by William Smead, Smead Capital Management

Dear fellow investors,

When you are in a long-term bull market in growth stocks, you move from acorns growing into trees to asking trees to grow into a forest. We prefer to find meritorious acorns that could grow into trees, and this stock market is providing lots of opportunities in the smallest neglected large caps, and the largest neglected mid-cap stocks.

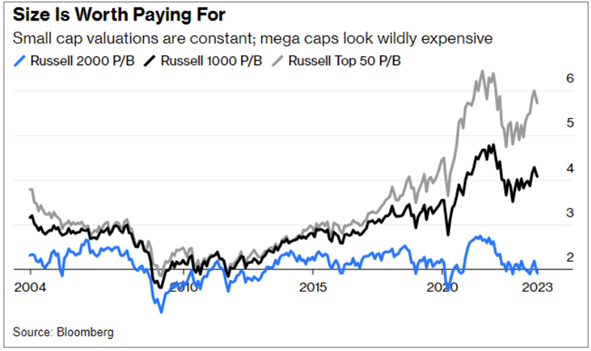

The best bargains in this stock market run smaller than normal and skew towards deeply out-of-favor sectors of the economy like energy and real estate. Who wants to own undervalued stocks that might take time to be rewarded when the biggest of the big seem to have no end to their success?

We have argued that the household formation of the 92 million millennials would cause a better economy than expected (it has) and that would translate into a better Main Street environment than a Wall Street environment. As shown in these charts provided by Cypress Capital, Wall Street is holding onto its better environment based on a narrower and narrower group of stocks. We have 43 years of experience in the stock market, and we were taught a long time ago that narrow markets end badly (1987, 2000, 2006).

When the smart investors (not measured as such by us) pile into a narrow group of stocks to find gains in a difficult environment, you should fear stock market failure. This is looking increasingly like a triple top in a tech-led financial euphoria episode dying to get crushed. Charlie Munger called it the biggest episode of his lifetime because of the “totality of it!”

Therefore, where can we turn to find substantial mid-cap and depressed large-cap stocks that have great merit and very solid forward economics? Look no further than the oil and gas sector:

We saw the silliest article over the weekend in The Wall Street Journal. The thesis was that at meaningfully higher oil prices, demand destruction would happen and be bad for oil and gas stocks. Let me get this correct. Are these experts saying that a recession that could drop oil and gas demand by 2-4% would be enough to offset a 15-20% increase in price? Name any business that wouldn’t trade lower sales for dramatically higher prices! Phillip Morris has laughed all the way to the bank for the last 50 years on lower smoking volumes and unending higher prices. Gasoline and heating oil are an addictive legal drug.

Lastly, the idea that higher oil prices will greatly affect consumption is satisfied by this chart that shows how gasoline expense is “dwindling” as compared to the last twenty years.

We are happy to be overweighted in oil and gas stocks like Ovintiv (OVV), Apache (APA) and Devon Energy (DVN) which could be positioned to “grow into trees.”

Fear stock market failure,

William Smead

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Bill Smead, CIO, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

©2023 Smead Capital Management, Inc. All rights reserved.

This Missive and others are available at www.smeadcap.com