Pre-opening Comments for Friday July 7th

U.S. equity index futures were lower this morning. S&P 500 futures were down 9 points at 8:35 AM EDT.

Index futures moved lower following release for June Non-farm Payrolls at 8:30 AM EDT Consensus was an increase of 230,000 versus a gain of downwardly revised 306,000 in April. Actual was an increase of 209,000. June Unemployment Rate was expected to remain unchanged at 3.7% reported in May. Actual was a drop to 3.6%. June Average Hourly Earnings were expected to increase 0.3% versus a gain of 0.3% in May. Actual was a gain of 0.4%.

The Canadian Dollar was unchanged at US74.95 cents following release of the June Canadian Employment report at 8:30 AM EDT. Consensus was an increase of 20,000 jobs versus a drop of 17,300 in May. Actual was an increase of 60,000 jobs. Consensus for the June Unemployment Rate was an increase to 5.3% from 5.2% in May. Actual was an increase to 5.4%.

Levi Straus dropped $0.90 to 13.33 after reporting less than consensus second quarter revenues.

Biogen gained $1.01 to $286.00 after the FDA approved its Alzheimer treatment.

Costco slipped $4.37 to $533.00 after reporting less than consensus revenues in June.

EquityClock’s Daily Comment

Headline reads “The bond market and gold are testing some critical levels of support as their upside gaps from March get filled”.

http://www.equityclock.com/2023/07/06/stock-market-outlook-for-july-7-2023/

Technical Notes

Starbucks $SBUX a Dow Jones Industrial Average stock moved below $96.52 completing a Head & Shoulders pattern.

The Canadian Dollar dropped 0.50 to US74.80 cents.

Trader’s Corner

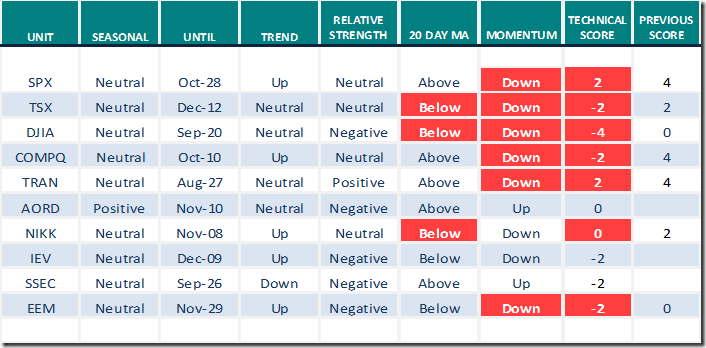

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for July 6th 2023

Green: Increase from previous day

Red: Decrease from previous day

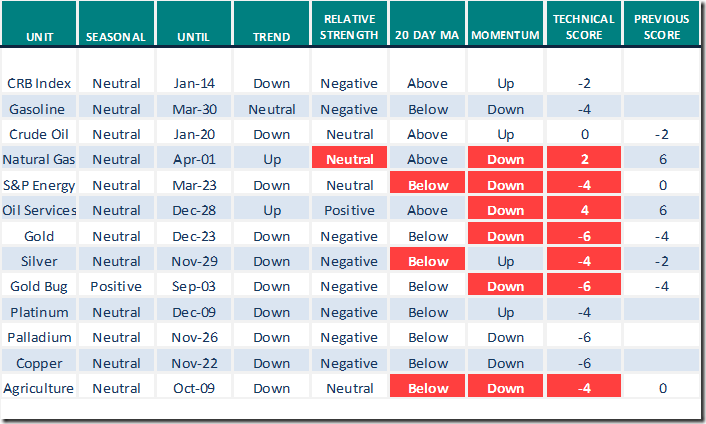

Commodities

Daily Seasonal/Technical Commodities Trends for July 6th 2023

Green: Increase from previous day

Red: Decrease from previous day

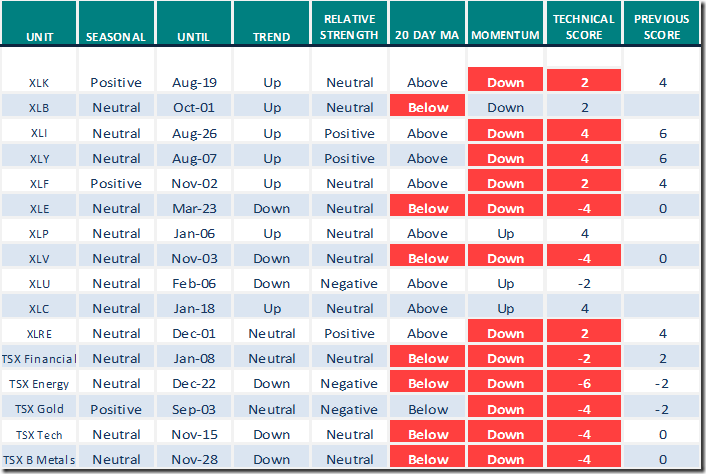

Sectors

Daily Seasonal/Technical Sector Trends for July 6th 2023

Green: Increase from previous day

Red: Decrease from previous day

Source for positive seasonal ratings: www.equityclock.com

Links offered by Valued Providers

Divergences Starting To Setup | TG Watkins | Your Daily Five (07.06.23)

https://www.youtube.com/watch?v=U8-84SFXcQ8

Surging Treasury Yields Halt Stock Market Rally | Tom Bowley | Trading Places (07.06.23)

https://www.youtube.com/watch?v=LBRot38ATWs

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 4.80 to 72.40. It remains Overbought.

The long term Barometer dropped 3.80 to 63.60. It remains Overbought.

TSX Momentum Barometers

The intermediate term Barometer dropped 8.33 to 40.35. It remains Neutral.

The long term Barometer dropped 3.95 to 51.32. It remains Neutral.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed