by Denise Chisholm, Director of Quantitative Market Strategy, Fidelity Investments

Fidelity strategist Denise Chisholm sees a few reasons for bullishness.

Key takeaways

- After 2 years defined largely by rising interest rates and falling earnings, I believe we’re now shifting to an environment of falling rates and accelerating earnings.

- Both of these trends have historically corresponded with rising stock prices, which leads me to believe broad-based stock gains could continue from here.

- Cyclical sectors in general, and financial stocks in particular, could be poised to outperform in this environment.

US stocks have rallied over the past few months, as inflation has continued to cool, economic growth has beaten expectations, and the Federal Reserve has signaled that rate cuts may be on the table later in 2024.

My research focuses on analyzing market history to uncover patterns and probabilities that can help inform the current outlook. Recently, my research has suggested that broad-based stock gains could continue, fueled by a changing interest-rate environment and accelerating earnings growth. My research has also turned up bullish signals in cyclical sectors, with one sector, financials, particularly well-positioned for potential outperformance.

Here’s more on 3 key bullish themes I’ve been seeing.

1. Accelerating profit growth could fuel further stock gains

While the overall US economy stayed resilient during 2023, corporate earnings were actually a weak spot. Between 2021 and mid-2023, earnings growth at US companies fell about as far as it usually does in major recessions.

But earnings growth turned positive again late last year, and my analysis suggests it could accelerate in 2024. One reason: Inflation has cooled even more for producers (in terms of the cost of their inputs) than it has for consumers (in terms of what they pay at the store). When inflation falls faster for producers than for consumers, companies’ pricing power grows. Historically, that has been good for corporate profit margins, meaning the profits companies earn on each dollar of sales. According to my research, when consumer inflation has historically exceeded producer inflation by amounts comparable to the last 12 months, corporate profit margins increased by 2.2 percentage points over the following 12 months, on average, since 1962.1

Read the full report

Get Fidelity’s complete Q1 2024 Investment Research Update, from the desk of Denise Chisholm, director of quantitative market strategy. Download the full report (PDF)

Another reason I think earnings growth could accelerate is a decline in unit labor costs—the amount companies pay workers to produce one unit of output. A surge in productivity last year caused growth in unit labor costs to slow markedly. In the past, corporate profit margins improved by 6 percentage points in the 12 months after similar declines in unit labor costs, on average.

Together, these trends could set the stage for an earnings recovery this year. Stock analysts also expect strong earnings: Their consensus forecast calls for companies in the S&P 500® to grow earnings by about 12% in 2024.

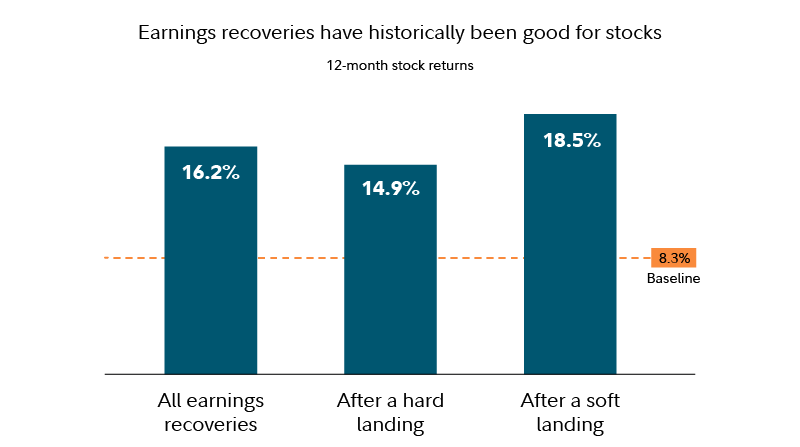

Historically, earnings recoveries have been good news for stock prices. In the past, when earnings growth turned from negative to positive, the stock market gained an average of 16.2% over the following 12 months.

Past performance is no guarantee of future results. Stock returns during 12-month periods with earnings recoveries versus baseline. Data analyzed quarterly since January 1950. Analysis based on the S&P 500. Hard landing refers to a cyclical economic slowdown associated with a recession. Recessions determined by the National Bureau of Economic Research (NBER) Business Cycle Dating Committee. Soft landing refers to a cyclical economic slowdown that avoids a recession. Sources: Haver Analytics, FactSet, Fidelity Investments, as of 9/30/2023.

