by Jeffrey Rosenberg, Sr. Portfolio Manager, Systematic Fixed Income, BlackRock

Key points

- As investors face continued macroeconomic and market uncertainty, evolving the 60/40 portfolio of stocks and bonds to include alternative investments may help build portfolio resiliency.

- When selecting alternative investments, investors may want to consider strategies that seek to deliver differentiated portfolio outcomes—like amplifying returns or diversifying risk exposures.

- The complementary risk and liquidity characteristics of liquid alternatives and private assets may make for a balanced and outcome-oriented alternatives allocation.1

The expected comeback of the 60/40 portfolio in the first half of 2023 has taken a pause as stock and bond returns face the pressure of higher yields—a backdrop reminiscent of the historic 60/40 drawdown of 2022. Despite a rising expectation for an economic soft-landing scenario, the range of potential economic outcomes remains broad and highly uncertain. Near-term recession risks have decreased, and expectations for recession have been pushed out into 2024. But the increasingly two-sided risks to a US Federal Reserve (“Fed”) committed to keeping monetary policy tight until price stability is fully restored have become more evident.

What does this backdrop mean for the durability of the 60/40 portfolio as we look ahead? Continued macroeconomic uncertainty threatens to put pressure on asset price returns. For portfolio construction, we see this as the stock and bond return correlation has again turned significantly positive in the second half of the year, with the surge in long-term bond yields driving stock and bond returns lower. This underscores the importance of building resiliency with alternative investments that offer additional sources of diversification and potential return in portfolios.

By (1) identifying strategies that seek to deliver differentiated portfolio outcomes like alpha, or excess returns that are uncorrelated to stock and bond returns, and (2) choosing a combination of strategies that are complementary and tailored to their specific risk, return, and liquidity needs, investors can seek to build an additive and effective allocation to alternatives. In this article, we discuss a framework for screening alternatives and key considerations for constructing an alternatives allocation using strategies across the full spectrum of alternatives ranging from private equity, private credit and liquid alternatives.2

Screening for alternatives that target differentiated portfolio outcomes

When it comes to selecting alternative investments, there is a wide range of strategies to choose from. The following framework breaks alternatives down into four distinct categories based on the outcomes that they’re designed to provide: hedge, diversify, modify, and amplify.

So how effective are each of these at improving portfolio outcomes? First, it’s important to examine how these types of strategies have behaved over time. Hedges, for example, have a negative beta to traditional asset classes like stocks. This has allowed them to generate returns when used tactically during periods of market declines. But historically, hedges have tended to lose money as markets trend higher over the long run.

Along with the cost of potential portfolio losses, it’s important to determine whether the fees associated with alternatives are justifiable for the value that they deliver. Modifiers move in the same direction as equity markets, but not as significantly. This means that they offer limited upside when broad markets are moving higher, and tend to struggle during equity market drawdowns. In general, they fail to deliver a unique return profile and the exposure that they offer can likely be replicated at a lower cost.

This leaves us with two categories of alternatives that may have the highest potential to provide differentiated outcomes in client portfolios: amplifiers and diversifiers. When carefully selected, these two types of alternatives can be complementary and serve as the foundation of a well-balanced alternatives allocation.

