by Russ Koesterich, CFA, JD, Portfolio Manager, BlackRock

In this article, Russ Koesterich discusses the reason behind the recent resiliency of stocks, despite rising rates.

Key takeaways

- Typically, a back-up in rates has led to a sell-off in stocks. We believe the current environment is different for three reasons: the degree of the move in rates, current economic cycle, and strength of mega-cap technology.

- In this environment, we would advocate for maintaining an overweight to equities, with a barbell structure for sector exposure.

- Within fixed income, we suggest a modest underweight to duration notably via long-term bonds with exposure focused on spread-related products as a complement to risk assets.

So far in 2024, stocks have continued to build on 2023’s gains but bonds are having a tougher start to the year. Stronger than expected economic data coupled with a steady stream of supply have pushed yields higher. Year-to-date, broad bond indices such as the Bloomberg US Aggregate Index is down around 1%, while long dated U.S. Treasuries are under more pressure, lower by roughly 4.5%.

Two years-ago an historic rout in bonds led to a sell-off in stocks, particularly growth names. Why have stocks proved more resilient in 2024? I would highlight three reasons: the modesty of the rate backup, the current economic cycle, and the earnings power of mega-cap tech. All of which suggest stocks can withstand the occasional sell-off in bonds.

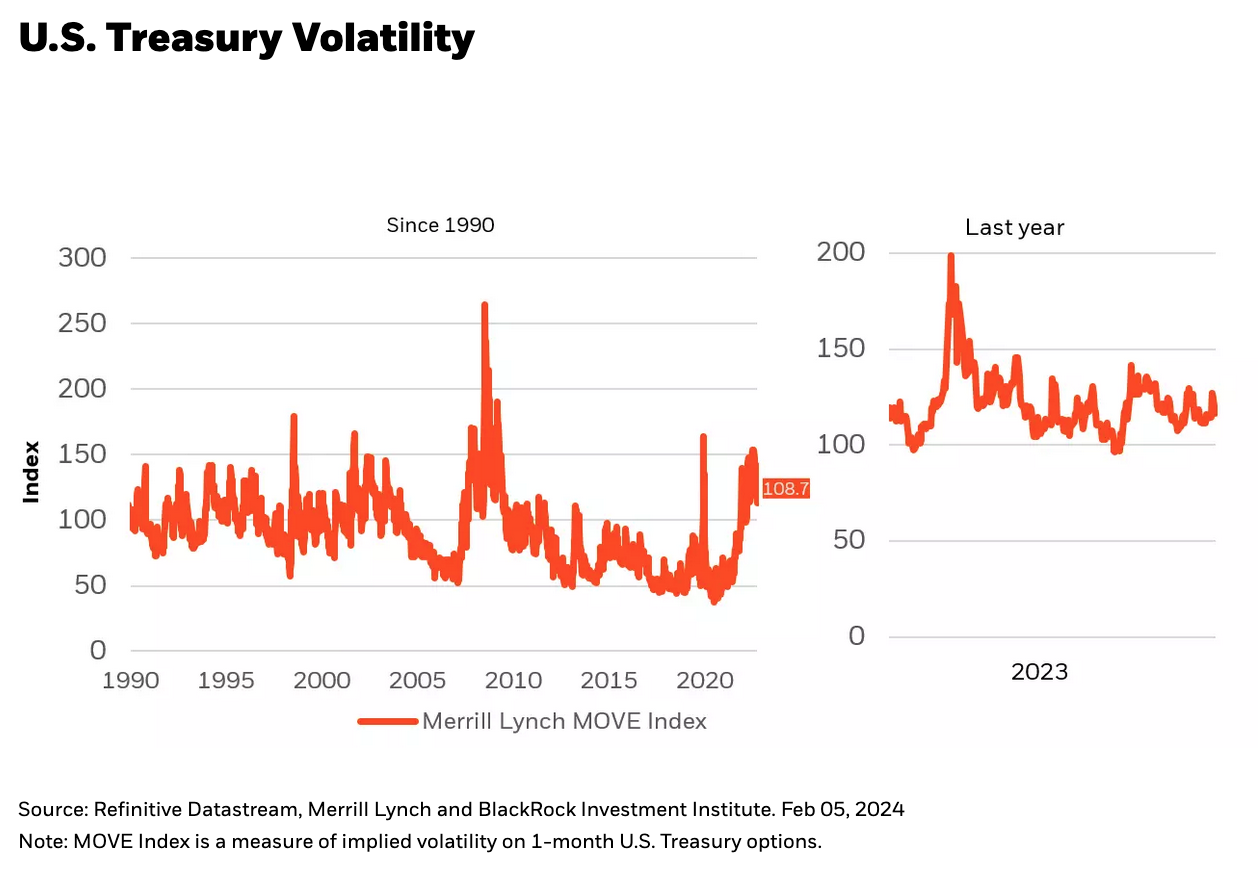

Starting with the size of the interest rate move. While 10-year yields have bounced approximately 0.30% from the recent lows, the backup still has rates below the January high and well below the October peak of 5%. It is true that bond investors have had to reconsider some of last fall’s more aggressive assumptions surrounding Fed cuts. That said, the central bank is still likely to begin easing monetary policy later this year. The end of the Fed tightening cycle and lower and more stable inflation are reflected in the decline in bond volatility (see Chart 1), which has in turn supported a stable environment for stocks.

Beyond the gyrations of the bond market, stocks are benefiting from a rethink on the broader economic outlook. Unlike in 2022, when investors assumed an aggressive tightening cycle would end in recession, today investors are more sanguine. Recession fears are fading and estimates for growth rising. According to Bloomberg, on average economists expect 2024 real growth of 1.50%, double last summer’s estimate. Recent data has further supported the positive outlook, with both employment reports and manufacturing releases surprising to the upside.

Finally, it is worth highlighting that while the broader stock market is resilient, the more rate sensitive parts of markets are hurting. Small cap stocks, many of which require constant refinancing to support loss making businesses, are down roughly 4%. And while mega-cap growth names continue to march higher, early growth companies are down approximately 10%. As with small caps, early growth companies have come under pressure as they are more dependent on refinancing and are vulnerable to changes in the discount rate. In other words, the resilience of the stock market has, once again, been a function of a limited number of high-quality companies, many of which benefit from long-term trends, such as artificial intelligence (AI).

What does this mean in practice? Continue to emphasize names and themes exposed to secular trends tied to artificial intelligence, semiconductors, healthcare services and internet commerce. At the same time, consider adding to names in segments of the market that were left behind in last year’s rally, and as a result are trading at a substantial discount. Examples of the latter include energy, autos, airlines, and aerospace and defense. To be clear, this does not suggest abandoning stocks geared to winning secular themes, but perhaps owning a bit less to take advantage of a number of names and sectors that are surprisingly cheap.

Implications for 2024

Going forward, I continue to believe stocks can move higher. While bond yields are unlikely to plunge, I would expect 10-year yields to trade in a range, probably between 3.75% and 4.25% this year. A range-bound bond market coupled with solid economic growth could allow stocks to rise another 4-8% before year’s end.

In terms of portfolio construction, I would advocate for maintaining an overweight to equities, with a barbell structure for sector exposure via an allocation to stable growth companies aligned with long-term structural trends as well as high quality cyclicals that can withstand a cooling economy. Within fixed income, a modest underweight to duration notably via long-term bonds with exposure focused on spread-related products as a complement to risk assets.