According to John Butters, Senior Earnings Analyst at FactSet, the S&P 500 is experiencing a year-over-year earnings decline of 3.7%. Nevertheless, five sectors within the index have reported positive year-over-year earnings growth, with the Consumer Discretionary sector leading the way at 47.8%.

In his research note today, Butters highlights the significant role of Amazon.com in the Consumer Discretionary sector's growth. The e-commerce giant singlehandedly accounts for over 70% of the net year-over-year earnings increase within the sector. On April 27, Amazon.com reported a GAAP EPS of $0.31, surpassing the mean GAAP EPS estimate of $0.21 and showing a substantial improvement from the year-ago GAAP EPS of -$0.38. Amazon's net income for Q1 2023 reached $3.2 billion, a stark contrast to the net loss of $3.8 billion in Q1 2022. Butters also noted that the company recorded a pre-tax valuation loss of $0.5 billion in Q1 2023, compared to a $7.6 billion loss in Q1 2022.

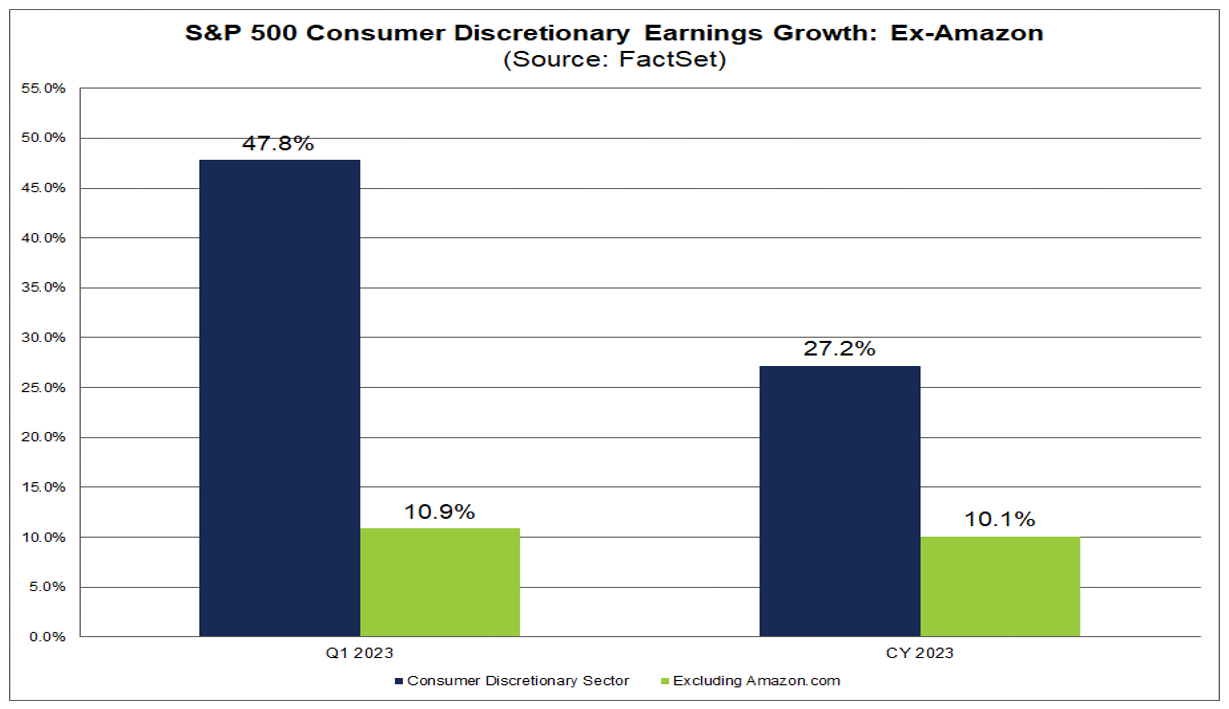

Due to the considerable year-over-year earnings increase, Amazon.com has become the largest contributor to the Consumer Discretionary sector's Q1 2023 earnings growth. Butters explained that if Amazon were excluded, the blended earnings growth rate for the sector would plunge from 47.8% to 10.9%.

Furthermore, Amazon.com is projected to be the most significant contributor to the sector's earnings growth for the entirety of 2023. The mean GAAP EPS estimate for Amazon.com in 2023 stands at $1.55, as opposed to the year-ago GAAP EPS of -$0.27. Butters pointed out that without Amazon, the estimated earnings growth rate for the Consumer Discretionary sector in 2023 would decrease from 27.2% to 10.1%.

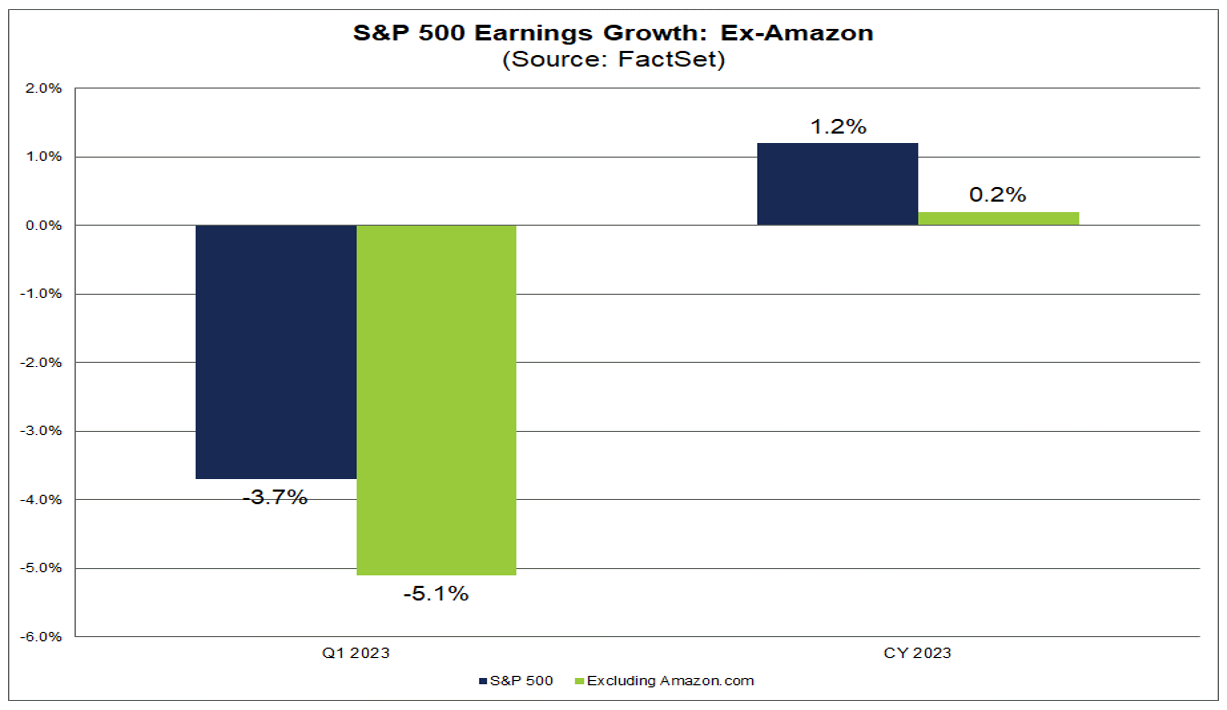

Interestingly, Amazon.com's influence extends beyond the Consumer Discretionary sector, as it is also the largest contributor to earnings growth for the entire S&P 500 in both Q1 and 2023. According to Butters, if Amazon were excluded from the S&P 500, the blended earnings decline for Q1 2023 would worsen from -3.7% to -5.1%. Meanwhile, the estimated earnings growth rate for the S&P 500 in 2023 would drop from 1.2% to 0.2%.

Footnotes:

1 Adapted from source: Butters, John. "Amazon is Largest Contributor to Expected Earnings Growth for the S&P 500 for 2023." 1 May. 2023, insight.factset.com/amazon-is-largest-contributor-to-expected-earnings-growth-for-the-sp-500-for-2023.

2 FactSet disclaimer: This blog post is for informational purposes only. The information contained in this blog post is not legal, tax, or investment advice. FactSet does not endorse or recommend any investments and assumes no liability for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.