Pre-opening Comments for Monday July 24th

U.S. equity index futures were higher this morning. S&P 500 futures were up 7 points at 8:30 AM EDT.

Chevron added $0.91 to $159.60 after reporting higher than consensus second quarter earnings.

Mattel gained $0.31 to $21.49 after the movie Barbie was the top selling movie in North America over the weekend.

American Express dropped $3.46 to $166.76 after Piper Sandler downgraded the stock to Under Weight.

Tesla dropped $2.36 to $257.66 after UBS downgraded the stock from Buy to Neutral.

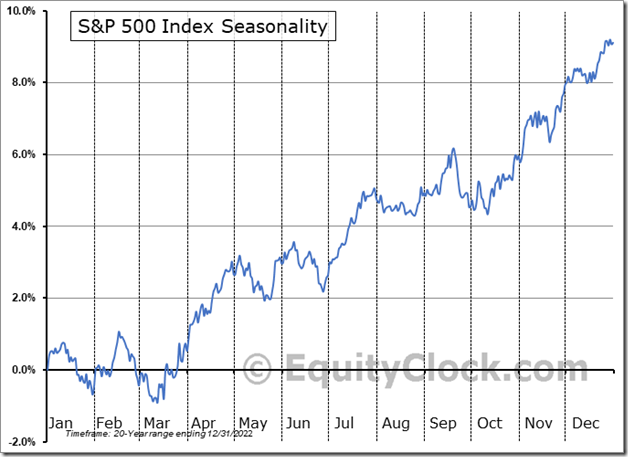

EquityClock’s Daily Comment

Headline reads “The average low to the Volatility Index (VIX) is today, resulting in an erratic trading pattern for stocks through the remainder of the third quarter”.

http://www.equityclock.com/2023/07/22/stock-market-outlook-for-july-24-2023/

The Bottom Line

Focus this week is on news released from the FOMC meeting on Wednesday. Consensus calls for at least another 0.25% increase in the Fed Fund Rate to 5.50%.

Second quarter results released by S&P 500 companies were mixed at best last week. Better than consensus results were released by most U.S. money center banks, airline companies and UnitedHealth Group. They were offset by less than consensus forward guidance offered by Tesla, Netflix and American Express. Net result: Analyst once again lowered consensus second quarter earnings estimates.

Regardless of quarterly corporate results, the S&P 500 Index and Dow Jones Industrial Average extended their summer rally. Traditionally the rally starts in the last week in June and ends at the end of July.

Consensus for Earnings and Revenues for S&P 500 Companies

Source: www.Factset.com

Earnings estimates moved lower again after 15% of S&P 500 companies reported second quarter results. Consensus for the second quarter earnings calls for a year-over-year drop of 9.0% (versus a drop of 7.2% last week). Second quarter revenues are expected to drop 0.3% (versus a drop of 0.4% last week). Consensus for the third quarter calls for an earnings increase of 0.1%. Revenues are expected to increase 1.2% (versus 1.1% last week). Consensus for the fourth quarter calls for a 7.5% increase in earnings (versus an increase of 7.6% last week). Fourth quarter revenues are expected to increase 3.3% (versus previous estimate at 5.0%). For all of 2023, consensus calls for an earnings increase of 0.1% (versus previous estimated gain at 0.6%). Revenues are expected to increase 2.3% (versus previous estimated gain at 2.4%.

The recovery in earnings continues into 2024. Consensus for 2024 calls for a 12.9% increase in earnings (versus previous estimate at 12.4%). Consensus for revenue growth is 5.0%.

Economic News This Week

June U.S. New Home Sales released at 10:00 AM EDT on Wednesday are expected to drop to 722,000 from 763,000 units in May.

Federal Reserve Decision on interest rates released at 2:00 PM EDT on Wednesday is expecting the Fed Fund Rate to increase another 0.25% to 5.50%.

June Durable Goods Orders released at 8:30 AM EDT on Thursday are expected to increase 1.0% versus a gain of 1.7% in May. Excluding Transportation, June Durable Goods Orders are expected to slip 0.1% versus a gain of 0.6% in May.

Second quarter core GDP released at 8:30 AM EDT on Thursday is expected increase 1.8% versus a gain of 2.0% in the first quarter.

European Central Bank interest rate decision released at 8:15 AM EDT on Thursday is expected to increase the Bank Rate to 4.25% from 4.00%.

June Core PCE Price Index released at 8:30 AM EDT on Friday is expected to increase 0.2% versus a gain of 0.3% in May. On a year-over-year basis, the Index is expected to versus a gain of 4.6% in May.

June Personal Income released at 8:30 AM EDT on Friday is expected to increase 0.4% versus a gain of 0.4% in May. June Personal Spending is expected to increase 0.4% versus a gain of 0.1% in May.

May Canadian GDP released at 8:30 AM EDT on Friday is expected to be unchanged versus unchanged in April.

July Michigan Consumer Sentiment released at 10:00 AM EDT on Friday is expected to remain unchanged from 64.4 in June.

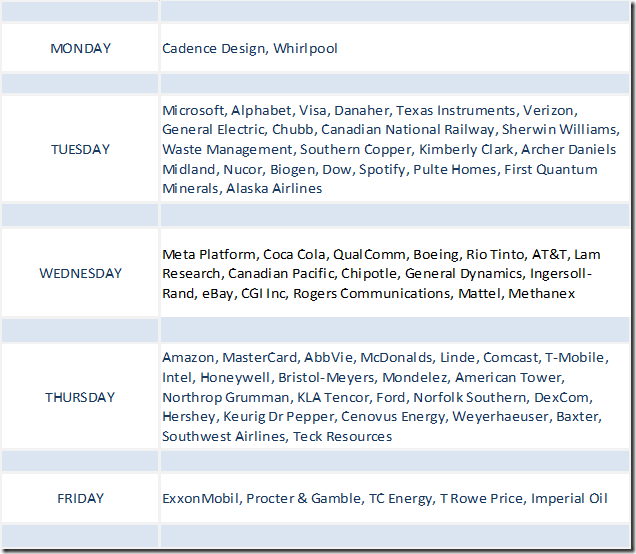

Selected Earnings News This Week

Another 166 S&P 500 companies are scheduled to report second quarter results this week (including 12 Dow Jones Industrial Average companies).

Nine TSX 60 companies are scheduled to report second quarter results this week.

