by Gabriel Sauma, Russell Investments

Executive summary:

- Investors experienced a shift in global risk sentiment during Q4, marked by lower inflation and the anticipation of an end to the rate hiking cycle.

- The prospect of lower interest rates and improved business sentiment has ignited expectations of expanding investment opportunities beyond the dominant Tech sector which drove much of the returns in 2023.

- A divergence among investors persists, with some foreseeing a looming recession yet to fully impact the economy, thereby continuing to tilt their portfolios towards defensive companies, emphasizing resilient growth and strong financial positions capable of withstanding tougher trading conditions.

Broad global trends

Expectation of soft landing drives renewed risk appetite, but investors remain divided

- On the back of lower inflation and an anticipated end to the rate hiking cycle, investors switched to risk-on mode, driving a re-rating across markets in Q4. Expectations of lower interest rates alongside improved business sentiment could trigger a new capex cycle. This would broaden the current opportunity set beyond the Tech sector (which drove the majority of the returns in 2023).

- Nonetheless, some investors still believe that a recession remains on the cards, with high rates yet to be fully felt across the economy. Lower rates will also likely lead to further USD weakness and a push up real asset pricing.

- These investors continue to tilt portfolios towards defensive companies with resilient growth and strong book balances that can endure tougher trading environments.

Where next for the Magnificent 7, or is it now 6?

- Growth managers believe that the big tech firms will continue to outstrip competitors through economies of scale. However, some are beginning to rotate to the next wave of beneficiaries, i.e. tech consultants, as well as companies seen as the "picks and shovel" in the industry. Hyperscale companies, like Microsoft, are expected to continue to benefit in building/deploying AI related solutions.

- Valuations continue to keep value managers at bay, while hedge funds have also been profit-taking from this space.

- Cracks are appearing in Tesla's outlook, guiding lower valuations on the back of increased competition from China, and tighter consumer budgets.

Excitement for European stocks

- Attractive valuations, improving economic backdrop and high consumer confidence are driving ongoing interest for investment in the region. Cyclicals and domestically orientated business are expected to perform strongly in this environment.

EM expected to benefit from increasing growth differential relative to DM.

- Concerns around China growth mask positive strides by other emerging markets (EM) countries that either deliver growth or are on the path to improvement via accommodative policies, i.e. rate cuts.

- Despite weak sentiment towards the asset class - largely driven by China - many EM countries delivered stronger returns in 2023 than developed markets; Taiwan (+30%), S Korea (+23%) Brazil (+32%), Mexico (+40%), Greece (+49%) .

Approaching the dragon

- Investors remain divided on China, which continues to contend with a weak economic environment, negative consumer sentiment and general concerns on government policies.

- Value managers in particular have continued to cautiously add to positions trading at attractive valuations where long-term earnings outlook remains positive, i.e. EV, Ecommerce, industrials, with a preference for market leaders.

Global equities

A soft landing benefits secular growth

- While inflation and geopolitical risks drive concern around a global recovery, the indication that these factors have peaked has renewed the risk appetite of investors.

- It is expected that lower rates and consumer resilience will improve corporate sentiment to regrow CapEx and initiate a new business cycle, benefiting manufacturers and tech infrastructure.

Enduring advantage of mature technology firms

- While the valuations for "magnificent 7" stocks are high, growth managers recognize the increasing reliance on Big Tech firms, going overweight or benchmark-neutral on certain names. They see mega cap tech firms outstripping competitors with economic scale and well-funded balance sheets e.g. hyperscale cloud providers.

The unlikely play against inflation risk

- Value managers are unconvinced that inflation will quickly subside since monetary policies will readjust to lower inflation levels that will continue devaluing currencies and positively drive real asset pricing. This is a tailwind for commodities which remains under-owned given topical discussions around climate change and carbon initiatives.

Weathering financial conditions

- Some managers are picking up High Quality European stocks that offer high returns on capital and can comfortably cover potential debt refinance costs. Valuations are seen as meaningfully attractive compared to the U.S. market.

Approaching the Dragon

- Perspectives on China remain mixed. Improving earnings data and attractive valuations are offset by regulatory overhang and geopolitical uncertainty. Value managers are cautiously adding to China given price disconnects, particularly market leaders in E-Commerce, Electric Vehicles (EV), and Health Care that trade below both intrinsic value and relative value to developed stocks.

- Managers are picking up Indian Financials on a positive economic backdrop, growing middle class, and rising financial inclusion.

U.S. equities

Two camps: Soft landing and recession

- Active equity manager economic outlooks broadly belong in two camps, with managers expecting either a benign soft landing or an interest rate-induced recession.

- Within the soft landing camp, growth managers are adding to their holdings in long-duration growth companies, while more value-oriented managers are shifting their portfolios toward more cyclical and highly leveraged companies.

- Managers taking the recessionary view are tilting their portfolios toward more defensive, resilient growth within healthcare and consumer staples, and adding to holdings in rate-sensitive defensive sectors like utilities and real estate.

From AI infrastructure to AI adopters

- AI capital spending beneficiaries like Nvidia (the "picks and shovels" of the AI gold rush) saw significant outperformance in 2023, and managers are beginning to rotate to the next wave.

- Growth managers believe technology consultants like Accenture and hyperscale tech companies like Microsoft will be able to create and deploy AI-driven solutions and stand to benefit next.

- A move of some AI capabilities to devices (in privacy- or latency-driven use cases) would likely bring about a significant replacement cycle, benefiting device manufacturers like Apple.

Reshoring today, overcapacity tomorrow?

- The U.S., EU, China and their allies are seeking to rebuild and strengthen domestic supply chains following the twin shocks of the pandemic and war in Ukraine by increasing internal manufacturing capacity and introducing fail-safe redundancies.

- While likely to make supplies more resilient over time, the overcapacity created by the initiative could see some industries (low-end semis, autos, etc.) in structural surplus, which could prove a headwind for companies operating in those segments.

Emerging markets equities

Views on China remain divided

- A negative macroeconomic environment and geopolitical concerns continue to limit exposure to China, but managers are finding compelling bottom-up ideas with strong expected earnings growth and cheap valuations.

- While outflows have continued in China, managers are looking for signs of bottoming and do not view the country as uninvestable. The Chinese government is increasing its focus on improving sentiment with continued stimulus and rate cuts.

- Other countries such as Japan, Brazil, and India continue to benefit from China outflows.

Short-term risks to India trade

- While managers agree on India's long-term structural growth opportunities, valuations remain high relative to history, which could become a risk if sentiment in China improves.

Inflection point for interest rates impacting opportunity set

- The reduction in inflation globally and USD weakness offers an attractive backdrop for emerging market economies.

- EM countries have been quicker to respond to inflation and are leading the charge in cutting rates, which is expected to be a tailwind for both top-down and bottom-up fundamentals. Brazil is expected to benefit from an improving environment for growth as access to capital improves through lower rates.

- Managers expect more favorable fundamentals to broaden the opportunity set and boost EM economic growth, widening the EM-DM growth spread, which should also translate into increasing interest, particularly given attractive valuations.

Election cycles introducing uncertainty ahead

- Managers don't expect major dislocations from upcoming election cycles, but elections are taking place in countries that make up over half the MSCI EM index, which has introduced caution for managers in making portfolio changes.

Long/short equity

Technology sector dynamics

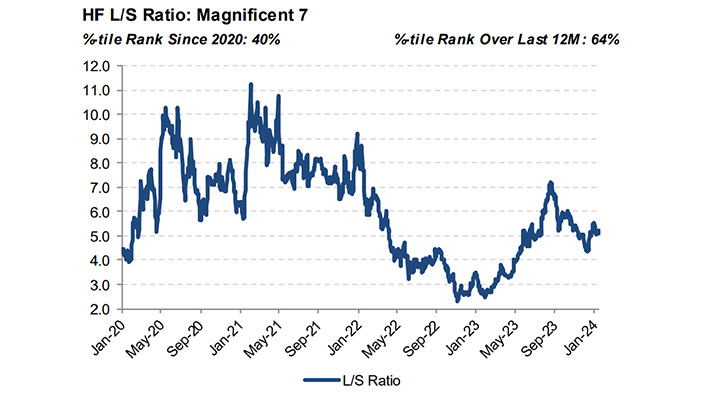

- Hedge Funds significantly lowered net exposure to TMT in Q4, impacting Quality and Size factor exposures.

- Equity long/short net exposure to the "Magnificent-7" made up more than 25% of total net exposure as of late 3Q23.

- However, managers meaningfully reduced long exposure to the space in November.

- As a result, the L/S ratio to the space declined to a 9-month low towards year-end.

Source: Morgan Stanley Prime Brokerage, data as of 1/16/2024.

Small caps set for outperformance in Europe?

- SCs have underperformed large caps by over 20% since January 2022, leading to attractive valuations with a 36% derating of forward P/E ratios*

- Economic growth is expected to accelerate, benefiting more cyclical and domestically-oriented SCs.

- Pick-up in M&A activity traditionally supports outperformance of SCs as acquisition targets

Geopolitical shifts: A new risk paradigm

- According to the Global Fund Manager Survey, geopolitical concerns have overtaken inflation and central bank policies as the top tail risk among fund managers, reflecting a change in focus towards global political dynamics.

Europe and UK equities

UK and Europe: More than just value

- An improving inflation picture, stable or falling interest rates and improving consumer confidence provide a backdrop for investors to take an increased interest in the UK's small and mid-cap segments. These areas, having borne the brunt of the market's disinterest in holding UK exposure, now trade among their lowest relative valuations ever.

- While the continuing cheap valuation of UK listed equities is often the focus, what is sometimes overlooked are the growth opportunities which the UK market can offer to gain exposure to a range of global themes. Outside of the well-known mega caps, the UK is home to a number of high-growth market leaders accessible at an earlier stage of their lifecycle. These firms span areas as diverse as Fintech, IT consultancy and industrial engineering. The stabilizing economic environment may provide the catalyst which stokes investor interest to take advantage of opportunities in these areas once more.

- Similarly, broad European equities continue to trade at a significant discount relative to global peers and history. However, the economic backdrop remains solid, consumer confidence is at a 10 year high. We expect monetary policy to loosen throughout 2024 as core inflation has come down below 3%. Additionally, unlike the US, there is significant room for additional fiscal stimulus in Europe which would provide a tailwind in the years to come.

- The European banks are at an interesting inflection point. They are well capitalized after years of regulatory pressure and are beneficiaries of the higher interest rates, however, the recessionary and NPLs fears have held share prices back. With recession probability declining and interest rate remaining at elevated levels, this could be an interesting entry point.

Japan equities

BoJ's policy change still expected but the timing likely delayed

- Many investors anticipated the Bank of Japan (BoJ) would abandon its negative interest rate policy early this year. However, the expected timeline for this shift is likely to be postponed, partly due to the Ishikawa earthquake on January 1st. While reducing some positions, many investors maintained a positive long-term view on banks, driven by expectations of sustained wage growth.

Mixed view on Yen-US dollar rate

- While some foresee yen appreciation due to a potential narrowing of the Japan-U.S. interest rate differential, others expect the yen to remain weak, attributing it to the BoJ's slower response.

Investors' appetite for semiconductors remains strong

- Due to rising expectations toward cyclical recovery for not only semiconductors but also electrical components, many investors started to invest in laggard stocks in these industries.

New NISA attracting individual investors as expected

- The introduction of the new NISA (Tax-exempt savings account) is leading a large inflow to equity markets. Retail investors appear to be most attracted to large-cap stocks with high dividends.

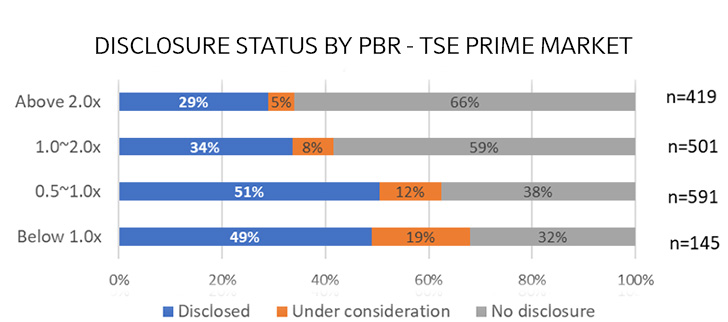

Meaningful impact from TSE's corporate reform initiatives

- 40% of companies listed on the prime market disclosed a capital efficiency improvement plan following the request from the Tokyo Stock Exchange. Low price-to-book companies proactively responded. Many value managers expect the percentage to rise further.

Canadian equities

Interest low in financials

- Despite attractive valuations and the 4Q23 rally in Canadian banking stocks, managers are wary of banks and the financial sector in general.

- The relief rally was driven by expectations for lower interest rates, but the banking industry is likely to be constrained in a slow economic environment, and is more likely to recover when there is better visibility on economic strength driving improved loan growth and capital markets activity.

Opportunities in resources

- Investors are bullish on copper and related companies given the long-term trend of electrification and limited investments in new supply for the last several years. That said, there is also some potential for weakness in the sector if the China economy weakens more than expected. Investors are also seeing opportunity in related "picks & shovels" industrial businesses that sell into the copper producing industry.

- Lumber has an attractive setup for long-term returns, with a housing under-supply driving demand and significant reductions in industry capacity.

- Managers are seeing long-term opportunities in Energy despite a difficult 4Q23. While natural gas prices are more volatile than oil, some managers believe gas will be a stronger commodity over the next decade as its considered critical to the energy transition as it's a relatively clean fossil fuel.

Shopify & the IT sector

- Information Technology was the strongest sector in the S&P TSX Composite, primarily driven by Shopify. Although more managers are interested in Shopify's long-term growth prospects after it divested its distribution business, they continue to view the valuation as excessive.

Australian equities

Potential Energy merger engages active managers

- In December, Woodside and Santos, the two largest Energy companies on the ASX, announced they were in initial merger talks. The potential $A80 billion merger would have an LNG portfolio on the scale of Shell. This scale and potential to attract global capital are the main motivations for the transaction.

- As both companies are in the ASX 20 largest weight companies, the M&A activity will have a material impact to future excess returns for active managers.

- The potential merger is occurring when gas prices are falling, and significant global capacity is coming online in the next few years.

- Both stocks are an overweight by many active managers, particularly value-biased strategies. For now, managers are maintaining their positions and engaging with the companies regarding their views. Some have publicly advocated against the merger, questioning the value of a deal to the shareholders of both companies. It is likely institutional investor support will be required for a successful deal.

- We expect managers to be active in managing their positions around this potential transaction and to continue to engage with the companies.

IRA adding to mining cost pressures

- Managers have noted that subsidies relating to the US Inflation Reduction Act is driving demand for engineering projects, leading to further cost pressures for miners.

- In addition to adding to labor costs, there is an impact on the efficiency and quality of employees for some Australian miners, as experienced professionals are moving to IRA projects in the US.

- Managers continue to prefer mining companies which they believe have strong balance sheets and are long life assets which are low on the cost curve and quality management. The impact of the IRA has the potential to affect the latter.

Copyright © Russell Investments