Building a balanced alternatives allocation with amplifiers and diversifiers

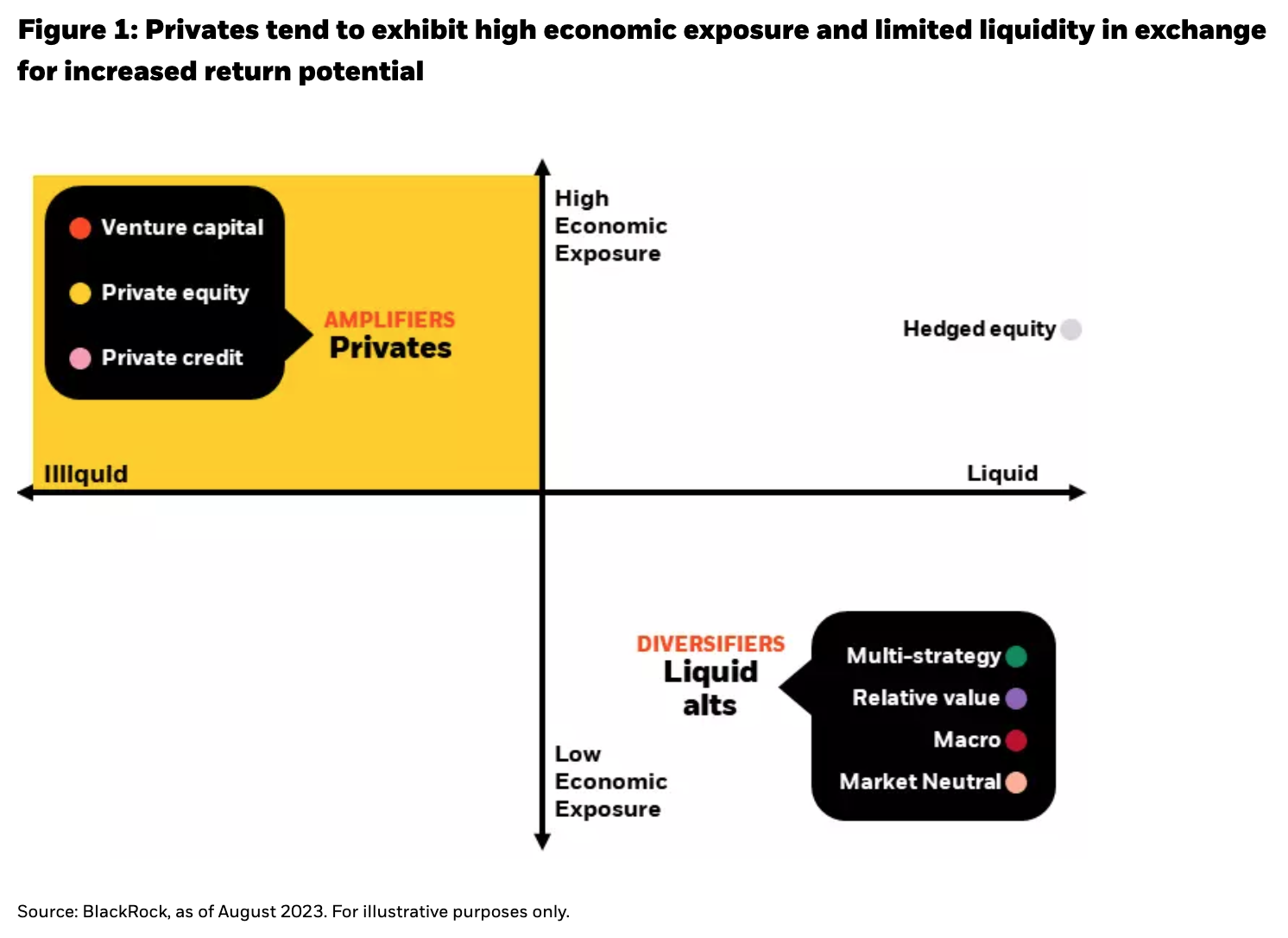

Due to their greater economic exposure and higher business and financial leverage, private assets—both private equity and private credit—tend to exhibit a higher expected return and risk profile compared to publicly traded assets. As a result, they are commonly used as amplifiers in portfolios. The enhanced opportunity set that privates offer has garnered growing investor interest, with more than 36% of US financial advisors surveyed by Cerulli planning to increase private market exposure by 2024.3 When increasing or establishing exposure to private markets, Figure 1 highlights two key considerations to account for—the liquidity profile of privates and the level of economic exposure that they introduce to portfolios.

From a risk factor perspective, private assets tend to exhibit high economic exposure. Why is this important? Returns from traditional asset classes like stocks are also heavily dependent on the direction of economic conditions. This means that private assets may add to existing dominant portfolio risk exposures—potentially reducing overall diversification in exchange for higher returns.