Trader’s Corner

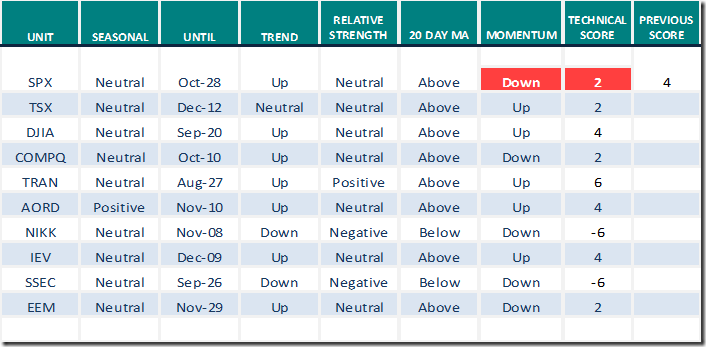

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for July 21st 2023

Green: Increase from previous day

Red: Decrease from previous day

Source for all positive seasonality ratings: www.EquityClock.com

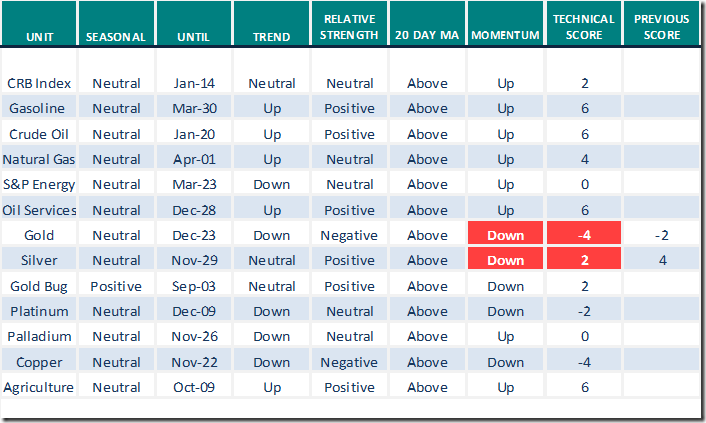

Commodities

Daily Seasonal/Technical Commodities Trends for July 21st 2023

Green: Increase from previous day

Red: Decrease from previous day

Sectors

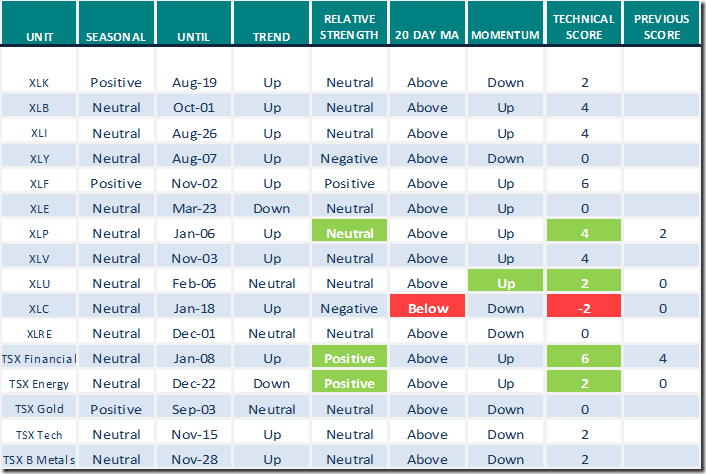

Daily Seasonal/Technical Sector Trends for July 21st 2023

Green: Increase from previous day

Red: Decrease from previous day

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Technical Notes

S&P 500 Equal Weight ETF $RSP moved above $154.27 extending an intermediate uptrend.

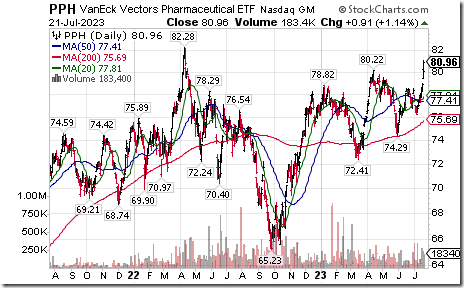

Pharmaceutical ETF $PPH moved above $80.22 extending an intermediate uptrend.

Medical Devices iShares $IHI moved above $57.19 extending an intermediate uptrend.

Texas Instruments $TXN a NASDAQ 100 stock moved above $184.88 extending an intermediate uptrend.

Abbot Labs $ABT an S&P 100 stock moved above $114.05 extending an intermediate uptrend.

Incyte $INCY a NASDAQ 100 stock moved above $64.01 completing a base building pattern.

Links offered by valued providers

Michael Campbell’s Money Talks for July 22nd

Michael Campbell’s MoneyTalks – Complete Show (mikesmoneytalks.ca)

Signs markets are being manipulated: Mark Leibovit

https://www.howestreet.com/2023/07/signs-markets-are-being-manipulated-mark-leibovit/

A PAINFUL PLUMMET for Netflix and Tesla! Is This Just the Beginning? | The Final Bar (07.20.23)

Premiere Episode! Focus On Stocks with Larry Williams (07.19.23)

Premiere Episode! Focus On Stocks with Larry Williams (07.19.23) – YouTube

Use These Indicators To Help With Exits JULY 21, 2023 AT 12:34 PM Greg Schnell

Use These Indicators To Help With Exits | The Canadian Technician | StockCharts.com

Tech Stock Decline Spooks Market | Mary Ellen McGonagle | The MEM Edge (07.21.23)

Tech Stock Decline Spooks Market | Mary Ellen McGonagle | The MEM Edge (07.21.23) – YouTube

Gold Mining Stocks vs Gold: What’s the Turnaround Trigger?JULY 18, 2023 AT 07:37 PM Karl Montevirgen

Gold Mining Stocks vs Gold: What’s the Turnaround Trigger? | ChartWatchers | StockCharts.com

All That’s Bullish is ✨GLD✨ As the Week Wraps! | The Final Bar (07.21.23)

All That’s Bullish is ✨GLD✨ As the Week Wraps! | The Final Bar (07.21.23) – YouTube

Bob Hoye: Stock Markets, Dow, Gold, Oil, Headlines

This Week in Money – HoweStreet

Victor Adair Jul 22, 2023:Trading Desk Notes for July 22nd 2023

Trading Desk Notes For July 22, 2023

Josef Schachter Jul 20, 2023: Is the AI craze about to go bust?

Is the AI Craze About to Go Bust?

Technical Scoop from David Chapman and www.EnrichedInvesting.com

S&P 500 Momentum Barometers

The intermediate term Barometer added 0.40 to 88.00. It added 0.40 on Friday and 4.80 last week to 88.00. It remains Overbought. Daily trend is up and extended.

The long term Barometer added 0.60 on Friday and 5.20 last week to 75.00. It remains Overbought. Daily trend is up and extended.

TSX Momentum Barometers

The intermediate term Barometer added 4.39 on Friday and 7.45 last week to 71.49. It remains Overbought. Daily trend remains up.

The long term Barometer added 1.32 on Friday and 3.95 last week to 62.72. It changed last week from Neutral to Overbought. Daily trend remains up.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed