by Brian Levitt, Global Market Strategist, Invesco

Key takeaways

The "soft landing" tradeOver the intermediate term, I believe falling inflation and moderating but not collapsing growth still favor cyclical equities and riskier credit. |

US election seasonIt’s time for our politicians to scare us into thinking that our investment accounts are in trouble if the other candidate wins. The data says otherwise. |

Shipping disruptionsCould shipping disruptions in the Red Sea lead to the type of inflation we saw in the early 2020s? I say no. |

What now? The markets in January initially seemed as if they were going nowhere (sort of like the NFC East) only to rally to new highs. Perhaps an overbought condition coming out of the fourth quarter had to be worked off. The broad outsized gains across market capitalizations may be behind us for the near term. After all, the market priced in six interest rate cuts by the US Federal Reserve in a mere matter of weeks, and the Fed could very easily underwhelm.4 In addition, US growth has been softening.5 In the near-term (3–6 months) however, we wouldn’t be surprised if higher quality equities return to the fore as the economy moderates and the market potentially recalibrates its expectation for interest rate cuts. Over the intermediate term (6–12 months), I believe falling inflation and moderating but not collapsing growth still favour cyclical equities and riskier credit.

It's that time already?

Election season has started in the US. You know what that means! It’s time for our politicians to scare us into thinking that our investment accounts are in trouble if the other candidate wins.

- In 2020, Donald Trump said that if he lost the presidential election, “Your 401(k) will drop to nothing, the stock market will drop to nothing.”6

- In 2016, Hillary Clinton said, “(Trump) believes he can treat the US economy like one of his casinos and default on our debts…which would cause an economic catastrophe far worse than anything experienced in 2008.”7

The rhetoric can be terrifying. That is, until you look at the data. Here’s a chart showing the 800 days from Trump’s 2016 election victory compared to the 800 days from Biden’s 2020 election victory. Trump is ahead, but the pattern is remarkably similar.8 Numbers can get in the way of campaign tactics.

Despite warnings from their opponents, both Trump and Biden presided over meaningful gains in the stock market

