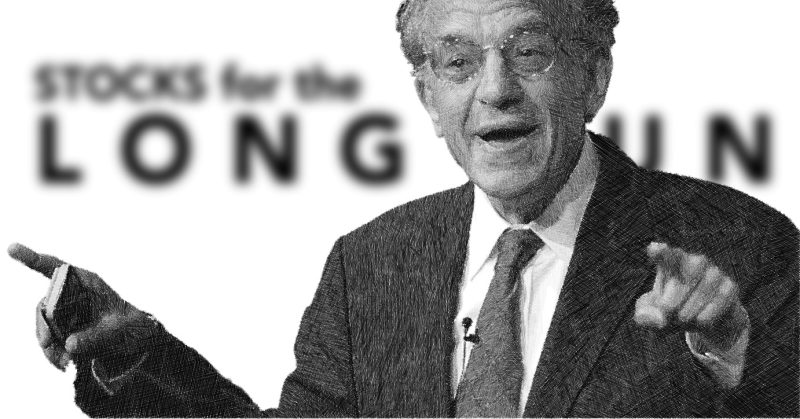

by Professor Jeremy J. Siegel, Senior Economist to WisdomTree and Emeritus Professor of Finance at The Wharton School of the University of Pennsylvania

This week I am vacationing with my family in Mexico, but delayed my departure to Thursday so I could evaluate the latest Fed meeting and it did not disappoint.

Jerome Powell was definitely on the dovish side and the market liked what it heard for both the interest rate outlook and the go-slow approach to quantitative tightening to ensure banks have adequate reserves as it continues its balance sheet run off.

Last week I commented that there was reasonable likelihood that the Dot Plot read out would suggest two rate cuts this year instead of the three previously shown. The press and commentators focused on the three cuts still penciled in whereas it would have taken only one Federal Open Market Committee (FOMC) member to forecast one rate cut less to change the median headline.

But I take comfort that the Fed will not overreact to the recent quirky and hotter inflation prints and Powell indicated that the Fed still thinks the bigger trend is cooling inflation. A significant statement from Powell was that if we see the employment situation deteriorating, the Fed will lower rates. The market jumped on those words, and the tone and message were consistent throughout the press conference.

The Dot Plot indicated a slightly higher long-term outlook for the neutral rate—as FOMC members moved up the median long-run Dot from 2.5% to 2.6%. In the early 2000s, the Fed moved this neutral rate down very slowly when they began thinking ‘lower for longer’ and likely will move it up to a ‘higher for longer’ rate slowly as well. I see this new neutral rate settling at 3.5% due to higher trend productivity growth and the 2% inflation targets—but it will take time for the Fed to get this.

The economy is still chugging along, and the Fed also raised its estimate of gross domestic product (GDP) for this year to 2.1% from 1.4%, which I believe is much more realistic. Deflationary forces are easing, and conditions are definitely easier on all fronts—including the weekly bank deposits which look to be increasing again. We’ll confirm this with the M2 money supply later this month. The upward momentum for the market should continue—even if you think the market is over-valued, it is hard to fight this powerful trend over the short run and even medium term.

At the introduction of last week’s Behind the Markets podcast, Jeremy Schwartz and I spoke to Dave Rosenberg, former Merrill Lynch Chief Economist. Rosenberg is not rosy with his outlook for the U.S. economy, and we had an interesting exchange on the divergences between gross national income (GNI) and GDP (the latter recently reported much higher). Rosenberg expects downward revisions to GDP, but I couldn’t pin him down to how much lower he expects GDP to be revised nor which component is overstated. I am less worried on the calculation differences, but we shall see where this settles soon. Jeremy’s conversation with Dave pivoted from Dave’s less optimistic outlook for the U.S. but I share his enthusiasm over the top ten reasons to be more optimistic on Japan’s markets.

Copyright © WisdomTree