by Scott DiMaggio, CFA Head—Fixed Income

Michael Rosborough, Portfolio Manager—Global Multi-Sector

Fahd Malik, Portfolio Manager—Income Strategies, AllianceBernstein

What does an era of higher equilibrium inflation mean for yields, volatility and active bond investing?

For the past 40 years, global deflationary forces have prevailed, facilitating a regime of low equilibrium inflation. But change is afoot. Mounting pressures from macro megaforces point toward higher structural inflation and lower real GDP growth in the years ahead. We think higher inflation and slower economic growth will reverberate across the global fixed-income markets, shaping how investors allocate capital over the long run.

In our view, this new regime will make itself known through a slow reveal rather than a seismic shift. Indeed, it’s likely already arrived. Here’s what we expect could unfold over the next decade.

Higher—and Spikier—Inflation

We believe we’ve entered a regime of not only higher structural inflation but also greater vulnerability to inflation shocks. At the core of our expectations for higher equilibrium inflation are three powerful forces: deglobalization, demographics and climate change.

- Deglobalization leads to higher inflation by constraining the global pool of labor and increasing labor’s bargaining power, among other factors. Deglobalization also puts downward pressure on GDP growth.

- Meanwhile, the global labor pool is shrinking, thanks to aging demographics. Without a sustained increase in productivity to offset it, a shrinking workforce not only impedes economic growth but also gives labor more bargaining power—yet another inflationary factor.

- The inflationary effects of deglobalization and demographics could be compounded by climate change. For instance, the energy transition—while probably deflationary in the long term—could drive costs higher in the next decade.

Of course, there also continue to be deflationary forces at work. Technology, for example, has been deflationary for years and will likely remain so, and we could see increased productivity from generative artificial intelligence, though evidence for this has yet to appear in aggregate statistics.

Together, combined inflationary and deflationary forces imply a shift in the balance of power between capital and labor, leading to a higher equilibrium inflation level where 2% becomes a lower bound, rather than a target. Indeed, it’s highly likely we’ve already entered this new regime, though evidence of it has been obscured by the recent cyclical highs in inflation.