It may be confirmation bias, but…

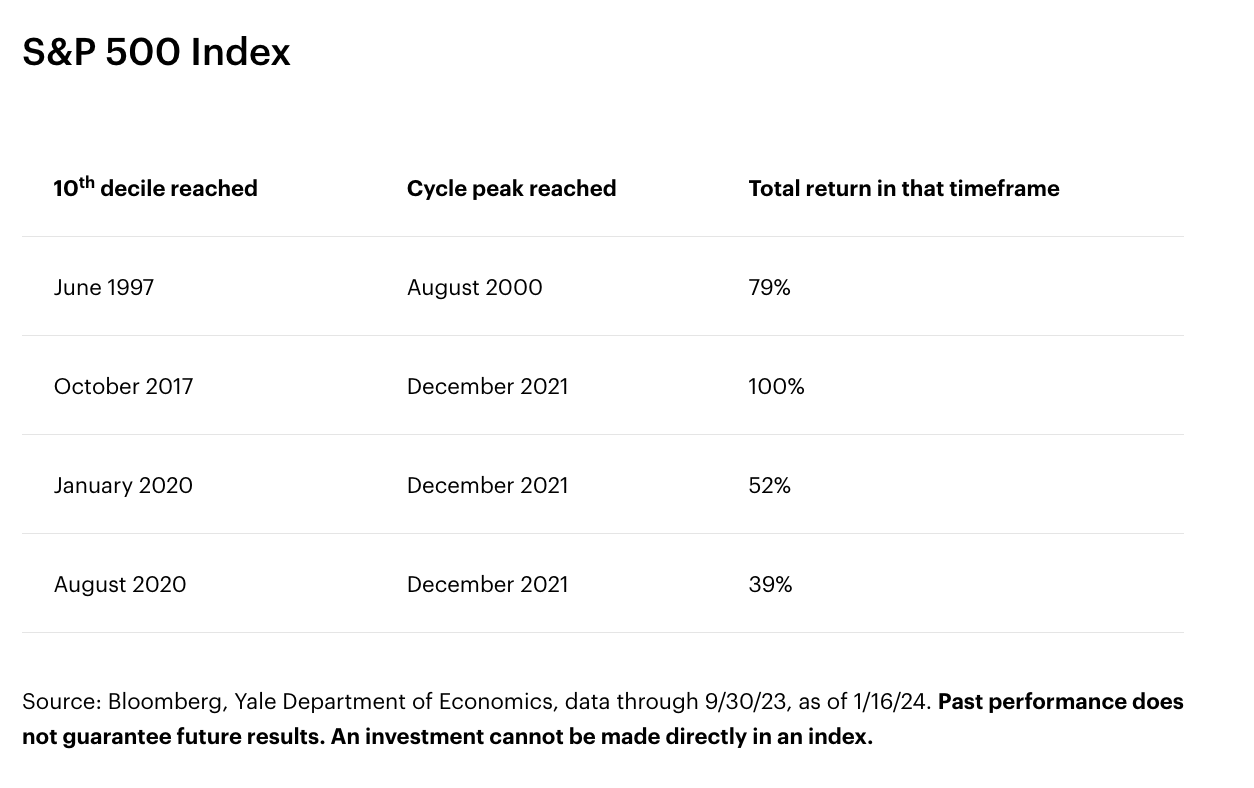

…concerns over equity valuations are overstated, as valuations have not been a reliable timing tool for long-term investors. While it’s true the S&P 500 Index is currently expensive relative to history, high valuations alone have not been a good reason to underweight stocks.

We can see this in the chart below, which tracks the total return of the S&P 500 and highlights times when the index reached a valuation in the 10th decile — in other words, it was more expensive than it had been 90% of the time. In the past two bull markets, US equities continued to rally even after valuations reached the 10th decile. Investors who exited these bull markets due to high valuations would have incurred a significant opportunity cost as returns continued to increase.9

For perspective, from October 2017 (when US equity valuations reached the 10th decile for the first time in decades) to the subsequent market peak in December 2021, the price of the index nearly doubled.10 This means those who weren’t invested in US stocks over that period would have missed an ensuing gain of 100%!

US equities have a history of rallying even after valuations reached high levels

Since you asked (Part 1)

Q: What’s the biggest risk to the equity market?

A: The market has embraced the “soft landing” scenario, in which US inflation returns to the Fed’s perceived “comfort zone” without a meaningful hit to economic activity. Is that too optimistic? Former Treasury Secretary Lawrence Summers called soft landings “the triumph of hope over experience.”11 I think Summers’ skepticism is reasonable but shouldn’t necessarily inform the base case. A recession (the hard landing), doesn’t appear to be coming, given the lack of cyclical excess in the economy12 and limited leverage on corporate balance sheets13.

Back to the question. The risk at this point in the cycle would be a meaningful deterioration in economic growth that we are not forecasting. A reacceleration of inflation would not be on the top of my list of risks for 2024.

Speaking of which…

Since you asked (Part 2)

Q: If this is ultimately a mid-cycle slowdown and a Fed pivot like the one in 1995, then why would anyone own anything but growth stocks over the next few years?

A: The mid- to late-1990s is remembered for the spectacular run in US growth stocks. However, don’t forget that value stocks gained 120% from the date of the last Fed rate hike in February 1995 through the end of 1997, modestly outpacing growth stocks.14 The massive outperformance of growth stocks came in the last two years of the decade, only to be erased by early 2002, followed by meaningful value outperformance until the Global Financial Crisis.14

It’s a great question, and an interesting history lesson. But it’s not what we use to determine our views — we’ll continue to use our tactical regime analysis to assess the level of economic growth and the direction of market sentiment to determine our evolving style views.

It was said

“…the economics of the events in the Red Sea, while not great, aren’t a reason to be greatly concerned…nothing happening in the Middle East will cause the kind of broader disruption that led inflation to become so high and widespread.” – Paul Krugman, Opinion Columnist New York Times

First, the bad news. The disruption of a major conduit for global commerce is not ideal when an intermediate-term bullish market call is predicated on a further moderation of inflation. Attacks by Yemen’s Houthi movement against maritime vessels have forced major shipping companies to divert their routes around the Cape of Good Hope off the southern tip of Africa instead of the Suez Canal in the Red Sea, costing them up to $1.5 million to $2 million more in fuel costs per ship.15 Compounding the problem, roughly 15% of global trade passes through the Red Sea, including 12% of the world’s oil and 8% of the world’s liquified natural gas.16 As Krugman says, “It’s not trivial.”

Now, the better news. The primary cause of the widespread inflation of the early 2020s was not the shipping challenges, even if the backup of ships at the ports of Los Angeles became the iconic image of the moment. Rather, the inflation was largely the result of businesses responding to the pandemic by frantically slashing inventories and cutting employees, just as consumers were going on a spending spree. Blame inopportune timing! Now, businesses have rebuilt inventories17 while total US payrolls stand at all-time highs18. At the same time, consumer spending is likely to moderate. The current environment is very different and one that does not appear ripe for a reacceleration of inflation.

