by Tina Downing, Russell Investments

Executive summary:

- An advisor’s greatest contribution to an investor’s bottom line is their guidance through volatile markets

- On their own, investors are likely to succumb to common behavioral biases and act against their own best interests

- Advisors should feel confident in the value they provide and confident communicating that value

Last year was a difficult one for investors. Not only did equities and fixed income both end the year lower, but they were also quite volatile throughout. It may have felt like the promise of diversification failed and it’s likely that many advisors fielded calls from investors wanting to flee the markets altogether and move to cash.

Our Value of an Advisor study, now in its 10th year, has consistently found that an advisor’s guidance is the biggest contributor to an investor’s bottom line. This year’s study once again confirms that investors who are guided by advisors benefit when markets are volatile. They are more likely to remain invested through thick and thin, and therefore don’t miss out when markets rebound after a decline – as they invariably do.

Without an advisor’s guidance, many investors struggle with the emotional impact of making decisions during times of fear or the unknown. Depending on the market environment, this fear or uncertainly may compel investors to sell at the bottom or buy at the top. Most advisors know far too well investors don’t always do as they should. Instead, their behavior is sometimes directly opposed to what is in their own best interest.

That’s what makes behavioral coaching an integral part of our Value of an Advisor formula:

This is the second in a series of blogs discussing the four pillars of an advisor’s value. In the first blog we discussed the value of annual rebalancing. In this blog, we’ll look at the value of the behavior coaching that you do to keep your clients from making decisions that go against their best interests.

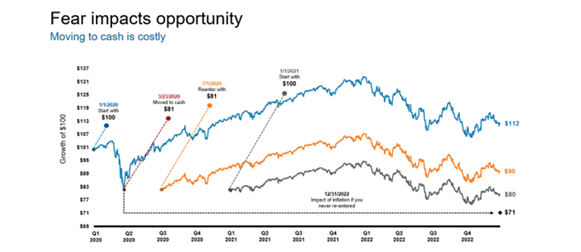

Let’s look at three hypothetical investors’ journeys from January 2020 through December 2022. This is a period that begins before the COVID-19 pandemic to the end of last year. It was a trying time to be sure, but the chart shows the importance of remaining invested through thick and thin:

- Investors who remained in the market for the entire period would have seen a $100 investment rise to $112 (blue line in the chart below).

- An investor who moved to cash in March 2020 and then returned to the market a few months later at the end of the second quarter, would have had only $90 by the end of 2022 (orange line in the chart below).

- An investor who moved to cash in March 2020 and remained in cash for the entire year, then re-entered the market at the beginning of 2021, would have had only $80 at the end of 2022 (grey line in the chart below).

- The chart also shows the impact of inflation, which soared in 2022. An investor who pulled out of the market when the pandemic began and remained in cash for the entire period, would have had only $71 by the end of 2022.

Click image to enlarge

Source: Morningstar Direct and BLS.gov. Balanced Portfolio: 60% S&P 500 Index & 40% Bloomberg Aggregate Bond Index. As of Dec 31, 2022. Monthly change in CPI as of Dec 31, 2022.

Pulling out of the market when it’s volatile can lock in losses and could lead to missing out on any subsequent rally. Without a crystal ball, it’s hard to time the perfect point to get back into the market once an investor has left.

This is where we believe an advisor can be a valuable guide. Your role as a behavioral coach can go a long way to keeping investors in the market, helping them focus on the long term rather than letting them fall prey to their emotions when markets become volatile.

Even pulling out of the market for a brief period can hurt returns. The thing is, you never know when the market will have a good or bad day. Market performance can be affected by anything from stock-specific news to geopolitical events to newly released data (such as employment statistics) to even technical trading triggers. That’s why they’re so unpredictable. Nevertheless, their long-term trend has been up. In fact, the S&P 500 Index has finished the year in positive territory 73% of the time since its inception in 19261.

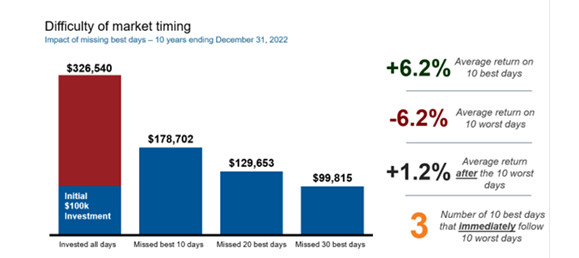

This chart shows how much return can be lost when an investor tries to time the market rather than remaining invested.

Click image to enlarge

Fear impacts opportunity

Source: Morningstar. Returns based on S&P 500 Index, for 10-year period ending December 31, 2022. For illustrative purposes only. Index returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Indexes are unmanaged and cannot be invested in directly.

The thing is, “best” days quite often follow “worst” days. Over the past 10 years, the average return of “the 10 “best” days was 6.2% while the average return of the 10 “worst’ days was -6.2%. And three of the “best” days immediately followed a “worst” day. That means an investor who pulls out of the market on a bad day would have nearly recouped their loss on the very next day if they had remained invested. This is why you should never underestimate your role as a behavioral coach. Helping your clients navigate volatility can have a substantial impact on their bottom line.

Not only should you never underestimate your value, but you should also feel confident in how you communicate it. Show your clients these charts. Let them know that your guidance can help them avoid making common investing mistakes such as:

- Chasing performance: there’s a reason every investment comes with the warning label “past performance is no guarantee of future returns.” Just because an investment did well yesterday doesn’t mean it will do well tomorrow.

- Herding: many people suffer from FOMO “fear of missing out” when certain trends take hold or specific names dominate headlines. They’re also likely to flee the market when they see that others are doing so. The problem with hot trends is that they can change, often quickly and unpredictably. This is true in investing as well as fashion.

- Loss aversion: most investors feel more of a sting from an investment loss than the joy from a similar-sized gain. That’s why many pull out of the market when it’s declining – they want to avoid more losses. But as we have just discussed, markets invariably rebound and have historically trended higher over time.

The good news is that you, the advisor, can have a huge impact by reducing this behavior through your guidance. Doing so can have an equally huge impact on your clients’ investment outcomes. In fact, addressing the investment behavior of your clients may be the greatest value you provide.

1 Source: Russell Investments, represented by the S&P 500® Index from 1926-2021