Coal may not be the most popular energy source, but it continues to be consumed by many. The question posed by Javier Blas in his Bloomberg article is whether the demand for coal can be turned into a multi-billion dollar company capable of attracting institutional shareholders, even as they face increasing pressure to improve their green credentials.

A few weeks ago, Blas would have said "no way." However, Glencore Plc, the world's largest commodity trader, is willing to risk $8 billion to prove that a coal-focused company can indeed succeed. Blas admits that Glencore has a chance if coal prices remain high.

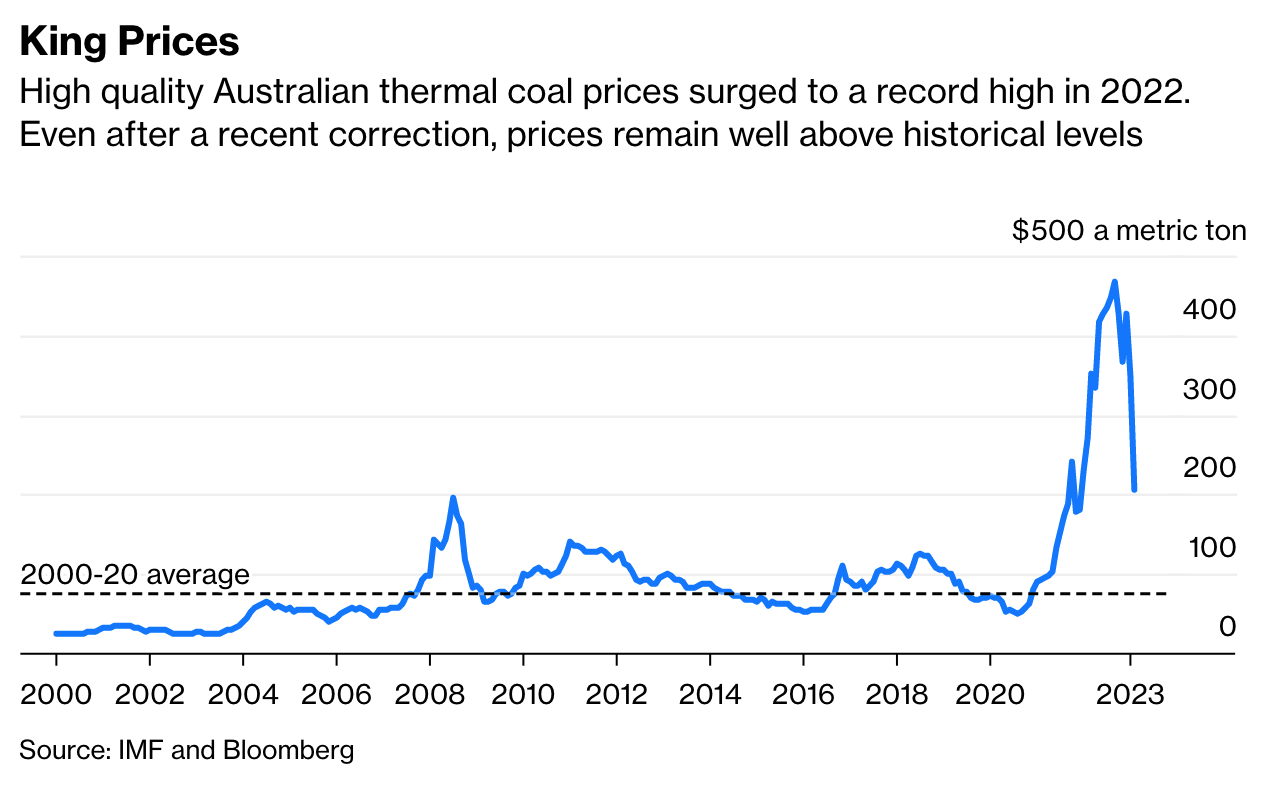

Coal-fired power stations remain the world's largest source of electricity. In 2021, nearly four-in-10 megawatts of electricity were generated by burning coal. Global coal demand has increased by 75% since 1997 and by 5% since 2015. High-quality Australian thermal coal prices surged to a record high in 2022, and even after a correction, they remain above historical levels.

Blas highlights a previous example of coal skeptics being proven wrong. When Anglo American Plc spun off its coal business, Thungela Resources Ltd., short-sellers claimed the new company's equity was worthless. However, Thungela's share price reached an all-time high in September 2021.

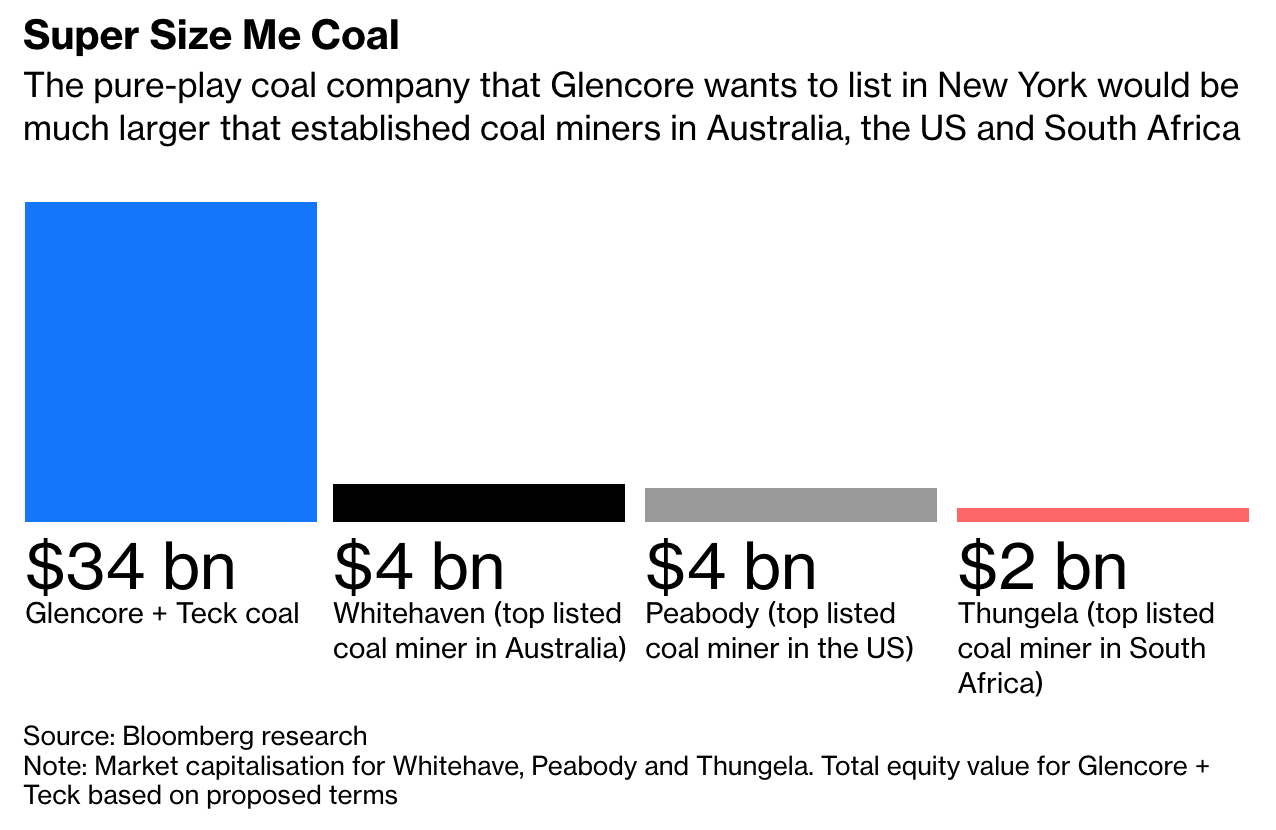

Glencore's coal strategy involves acquiring Canada's Teck Resources Ltd. and spinning off their combined coal-mining businesses on the New York Stock Exchange. Some Teck shareholders have expressed reluctance to own part of the new coal company, leading Glencore to offer $8.2 billion in cash to buy their 24% stake. If the plan is successful, the new coal company would be worth approximately $34 billion, exceeding the combined market value of the top 15 pure-play coal companies listed in New York, London, Johannesburg, and Sydney.

In pursuing this coal strategy, Glencore is making two key bets. First, they believe that while many institutional investors dislike coal, others would still be attracted to the high dividends the coal miner would likely pay, similar to their relationship with Big Tobacco. Second, Glencore recognizes that mining companies that have remained in the coal sector despite pressure to divest are reaping significant profits. Demand for coal is rising, while supply is constrained due to institutional investors convincing publicly listed miners to stop opening new pits.

As a result of these supply constraints, coal prices reached an all-time high in 2022. Europe increased coal imports to offset the loss of Russian natural gas, and China increased consumption to address power blackouts during the summer. Even after falling nearly 50% in early 2023, coal prices remain at historically high levels.

Investment bank TD Cowen estimates that the new coal miner would deliver underlying earnings of approximately $16 billion in 2023. With low capital expenditures and a commitment to reducing coal production to meet climate change pledges, shareholders could expect a substantial amount of free cash flow for at least two decades. However, Blas emphasizes that this success is contingent on coal prices remaining high, around $200 a ton for benchmark Australian material, compared to an average of $75 a ton between 2000 and 2020.

Ironically, Blas argues that Environmental, Social, and Governance (ESG) factors are crucial to the coal industry's downsizing and continued profitability. As investors increasingly oppose coal, limiting production, coal prices are more likely to remain high. This dynamic is central to Glencore's strategy for the new coal company.

In summary, Glencore is betting $8 billion on the formation of a new coal company, hoping that high coal prices and ESG-driven profitability will attract institutional shareholders. The potential success of this venture depends on coal prices remaining high, investor interest in high dividends, and the industry's ability to capitalize on ESG factors while downsizing. If these conditions are met, Glencore's ambitious coal strategy may indeed prove skeptics wrong and create a profitable coal-focused company worth billions of dollars.

Footnotes:

1 Adapted from source: Blas, Javier. "Glencore Envisions a Super-Sized King of Coal." Bloomberg, 14 Apr. 2023, www.bloomberg.com/opinion/articles/2023-04-14/glencore-envisions-a-super-sized-king-of-coal?utm_medium=email&utm_source=newsletter&utm_term=230414&utm_campaign=sharetheview&sref=9GO9fxP5.

2 Photo by Chris Münch on Unsplash