2.8% and one-year-ahead inflation expectations down to 2.9%. As I have said before, inflation expectations appear well anchored.

Fedspeak: We got mixed messaging from Fed officials last week. Fed Chair Jay Powell explained, “The recent data do not...materially change the overall picture which continues to be one of solid growth, a strong but rebalancing labour market, and inflation moving down toward 2% on a sometimes bumpy path.”7 We got similar messaging from Cleveland Fed President Loretta Mester in terms of recognizing that the disinflationary process can be very imperfect: “…the disinflation process won’t be a smooth path back to 2%.”8

However, we got more hawkish Fedspeak from other members of the Federal Open Market Committee (FOMC). Richmond Fed President Thomas Barkin and Atlanta Fed President Raphael Bostic urged caution, suggesting the Fed should maintain rates at current levels until they are very satisfied inflation has been vanquished. Similarly, Dallas Fed President Lorie Logan said it’s much too soon to be thinking about cutting rates. And Minneapolis Fed President Neel Kashkari suggested there might be no rate cuts this year. These comments were certainly not happily received by markets. However, I continue to dismiss this as “tough talk” intended to keep a lid on easing financial conditions.

When might the Fed cut rates? I still believe we will see the first US rate cut in June.

UK: Disinflationary progress has been significant

Labour market: The labour market is clearly weakening in the UK. The UK unemployment rate for is 3.9%, up from 3.8% the previous month.9 This lackluster jobs market was largely confirmed by the Recruitment and Employment Confederation trade body, and the accounting firm KPMG said their monthly index of demand for staff fell to 46.9 in February from January's 49.4, the lowest reading since January 2021.10

Inflation: Disinflationary progress has been significant. UK Consumer Price Index (CPI) inflation fell from 4% in January to 3.4% in February, and core CPI inflation (excluding energy, food, alcohol and tobacco) fell to 4.5% in February from 5.1% in January.11

Inflation expectations: A recent Bank of England (BOE) survey12 showed median inflation expectations for the year ahead at 3%, down from 3.3% in the previous survey. Longer-term consumer inflation expectations fell to 3.1%, getting closer to the BOE’s target. This was supported by the Citi/YouGov survey, which also showed a drop in consumer inflation expectations for both the short and longer terms.13

Bank of England speak: In recent weeks, BOE Governor Andrew Bailey has gotten more dovish.14 In late February, he said he was “comfortable” that markets are anticipating rate cuts this year. And at the last Bank of England meeting, two Monetary Policy Committee (MPC) members changed their position on wanting a rate hike.

When might the BOE cut rates? Now Composite PMI has improved after spinning its wheels in March but I believe the combination of a tepid economy and significant disinflationary progress means rate cuts can begin very soon. It seems markets are anticipating a cut in June, but I think we could see Bank Rate cut as early as the May MPC meeting.

Eurozone: The European Central Bank has sounded more dovish

Labour market: Euro area unemployment is rather stable at 6.5 % for February.15 However, the European Central Bank has characterized the overall economy as remaining “weak” with consumers reluctant to spend, investment moderating and a decline in companies’ exports.

Inflation: We got a flash estimate of euro area inflation last week. It is expected to be 2.4% for March, down from 2.6% in February.16 In my view, more important is the progress we are seeing on core inflation, which has fallen for an 8th consecutive month to 2.9% in March 2024.16

Inflation expectations: Progress has been made on short-term consumer inflation expectations. Median consumer expectations for euro area inflation for the next 12 months fell from 3.3% in January to 3.1% in February – which is the lowest level we have seen since the Ukraine war started.17 Longer-term inflation expectations remain stable at 2.5% for three years ahead. Even more progress has been made recently in terms of companies’ inflation expectations. Firms expect their selling prices to increase by an average 3.3% in the coming year, down from 4.5% in the previous survey. We also saw expectations for average wage growth in the coming year drop to 3.8% from 4.5%.18

European Central Bank (ECB) speak: In a speech in late March, ECB President Christine Lagarde gave the familiar central banker refrain that she needs to see more progress. She did provide specifics – that she is focused on progress in wage growth, continued lack of pricing power for firms and productivity growth. She said that, in terms of wage growth, it is showing signs of moderating (and we saw firms’ expectations of wage growth for the coming year fall significantly – mentioned above). She shared that by June, the ECB will have a new set of projections that will confirm whether the central bank’s forecasts for inflation remain valid.