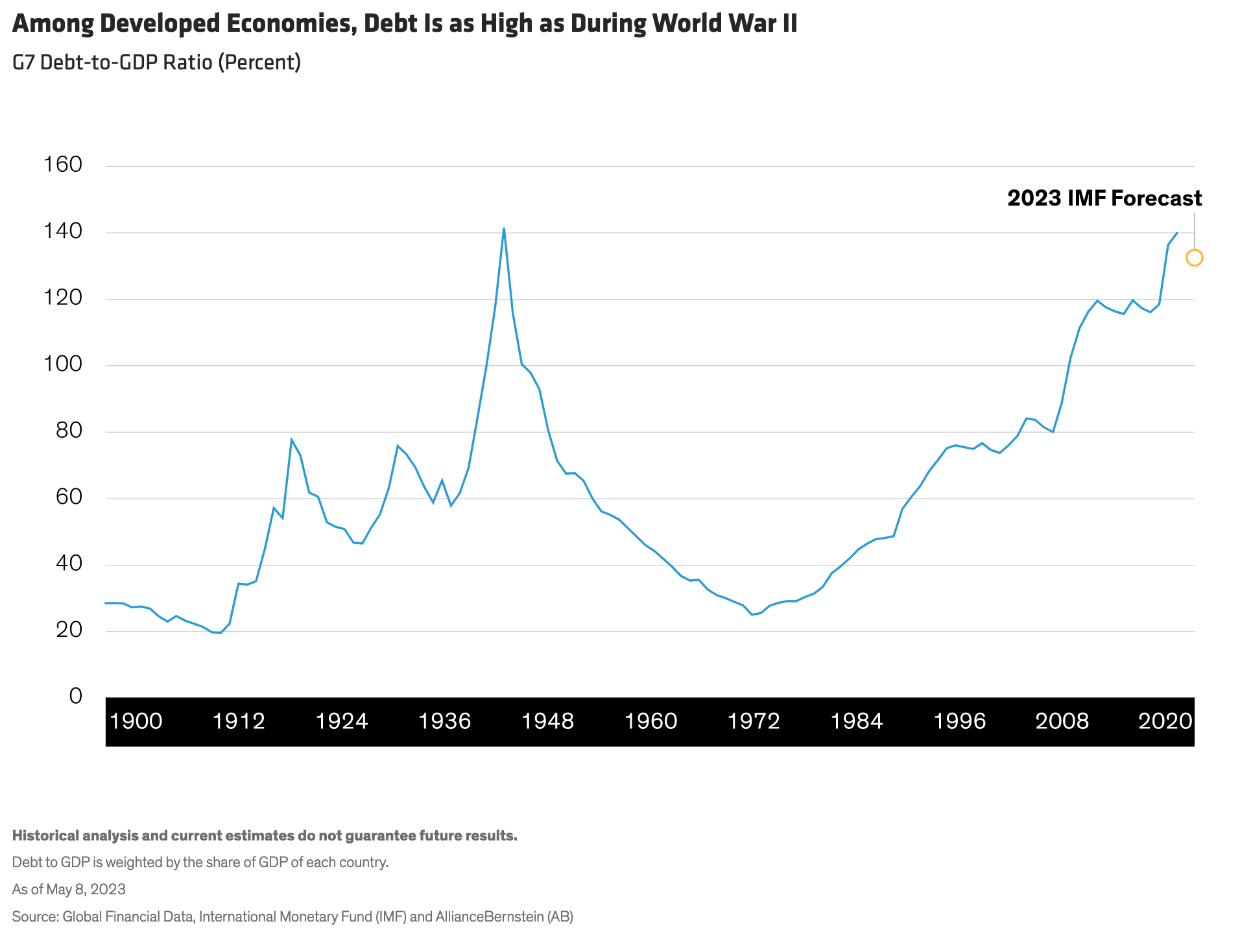

That said, more frequent spikes in inflation may be characteristic of the new regime. That’s because today’s massive government debt levels incentivize policymakers to inflate away liabilities. The debt-to-GDP ratio for developed economies is as high today as during World War II, when it hit its previous record (Display). So far, this huge buildup of public debt hasn’t much mattered, because the cost of debt has been so low.

Among Developed Economies, Debt Is as High as During World War IIG7 Debt-to-GDP Ratio (Percent)

It’s a different story now that the cost of debt has risen. Managing the debt is likely to involve running nominal GDP (real GDP plus inflation) higher than the cost of the debt. And if real GDP is expected to slow—and we think it will—then inflation becomes not only acceptable but critical in reducing overall debt burdens.

At the same time, policymakers have revealed a strong preference for avoiding deflation, as we saw coming out of the global financial crisis and the COVID-19 pandemic. As Japan can attest, deflation can be incredibly difficult to overcome. To ensure against it, policymakers tend to aggressively deploy fiscal expansion and rate cuts, leading to overcorrection in the form of higher inflation.

In our view, the result will likely be a higher tolerance for episodic surges in inflation above already higher equilibrium levels.

Higher Nominal Rates and a Steeper Yield Curve

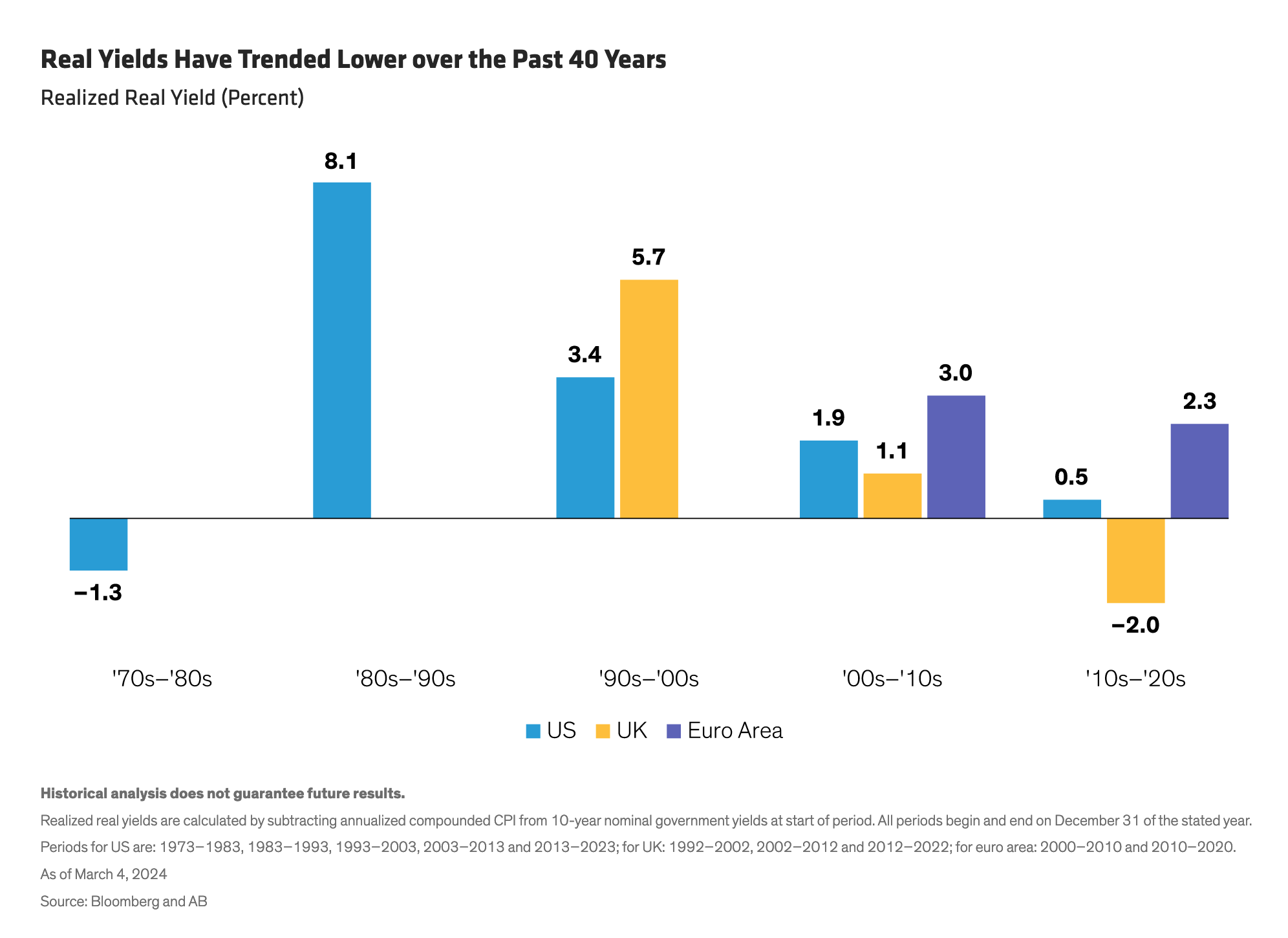

If long-run inflation is higher, then nominal interest rates will likely be higher over the next decade, too. Since nominal yields comprise inflation plus real yield, this begs the question of whether real yields will remain as low as they’ve been over the past 20 years (Display).

Real Yields Have Trended Lower over the Past 40 YearsRealized Real Yield (Percent)

We think they could.

On the one hand, now that quantitative easing is behind us, it’s unlikely that real yields will turn negative again; real yields were so low on average over the past 10 years that they failed to keep up with the rate of GDP growth. On the other hand, real yields should be capped over the long term by (more modest) real economic growth. Thus, in our analysis, real yields could trend in line with realized real yields of the previous decade, prior to the global financial crisis.

While higher inflation implies higher nominal yields, higher inflation volatility implies steeper yield curves. Over the past decade, term premiums have mostly evaporated. In the next decade, we think term premiums will increase to compensate investors for the risk of holding longer-maturity bonds in an environment of less-certain inflation expectations. Supply constraints also may keep the long end of the yield curve more elevated than in the recent past.

Active Management May See a Resurgence

Higher rates are typically associated with higher rate volatility. In turn, higher volatility equates to greater dispersion and disruption—more variation in return patterns among regions, sectors and industries, as well as bigger challenges and more idiosyncratic opportunities.

While both active and passive strategies play a role in investors’ portfolios, a more volatile landscape works in favor of active managers, who can take advantage of new avenues for diversification, increased opportunities to add alpha, and the ability to maneuver to avoid trouble spots.

As a result, we expect to see a resurgence of active strategies over the coming decade.

Explicit Inflation Protection Needed

In the face of both higher inflation and more frequent inflation spikes, we anticipate that investors will also make bigger allocations to inflation strategies. This includes explicit inflation protection in the form of inflation-linked securities, known as “linkers” outside the United States and as Treasury Inflation-Protected Securities (TIPS) in the US.

This may be an especially opportune time to buy TIPS. TIPS, like other Treasuries, are backed by the full faith and credit of the US government. They are designed to fully compensate the investor for inflation and, if newly issued, also provide protection against deflation—that is, inflation compensation will not be negative.

And today, investors can buy TIPS whose annual return may approximate the growth of the US economy over the next decade. In the 27 years since TIPS first came to market, TIPS yielded an average 90 basis points below GDP growth.

That’s not the only measure by which TIPS look attractively priced. The current 10-year breakeven rate—the yield difference between 10-year nominal Treasuries and 10-year TIPS, and thus the implied market forecast for CPI over the next 10 years—is 2.30%. Our analysis of historical inflation measures since TIPS first came to market 27 years ago suggests a fair breakeven should be 2.51%.

In other words, TIPS are abnormally cheap by multiple measures, and investors should consider increasing their allocations now.

Investors May Return to Their Natural Habitats

After more than two decades of exceptionally low rates and under-allocations to fixed income, a new regime of higher equilibrium inflation, higher nominal yields and higher volatility could reshape how investors allocate capital over the long run.

Institutional investors will want to rethink the long-term assumptions they’re using for asset allocation. Even the mindset around risk will likely change; many investors have devoted mindshare to hedging against 2008-style credit distress, but inflation is likely to be the biggest risk to guard against in the years ahead—just as it’s been in the past.

In our view, that’s no reason to shun fixed income. If anything, with allocations to active fixed income and explicit inflation strategies playing a bigger role than in recent years, many investors may find themselves back in familiar territory when it comes to allocating to bonds.

Copyright © AllianceBernstein