Another important consideration is the liquidity profile of privates. Liquidity constraints on private investments are highly variable, but strategies often come with “lock up” periods, where capital may not be able to be accessed for a significant amount of time once invested—ranging from 5 years, 10 years, or as long as 12 years.4 Some private investments provide more frequent access to liquidity through tender offers which are periods where a limited portion of the strategy’s shares eligible for redemption. But if several investors seek redemptions during the same period, redemption requests may not be completely fulfilled. When allocating to privates, it’s important to consider where they fall on the liquidity spectrum and account for the portion of a client’s overall portfolio that must remain liquid based on future funding requirements.

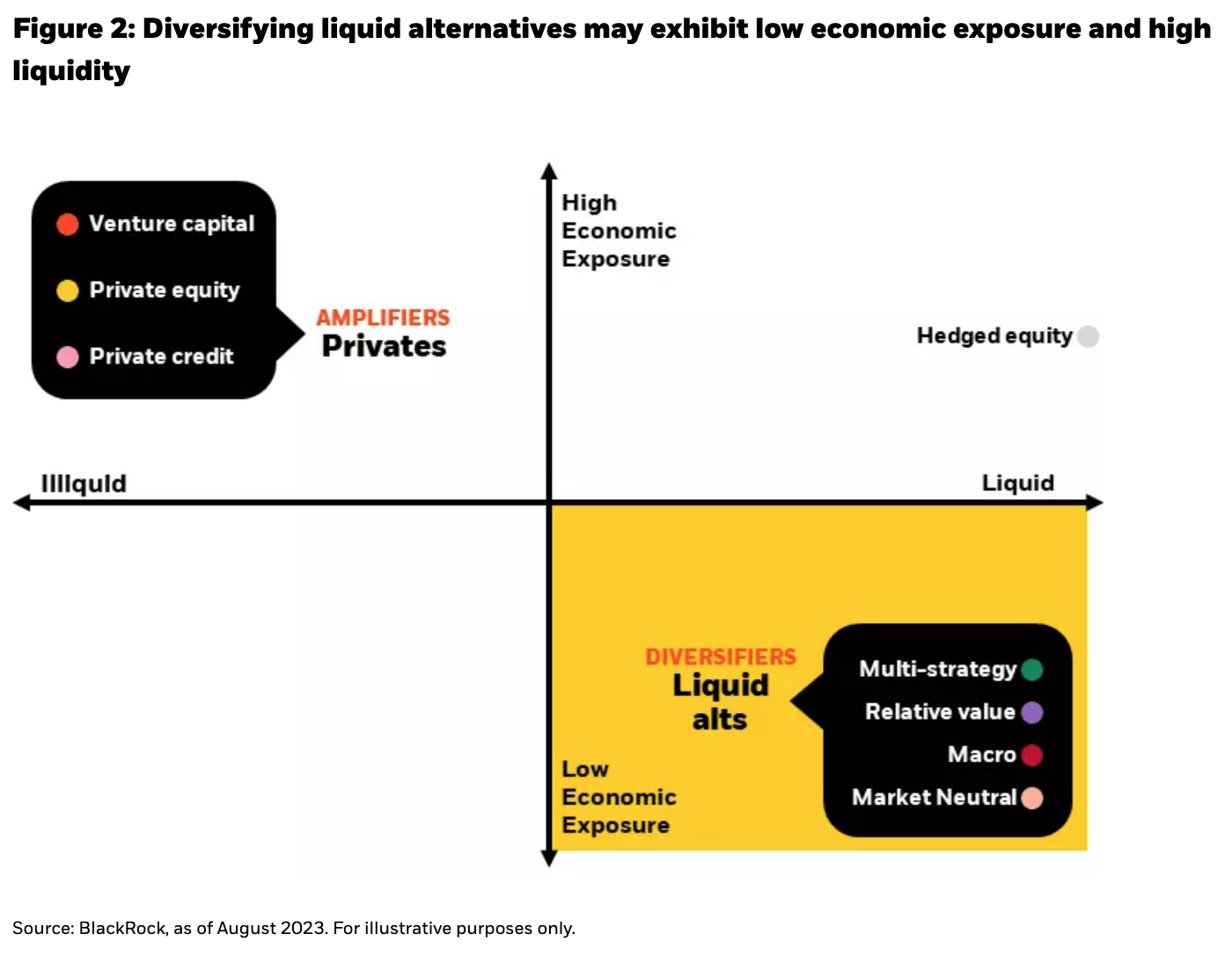

So how can investors balance the need to generate higher returns, diversify portfolio risk exposures, and maintain an adequate liquidity profile? This is where diversifying liquid alternatives can be complementary to private assets as part of an alternatives allocation (Figure 2).

Liquid alternatives with a return objective targeting alpha (excess returns from idiosyncratic exposures) while at the same time limiting or eliminating market, beta, factor and directional exposures may help to balance overall portfolio risk exposures. These types of alternatives can be diversifying because their returns should be primarily driven by risk factors that aren’t closely related to economic and market conditions—and potentially even defensive in nature if their alphas tend to be strongest when economic risk is rising. These exposures can be accessed in a daily liquid mutual fund wrapper as liquid alternatives invest in tradeable securities, but deploy different investment strategies to provide diversification and defensive alpha.