2. Any cut in rates could further help stock prices

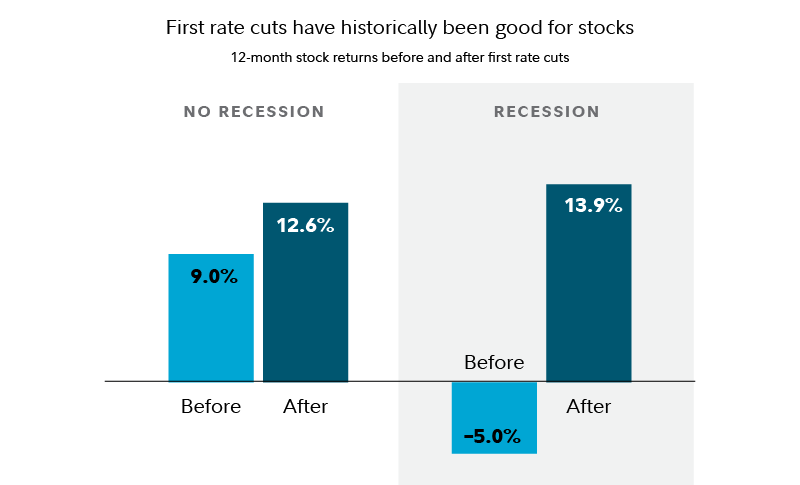

After raising interest rates by 5 percentage points between March 2022 and July 2023, the Fed has signaled it’s open to reversing course and beginning rate cuts later this year. I reviewed the historical record to see how stocks fared before and after the first rate cut of previous cycles.

The results depended in part on how the economy performed around the time of the first rate cut. When the first cut corresponded with a recession, stocks dipped 5% over the 12 months before the Fed lowered rates—but then they gained an average of 14% over the following 12 months. When there wasn’t a recession, stocks gained an average of 9% in the 12 months before the rate cut, then gained an average of 12% more over the next 12 months.

Past performance is no guarantee of future results. 12-month stock returns before and after first rate cuts, with or without recessions. Data analyzed monthly since July 1954. Analysis based on the S&P 500. Recessions determined by the NBER Business Cycle Dating Committee. Sources: Haver Analytics, FactSet, Fidelity Investments, as of 10/31/2023.

While economic forecasting is always fraught with uncertainty, personally I believe it is more likely than not that we will avoid recession this time around. My opinion is based on the economy’s solid economic growth, the strong employment picture, a healthy outlook for corporate earnings, and other factors. That said, the closer we get to the Fed’s first rate cut, the better the outlook for stocks, whether or not we get a recession, based on history.

3. Cyclical sectors—particularly financials—look attractively positioned

Since early 2022, we have generally been in an environment of rising interest rates and falling earnings. I believe the economy is now pivoting to an environment of falling interest rates and rising earnings, which historically has particularly benefited cyclical sectors. The consumer discretionary, technology, real estate, and financials sectors have historically been especially likely to outperform the market when rates fall and earnings rise.

Outlook for sectors

Get our sector portfolio managers’ top ideas: 2024 US sector outlook

Financial stocks look particularly appealing, due to how inexpensive they’ve recently been. The median forward price-to-earnings ratio (P/E) among financial stocks was recently in the bottom 25% of its historical range going back to 1977. When this metric hit similar levels in the past, financials outperformed the market more than two-thirds of the time over the following 12 months.

Falling interest rates might increase those odds of outperformance. Historically, when financials’ P/E was in the bottom 25% of its range and interest rates fell, the sector outperformed over the next 12 months more than three-quarters of the time.

In conclusion

Past performance is never a guarantee of future results. But many of the winds of economic change that we’ve been seeing in early 2024 have historically led to positive results for stocks.

Earnings recoveries have been a tailwind in the past, as has the first rate cut in a cycle. And cyclicals, particularly financials, could be primed to outperform in an environment of falling rates and rising earnings.