When might the ECB cut rates? Conventional wisdom suggests a June rate cut, and I would expect a rate cut in June at the earliest, given Lagarde’s desire to see the new set of projections.

Even the strongest economy may experience rate cuts in the near term

So there you have it. My assessment on the state of these major economies and when we are likely to see the first rate cut from each. I believe even the strongest economy is likely to experience rate cuts in the near term — while the US economy continues to positively surprise (the economic equivalent of sinking a 35-foot three pointer), I’d say monetary policy is still in restrictive territory and needs to be cut. While we may see a flurry of central bank cuts in a short period of time, I must stress it’s not because these central bankers are lemmings. They are just responding to the conditions in their respective economies, which I think will all point in the direction of rate cuts starting in coming months (although some, like the Bank of England, are likely to cut more than others).

What else are central banks doing?

Well, some central banks seem to be busy buying gold – a number of them have been increasing their gold reserves in recent months.

The rationale seems to be multi-fold.

Some nations have eschewed the use of dollars because they believe them to have been “weaponized” by the US in response to the Russia-Ukraine war. This has created a desire to own gold rather than the US dollar on the part of some central banks.

Then there is the concern about US debt and the long-term unsustainability of the US’ fiscal situation. That seems to have caused some central banks to increase holdings in gold at the expense of US Treasuries.

Then there are additional factors driving other investors to gold such as a heightening of tensions in the Middle East, since gold has historically been utilized as a hedge against geopolitical risk.

Then there are expectations of rate cuts. Recall that, as a non-yielding asset class, the opportunity cost of owning gold is higher when rates are higher. So expectations of impending rate cuts could be another driver of increased interest in gold by investors.

Dates to watch

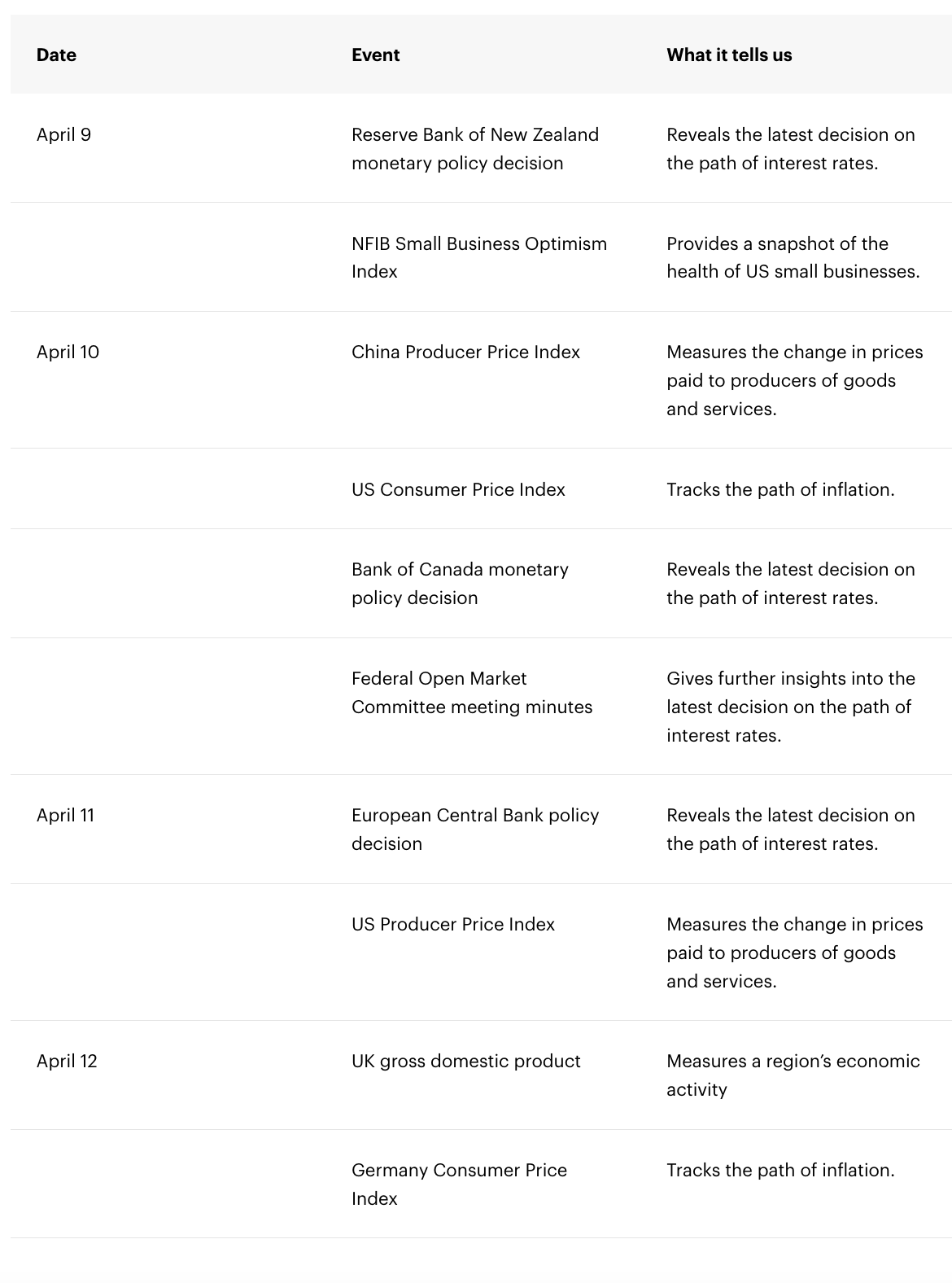

We will be eagerly awaiting the next US CPI print on Wednesday as well as decisions from the Reserve Bank of New Zealand, the Bank of Canada, and the ECB. The more we can understand current central bank thinking, the better we can be at guessing about their policy decisions. The release of the FOMC minutes should also be helpful in that regard.

Footnotes

1 Source: Statistics Canada, April 5, 2024

2 Source: statistics Canada, March 19, 2024

3 Source: Canadian Survey of Consumer Expectations – First Quarter of 2024, April 1, 2024

4 Source: Reuters, “Bank of Canada sounds alarm on low productivity, cites inflation risks,” March 26, 2024

5 Source: US Employment Situation Report, April 5, 2024

6 Source: US Bureau of Economic Analysis, March 29, 2024

7 Source: Federal Reserve, speech transcript, April 3, 2023

8 Source: Barron’s, “Fed Officials Are Walking a Tight Line on Rate-Cut Timing,” April 4, 2024

9 Source: UK Office for National Statistics, “Employment in the UK: March 2024”

10 Reuters, “UK labour market loses more momentum in February, REC survey shows,” March 10, 2024

11 Source: UK Office for National Statistics, March 20, 2024

12 Source: Bank of England/Ipsos Attitudes Survey, March 15, 2024

13 Source: Citi/YouGov Survey, March 28, 2024

14 Source: Reuters, “BoE's Bailey says rate cuts in play, FT reports,” March 22, 2024

15 Source: Eurostat, April 3, 2024

16 Source: Eurostat, April 3, 2024

17 Source: ECB Consumer Expectations Survey, April 2, 2024

18 Source: European Central Bank

Copyright © Invescoin