The ability to target a diversifying and defensive return stream is especially important as macroeconomic uncertainty remains elevated. Why? The Fed’s commitment to defeating inflation means that policymakers are less likely to materially cut interest rates in the face of slowing growth. As a result, the degree of diversification that traditional bonds can offer in portfolios may be less reliable than in recent decades of below-target inflation. The defensive alpha in some diversifying liquid alternatives can offer an added source of ballast in portfolios for when risk assets with high economic exposure come under pressure.

Liquid alternatives can seek to take advantage of today’s macroeconomic and market dynamics to generate alpha from idiosyncratic risk while limiting market directional risks. This provides the “plus” in the “cash-plus” return targets of liquid alternatives. Security dispersion, or the difference in returns across individual securities, as well as macro dispersion, or the difference in returns across countries, regions, and instruments tends to rise during periods of market stress and volatility. Liquid alternatives that can take both long and short positions may thrive in these high dispersion environments because they can go long securities that may become outsized winners and go short securities that may become relative losers—targeting returns in the cross-section of markets with reduced dependence on market direction.

It's important to note that liquid alternatives can vary widely and not all strategies are effective at playing the role of a diversifier. And like all investments, liquid alternatives come with inherent risks including potential losses and can be highly correlated with other asset classes like stocks and bonds. When identifying a liquid alternative to diversify portfolio exposures, investors may want to consider strategies that exhibit a low correlation to existing portfolio holdings and market beta factors such as overall stock and bond returns. Additionally, a history of consistent returns across a range of market environments, but especially during market downturns, may characterize defensive alpha strategies.

Seeking to enhance portfolio outcomes with alternatives

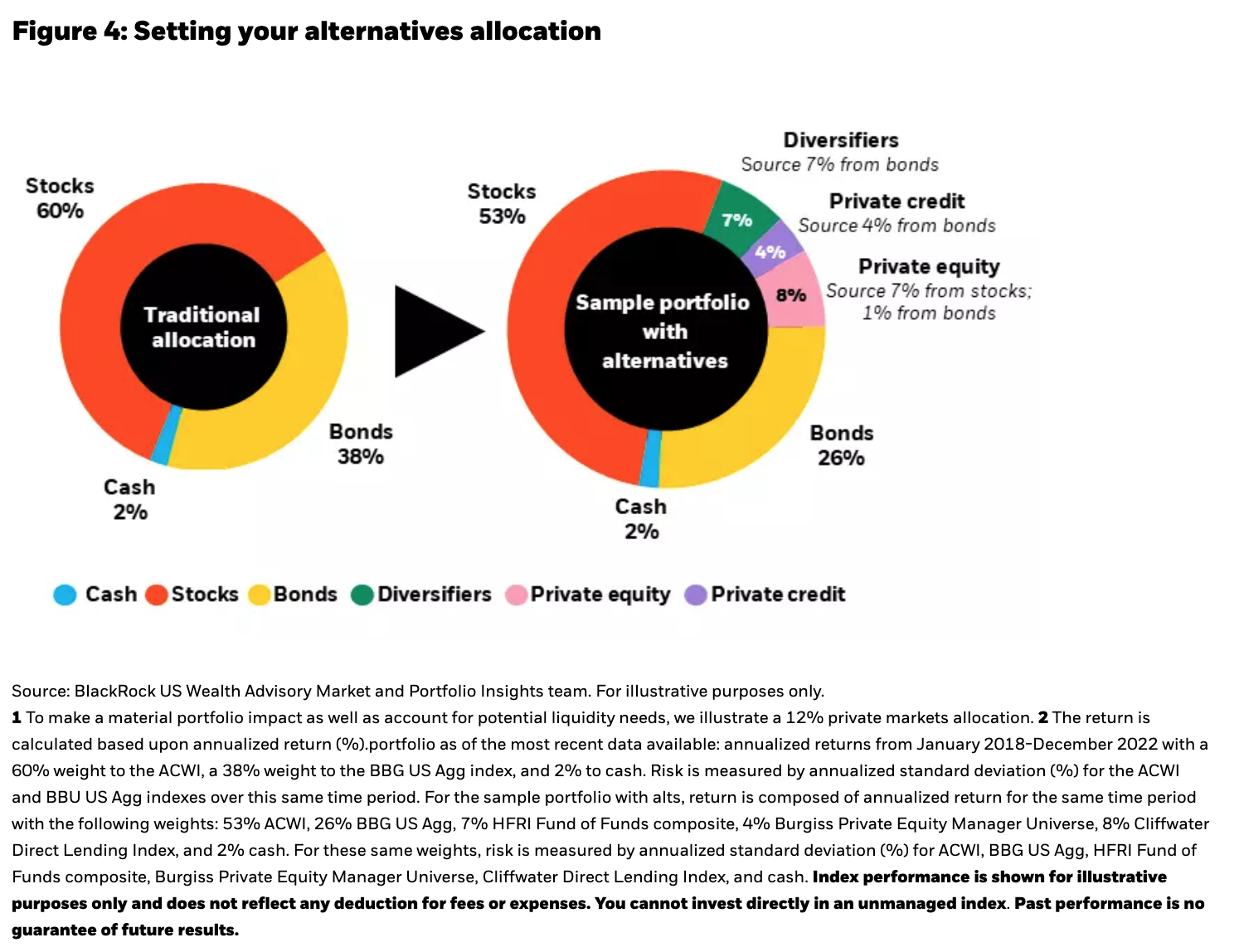

As a starting point for building an alternatives allocation, our colleagues in BlackRock’s US Wealth Advisory Market and Portfolio Insights team designed the portfolio highlighted in Figure 4, adding 12% to amplifiers (private equity and private debt) and 7% to diversifiers from a 60/40 portfolio. They found that over the last 5 years, adding alternatives improved portfolio returns by 1.5% while reducing overall portfolio risk by 0.3%—delivering the intended portfolio outcomes of seeking to amplify returns and diversify risk.

Conclusion

Continued macroeconomic uncertainty makes it more crucial than ever to explore alternative investments that offer differentiated portfolio outcomes. Amplifiers like private assets, are commonly used in portfolios to enhance return potential. Liquid alternatives with diversifying and defensive properties can help balance these amplifiers from both a risk and return and liquidity perspective. When used together, the two may make for a well-rounded alternatives allocation that can help build portfolio resiliency.

Copyright © BlackRock