Phone a friend

How concerned should investors be about the US Federal Reserve underwhelming the market by cutting interest rates less than six times in 2024? I posed the question to Matt Brill, Head of US Investment Grade Credit at Invesco. His response:

“That’s certainly a different question than I was getting last time this year! It’s amazing how quickly things can change. I’ve likened it to how much the kids change in their photos taken on the first day of school and the last day of school. Few believed us last year when we said that the US Federal Reserve will be cutting rates by the first half of 2024. Now it’s consensus. From my perspective it doesn’t much matter to me how many cuts we get this year. I believe the Fed is done tightening and the path going forward will be easier to navigate than was the past 21 months.”

Automate My Job?

Each month I pose a question to ChatGPT — the artificial intelligence-driven chatbot — and assess the response.

Q: Does it matter for markets whether we have a soft or hard landing?

A: Yes, the type of economic landing, whether soft or hard, can impact financial markets. A soft landing, with a gradual economic slowdown, is generally preferred as it minimizes disruptions. A hard landing, marked by a sharp economic downturn, can lead to increased market volatility and uncertainty.

That answer left me wanting. Give me some statistical evidence, ChatGPT!

I would have compared years such as 1995 and 2015, when the economy slowed but did not collapse, with years such as 1981 and 1991, when mild recessions emerged. The peak-to-trough returns associated with the mid-cycle slowdowns were 9% and 13%, respectively compared to drawdowns of 27% and 19% in the recession years of 1981 and 1991, respectively.19

On the road again

My travels took me to Beverly Hills, California, to see clients. The price of cocktails had me feeling sticker shock, although I was informed that the prices aren’t all that different than in New York City. I guess I don’t go out that often anymore. Regardless, $25 for a 5-ounce glass of the house white felt excessive. I was pressed by the clients to square my view of inflation being a challenge of the past with the cost of our libations. Here’s essentially how that conversation went:

Me: What did the drink cost in 2019?

Them: $17.

Me: What did the drink cost last year?

Them: $25.

Me: Well, then that’s zero percent year-over-year inflation. The US Federal Reserve doesn’t concern itself with the level of prices. Its goal is price stability. It concerns itself with the level of change, which in this case is zero.

Them: Well, my wallet concerns itself with the level.

Me: Understood.

Welcome to February. I think I speak for most Americans when I say I’m glad that groundhog didn’t see his shadow!

Footnotes

1 Source: Bloomberg, 12/31/23. Based on the 2-month return, ended 12/31/23, of the S&P 500 Index (+13.74%), the Russell 2000 Index (+21.95%), the Russell Midcap Index (+18.28%), the Russell 1000 Value Index (+12.95%), and the Russell 1000 Growth Index (+15.63%).

2 Source: Bloomberg, 12/31/23. Based on the 10-year US Treasury rate.

3 Source: Bloomberg, 12/31/23. Based on the S&P 500 Index.

4 Source: Bloomberg, 1/18/24. Based on the Fed Funds Implied Futures.

5 Source: Invesco, 12/31/23. Based on Invesco Solutions’ proprietary leading economic indicator.

6 Source: MarketWatch, 7/2/20.

7 Source: Wall Street Journal, 6/2/16.

8 Source: Invesco, Bloomberg, 1/17/24. Based on the S&P 500 Index.

9 Source: Bloomberg, Yale Department of Economics, data through 9/30/23, as of 1/16/24.

10 Source: Invesco, Bloomberg. Based on the S&P 500 Index.

11 Source: Yahoo!Finance, 1/18/23.

12 Source: Bloomberg, Realtor.com, US Census Bureau, 12/31/23. Based on US Housing Inventory: Active Listing Count in the US and US Retail Inventory to Sales ratio.

13 Source: US Federal Reserve, 9/30/23. Latest data available. Based on year-over-year percent change in Debt and Liabilities on Nonfinancial Corporate Businesses.

14 Source: Bloomberg, 12/31/23. Based on the returns of the Russell 1000 Value Index compared to the Russell 1000 Growth Index.

15 Source: S&P Global Market Intelligence, 1/18/24.

16 Source: S&P Global Market Intelligence, 1/18/24.

17 Source: US Census Bureau, 12/31/23.

18 Source: US Bureau of Labor Statistics, 12/31/23.

19 Source: Bloomberg, 12/31/23. Based on the S&P 500 Index.